Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 2 October 2023 00:51 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The largest round of Treasury bond auctions in Sri Lanka’s history, conducted last Monday, saw its total offered amount of Rs. 220 billion being successfully taken up.

The largest round of Treasury bond auctions in Sri Lanka’s history, conducted last Monday, saw its total offered amount of Rs. 220 billion being successfully taken up.

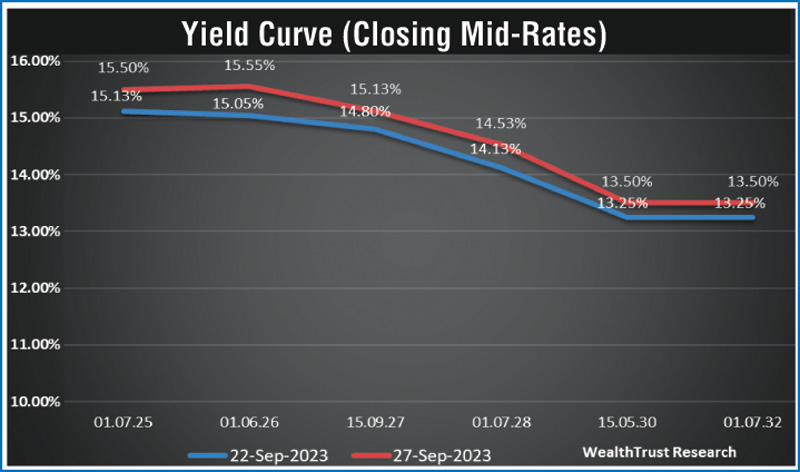

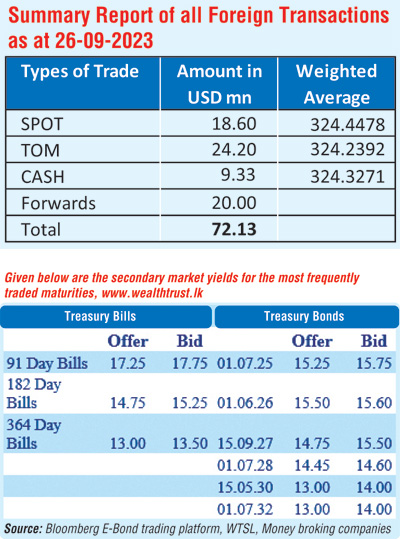

The offered maturities of 01.06.2026 and 01.07.2028 recorded weighted averages of 15.64% and 14.52% respectively. For context, the previous round of auctions held on 12 September saw Rs. 90 billion offered on similar tenors of 01.06.2026 and 01.05.2028, which recorded weighted average rates of 15.58% and 14.64% respectively. As such primary yields were seen holding broadly steady despite the significant increase in the volume offered.

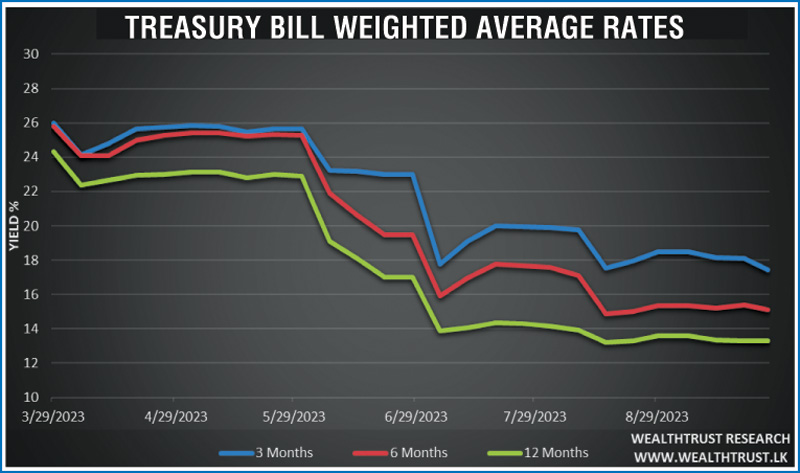

Meanwhile, last week’s Treasury bill auction, saw weighted average rates drop across the board. The 91-day bill in particular saw significant demand, which led to its weighted average yield dropping steeply by 70 basis points to 17.42% as it received Rs 72 billion of bids against an offered amount of only Rs. 20 billion. Similarly, the 182-day and 364-day bills dropped by 25 and 2 basis points respectively to record weighted averages of 15.13% and 13.30%.

On the inflation front, the Colombo Consumer Price Index -CCPI (Base: 2021=100) for the month of September decreased sharply to 1.30% on its point to point as against 4.00% recorded in August and a peak of 50.6% in February of 2023. This is the lowest level witnessed in the CCPI since the index was rebased, at the start of the year 2023. The figure also beat a Bloomberg consensus estimate of 2.2% for the month of September.

