Friday Feb 27, 2026

Friday Feb 27, 2026

Wednesday, 18 May 2022 00:00 - - {{hitsCtrl.values.hits}}

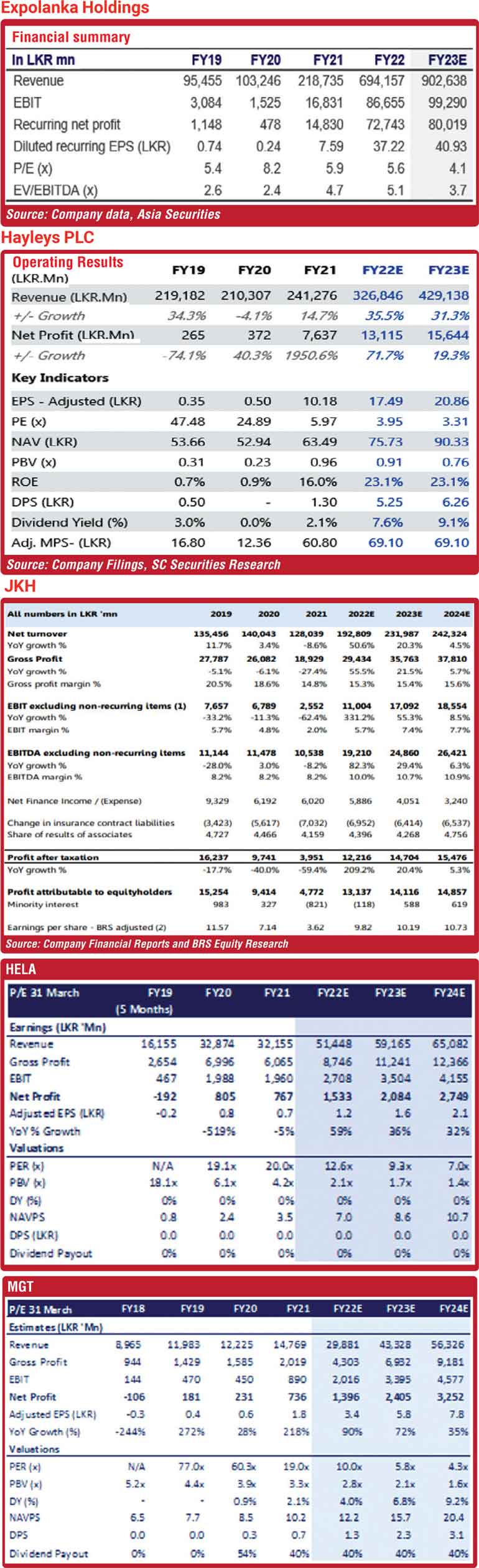

The Daily FT-SC Securities joint initiative Market Pulse recently hosted several listed conglomerates as well as industry leaders to get an overview of their future outlook. This was preceded by leading stock broking firms unveiling their research on the selected companies. They were Expolanka Holdings PLC, LOLC Holdings, John Keells Holdings, Hayleys PLC, Hela Apparel Holdings PLC, Teejay Lanka PLC and Hayleys Fabrics PLC.

The research presentations were done by Asia Securities Vice President Research Hilal Zainudeen – Expolanka Holdings PLC, Capital Trust Head of Research Hasitha Leanage – LOLC Holdings and Browns Investments, SC Securities Head of Research Charitha Gunasekere – Hayleys PLC, Bartleet Religare Senior Research Analyst Heshan Chamika – John Keells Holdings PLC and First Capital Head of Research Dimantha Mathews – apparel and related sector trio Hela Apparel Holdings PLC, Teejay Lanka PLC and Hayleys Fabrics PLC.

Asia Securities Vice President Research Hilal Zainudeen presented more insights about Expolanka Holdings PLC where he emphasised that Expolanka Holdings PLC is having a strong defensive exposure amidst uncertain local backdrop. The stock provides good defensive exposure to investors, given current macro uncertainty in the country.

