Friday Feb 20, 2026

Friday Feb 20, 2026

Tuesday, 30 April 2024 00:25 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The bond auctions conducted yesterday recorded impressive outcomes as the weighted average rate on the 15.03.2028 maturity was registered well below its pre-auction rate while an offered amount of Rs.55 billion on two maturities including the 15.05.2030 was taken up at its 1st phase of the auctions. This in turn will see a further 10% been offered on each maturity, through a direct issuance window, until close of business today. (I.e. 4.00 p.m. on 30.04.24).

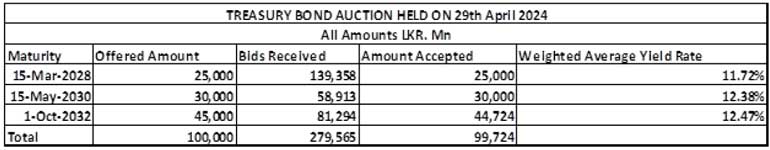

The 15.03.2028 maturity recorded a weighted average rate of 11.72% against its pre-auction rate of 11.80/85 while the 15.05.2030 recorded a weighted average rate of 12.38% against a pre-auction rate of 12.25/40.

The weighted average rate on the eight-year maturity of 01.10.2032 was registered at 12.47% while it went undersubscribed which led to its 2nd phase of the auction. In all, Rs. 44.72 billion was accepted in successful bids against an offered amount of 45 billion.

The total bids received exceeded the total offered amount by 2.8 times at the 1st and 2nd phases. Given below are the details of the auction,

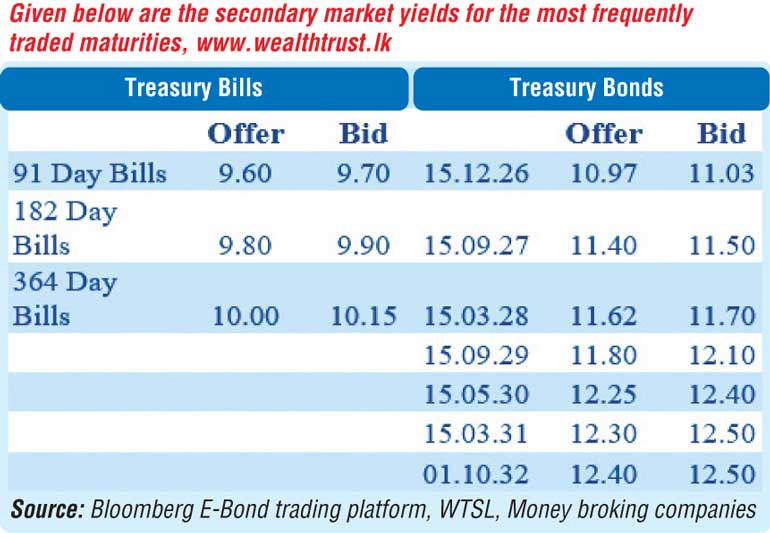

The start of a new trading week saw the positive momentum in the secondary bond market continue as yields dipped considerably.

In particular the popular liquid 15.12.26 maturity experienced a steep decline in yields, falling to an intraday low of 10.93% from an intraday high of 11.15% on the back of robust volumes. Similarly, the other 2026 tenors (i.e. 15.05.26, 01.06.26 and 01.08.26) were seen dropping from intraday high of 11.05% to a low of 10.90%, also on the back of sizeable volumes. Meanwhile the 2028 tenors (i.e. 15.01.28, 01.05.28, 01.07.28 and 15.12.28) also saw yields plunge to intraday low of 11.60% from intraday high of 11.95%. Additionally, trades were observed on the 2027 tenors (i.e. 01.05.27 and 15.09.27), hitting intraday low of 11.30% from intraday high of 11.60%.

Meanwhile, this week’s Treasury bill auction due today, will have in total an amount of Rs. 130.00 billion on offer, which will consist of Rs. 25.00 billion on the 91-day maturity, Rs. 65.00 billion on the 182-day maturity and a further Rs. 40.00 billion on the 364-day maturity. This reflects an increase of Rs. 38.00 billion on the offered amount on a week-on-week basis.

For context, at the weekly Treasury bill auction conducted last Wednesday (24 April 2024), the weighted average yields were seen decreasing across all three tenors for a third consecutive week. The 91-day maturity reduced by 13 basis points to 9.90%, while the 182-day maturity decreased by 14 basis points to 10.08% and the 364-day maturity dropped by 02 basis point to 10.21%. The entire offered amount of Rs. 92.00 billion was taken up at the 1st phase, with total bids received exceeding the total offered amount by 2.33 times. In addition, a further Rs. 9.20 billion was raised at the 2nd phase across all three maturities which was the maximum offered amount out a total market subscription of Rs. 88.05 billion.

The total secondary market Treasury bond/bill transacted volume for 26 April was Rs. 19.59 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.64% and 8.82% respectively as the DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight and 7-day term reverse repo auction for Rs. 9.18 billion and Rs. 40.00 billion respectively at the weighted average rates of 8.59% and 8.82%.

The net liquidity surplus stood at Rs. 130.23 billion yesterday as an amount of Rs. 0.25 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 9.50% against an amount of Rs. 179.66 billion being deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.50%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day at Rs. 297.80/298.50 as against its previous day’s closing level of Rs. 296.00/296.30.

The total USD/LKR traded volume for 26 April was

$ 96.85 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money

broking companies)