Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 10 November 2023 00:18 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

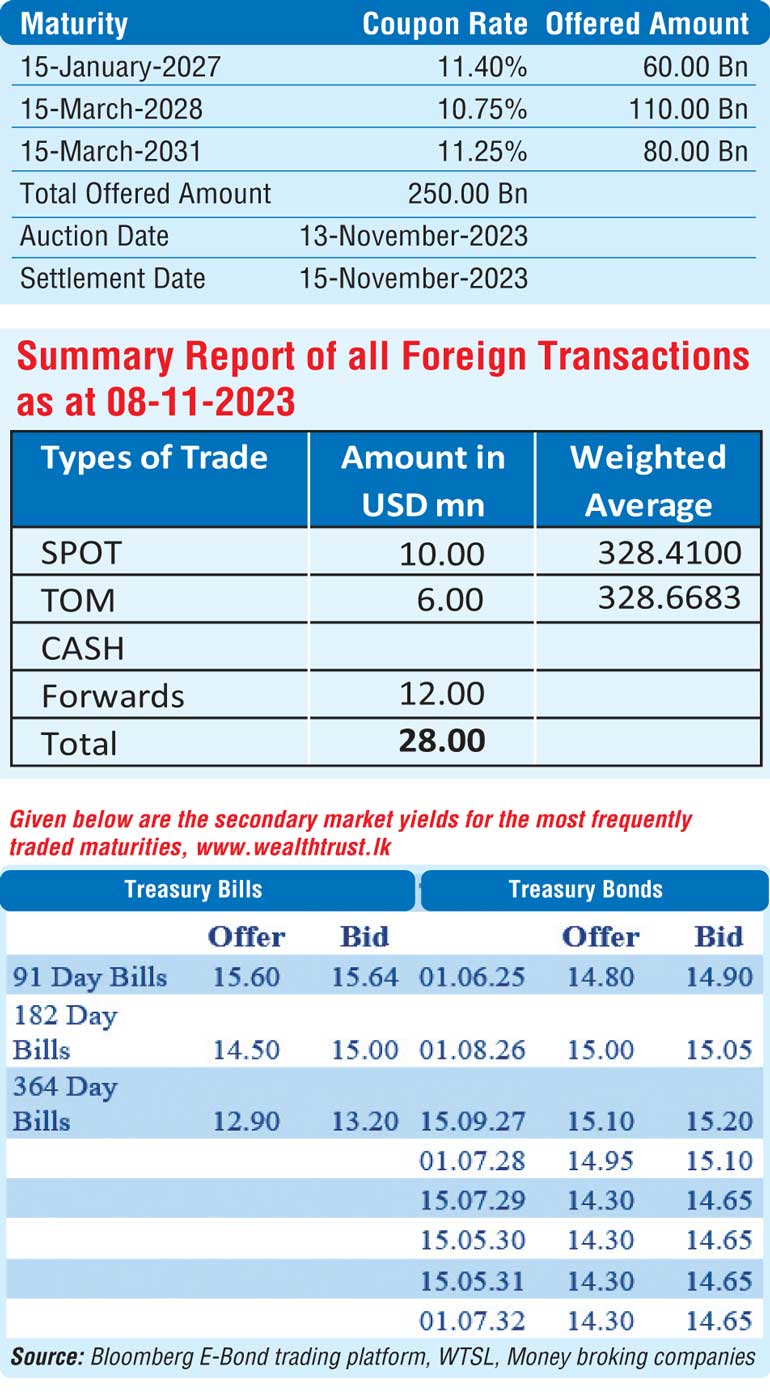

The Central Bank of Sri Lanka (CBSL) is due to conduct a round of Treasury Bond auctions on Monday, the 13th of November. The auctions will see a total offered amount of Rs. 250 billion, making it the largest in Sri Lanka’s history.

The Central Bank of Sri Lanka (CBSL) is due to conduct a round of Treasury Bond auctions on Monday, the 13th of November. The auctions will see a total offered amount of Rs. 250 billion, making it the largest in Sri Lanka’s history.

For reference, the previous bond auctions conducted on 30 October 2023 saw all bids rejected for the first time in over 19 months or since the round of auctions conducted on 29 March 2022.

The secondary bond market was seen adopting a somewhat reserved stance ahead of the upcoming auction with activity remaining moderate. Nevertheless, trades were observed across the yield curve with an emphasis on short tenure bonds which drew demand. Accordingly, the three 24’s (01.05.24, 01.08.24 and 15.11.24) was seen trading within the range of 14.50% to 14.45%, on relatively significant volumes while the two 25’s (01.06.25 and 01.07.25) changed hands within the range of 14.85% to 14.83%.

In addition, the three 26’s (01.06.26, 15.05.26 and 01.08.26), 15.09.27, 15.07.29 and 15.05.31 traded at levels of 15.15% to 14.95%, 15.15%, 14.80% to 14.77% and 14.70% respectively.

In secondary bills, December 2023 maturities changed hands at 14.25%.

The total secondary market Treasury bond/bill transacted volume for 8 November 2023 was Rs. 94.60 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 10.23% and 11.00% respectively while the net liquidity deficit stood at Rs.13.21 billion yesterday.

The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight reverse repo auction for Rs 12.53 billion at the weighted average rates of 10.04%. An amount of Rs. 16.54 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 11.00% while an amount of Rs. 15.85 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 10.00%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day marginally up at Rs.327.40/327.70 against its previous day’s closing level of Rs.328.40/328.70.

The total USD/LKR traded volume for 08th November was US $ 28.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)