According to Hilal Zainudeen, Expolanka Holdings was a strong COVID beneficiary counter due to spike in freight rates, but share has seen a sharp decline along with the broader market. Expolanka Holdings PLC share price is down 54.8% YTD (vs. ASPI down 37.6%). Share price has seen good buying support after steep recent selloff in line with the broader market. Dollar income provides natural hedge against potential depreciation of rupees.

Air freight prices in the key Hong Kong – North America route reached record highs in December 2021, however overall rates across the globe have started to moderate since the onset of the Chinese New Year holidays in February, however air freight rates are still well above levels seen before the COVID-19 pandemic and also ocean freight rates remain elevated but showing signs of correction. However, Asia Securities expects ocean and air freight rates to moderate through 2022.

Although some disruption to freight transportation was experienced due to the Ukraine issue, the impact has been seen more in the European trade routes. EXPO is less impacted given that 80%+ of EXPO business is from the US trade lane.

According to Asia Securities Research estimates the summary of Financials of Expolanka Holdings is as follows.

SC Securities Head of Research Charitha Gunasekere added his commentary on Hayleys PLC. Hayleys PLC is the most diversified conglomerate in Sri Lanka operating across 12 diverse industry sectors. Products are sold in over 70 markets across the world and Hayleys is one of the country’s largest value-added exporters. Further he mentioned 49% of group revenue was earned in foreign currencies and Hayleys accounted for 4.22% of the country’s total exports.

Hayleys earns almost half of its revenue through export markets. Its traditional business sectors (Textile, Purification, Hand Protection, Transportation and Logistics, Eco Solutions) have remained the major contributors of foreign exchange. During FY21 net foreign exchange gain amounted to Rs. 1,150 million compared to Rs. 274 million in FY20.

Due to the favourable exchange rate movement net exchange gain in FY22 would be much higher. Net Profit Margin improved to 5.8%: This achievement reflects organisation-wide efforts to rationalise costs, optimise resources, productivity maintenance and increased efficiencies gained through stringent cost management strategies. Gunasekere elaborated segmental performance and outlook of Hayleys PLC during his presentation.

Based on SC Securities research estimates they have arrived fair value of Rs. 126.40 for the Hayleys PLC share using the bended valuation approach and the earnings highlights of Hayleys PLC is as follows.

Heshan Chamika, a Senior Research Analyst from Bartleet Religare Securities (BRS) brought up his idea on way forward of John Keells Holdings PLC (JKH) mentioning the fact that resiliency is the key to unlock the long-term value. As of his views, Cinnamon Life project of JKH is to record residential apartment sales along with rent income from HCL technologies. Rising fuel prices and rupee devaluation is expected to benefit transportation sector to report higher earnings.

Further he mentioned that the anticipated revival in tourism and leisure sector will aid to strengthen JKH’s financial position. Centralised distribution centre in supermarket chain is to aid for operational efficiencies whilst the expansion remains intact. Higher interest rates are expected to favour life insurance segment with the increased awareness of general public.

However, several investments risks associated with JKH have been quoted by BRS at the event held. Accordingly, continuous power cuts and fuel shortages, delays in construction of Tri-Zen apartments and Cinnamon life hotel rooms, rising commodity prices, import restrictions, subdued economic growth are adding pressures to group financials.

BRS has given a fair value of Rs. 184.62 for JKH with net earnings forecast of Rs. 14 billion for 2023 as follows.

First Capital Head of Research Dimantha Mathews opined his insights regarding apparel and related sector trio Hela Apparel Holdings PLC, Teejay Lanka PLC and Hayleys Fabrics PLC. Dimantha mentioned that the rapid growth in global apparel demand and currency depreciation is in favour of Sri Lankan apparel and textile industry.

He also elaborated the fact that the overall demand for clothing and shoes are to rise significantly by 2025 and apparel export companies are to thrive on booming top-line owing to potential rupee depreciation.