Meanwhile, in key some developments during last week, the S&P Global rating agency and Fitch ratings said Sri Lanka’s local currency rating was raised to CCC+/C and CCC- from SD (Selective Default) and RD (Restricted Default) respectively, after concluding the domestic debt restructuring. The International Monetary Fund also concluded its visit to Sri Lanka on 27 September as part of the first review of the IMF Extended Fund Facility program. In an official press release the IMF commended progress on important reforms and affirmed its commitment to support Sri Lanka. The concluding remarks stated of continued discussions with the goal of reaching a staff level agreement in the near term. In addition, it was reported that Sri Lanka was in talks with the ADB for up to $ 400 million in Policy-Based Loans.

This week will see the announcement of the seventh monetary policy meeting by CBSL, due this Thursday, 5 October at 7:30 a.m. The Central Bank previously kept policy rates unchanged at 11.00% and 12.00% on its Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) respectively at its announcement on 24 August. This was preceded by two consecutive cuts which saw a cumulative reduction on the two policy rates by 450 basis points from highs of 15.50% and 16.50% on the SDFR and SLFR respectively.

The secondary market bond yields were seen increasing following the bond auctions, while activity remained reserved during the shortened trading week ending 27 September. As such the yield curve recorded a shift upwards.

The daily secondary market Treasury bond/bill transacted volumes for the first three days of the week averaged at Rs. 51.55 billion.

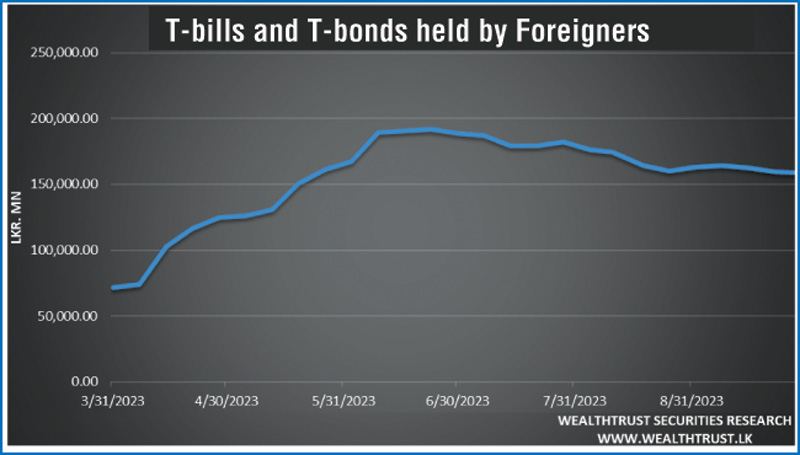

The foreign holding in Rupee bonds and bills recorded a further drop, making it three consecutive weeks of declines, albeit with a relatively marginal outflow of Rs. 0.34 billion for the week. This brings the total T-bills and T-bonds held by foreigners to Rs. 159.16 billion for the week ending 27 September.

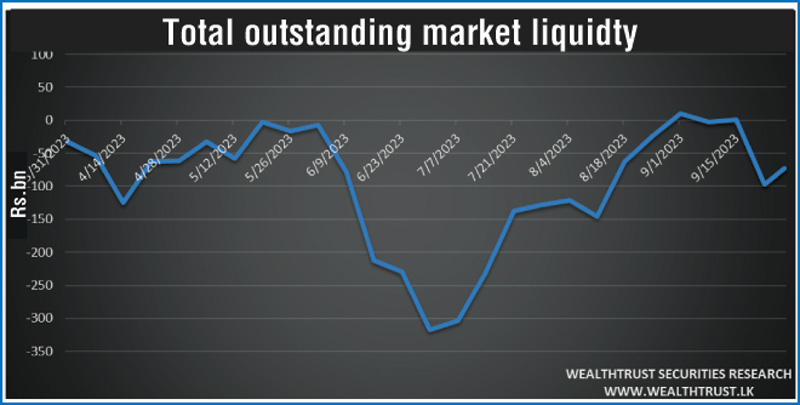

The total outstanding liquidity in the money market was a deficit of Rs. 73.51 billion at the end of the week against its previous week’s deficit of Rs. 96.62 billion. The Domestic Operations Department (DOD) of Central Bank injected liquidity during the week by way of overnight and term Reverse repo auctions at weighted average yields ranging from 11.27% to 11.37%. The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered static at Rs. 2,839.35 billion against its previous week’s level, following the restructuring of CBSL held Treasury Bills and Advances to the Government.

In the forex market, the USD/LKR rate on spot contracts was seen appreciating during the week to close the week at Rs. 323.50/324.25 against its previous week’s closing level of Rs. 324.50/325.00, subsequent to trading at a low of Rs. 325.00 and a high of Rs. 323.05.

The daily USD/LKR average traded volume for the first two trading days of the week stood at $ 77.78 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)