Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 31 May 2022 01:43 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The bond auctions conducted yesterday recorded impressive outcomes as the weighted average rate on the 1 June 2025 maturity was registered well below its pre-auction rate while the total offered amount of Rs. 40 billion on both maturities including the 15 January 2028 was taken up at its 1st phase of the auctions. This in turn will see a further 20% been offered on each maturity, through a direct issuance window, until close of business today. (I.e., 4.00 p.m. on 31 May).

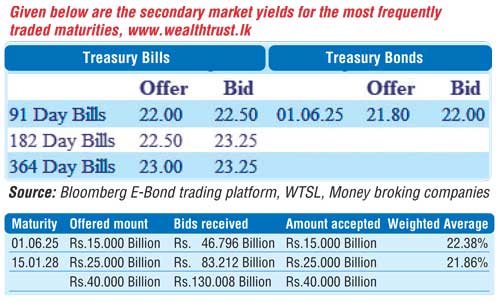

The 1 June 2025 maturity recorded a weighted average rate of 22.38% against its pre-auction rate of 22.55/70 while the 15 January 2028 recorded a weighted average rate of 21.86% against a pre-auction rate of 21.50/00 on a similar maturity. The bids to offer ratio stood at 3.25:1. Given below are the details of the auction,

The 1 June 2025 maturity changed hands at a low 21.90%, post auction in the secondary bond market while two-way quotes on the rest of the yield curve eased as well. In secondary bills, 12 August and 26 May 2023 maturities changed hands at levels of 21.50% to 22.50% and 23.30% respectively.

The total secondary market Treasury bond/bill transacted volume for 27 May 2022 was Rs. 2.58 billion.

In money markets, the net liquidity deficit improved to Rs. 475.50 billion yesterday from its previous days Rs. 588.62 billion while CBSL holding of Government securities remained steady at 1,971.46 billion. Overnight Call money and REPO averaged 14.50% each while an amount of Rs. 206.11 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 13.50% against an amount of Rs. 681.61 billion withdrawn from Central Banks SLFR (Standard Deposit Facility Rate) of 14.50%.

Forex market

In the forex market, the middle rate for USD/LKR spot contracts depreciated to Rs. 360.76 yesterday against its previous day’s Rs. 359.25.

The total USD/LKR traded volume for 27 May was $ 7.25 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)