As of First Capital research, major fabric manufacturers are expected to benefit from the relocation strategy by brands out of China to South Asia. More than 85% of respondents plan to increase sourcing from Asian including Sri Lanka in next two years. On top of that Sri Lanka’s reputation for ethical manufacturing of high-quality apparels will continue to stand as a key competitive advantage.

Further, First Capital expects cotton prices to stabilise in upcoming quarters boosting margins of apparel and fabric makers specially to ease by 6.0% in 2023 as weather related challenges unwind.

All and all, First Capital has given fair estimations for the top picks from apparel sector. Accordingly, Teejay Lanka PLC (TJL) was given a fair value of Rs. 56 with a profit estimation of Rs. 4.4 billion for 2023, Hayleys Fabric (MGT) a fair value of Rs. 45 with an estimated 2023 net profit of Rs. 2.4 billion and recently listed Hela Apparel Holdings (HELA) a fair value of Rs. 16.8 with a profit estimation of Rs. 2.1 billion for the year 2023.

First Capital research has provided below financial estimates with regards to three stock picks.

n TJL

n MGT

n HELA

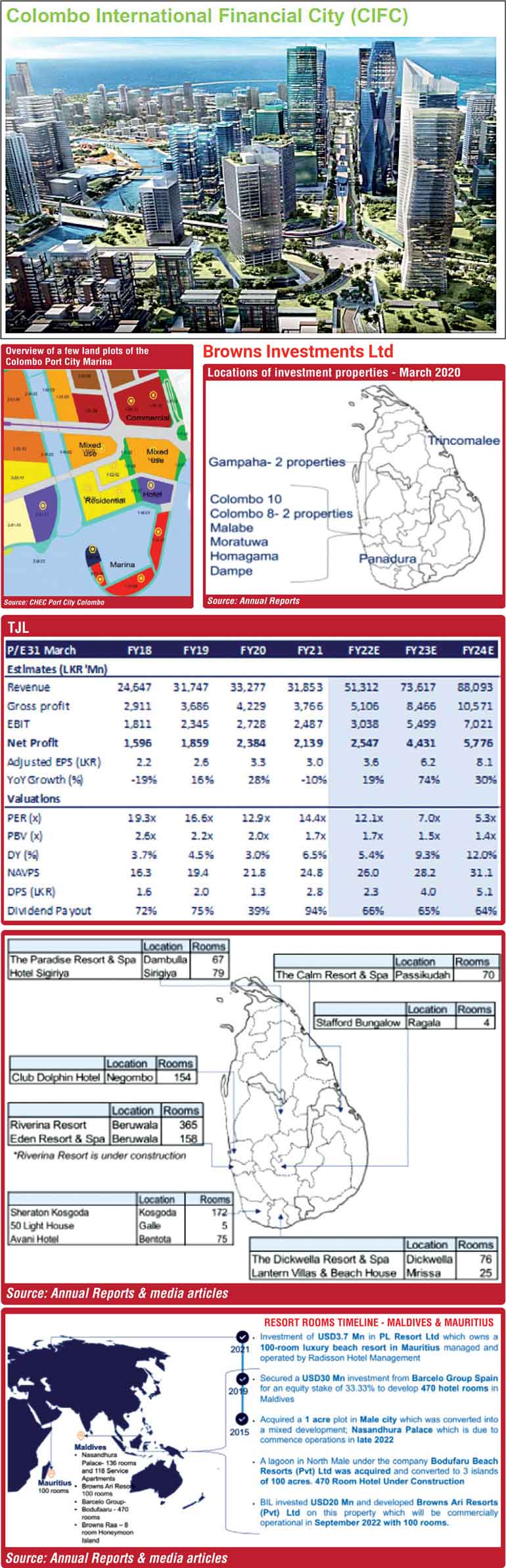

Capital Trust Head of Research Hasitha Leanage brought more insights about Browns Investments PLC and LOLC Holdings PLC. According to Leanage, Browns Investment PLC invested $ 55 million in the Colombo Marina Development Project on 17th December 2021 and secured 99-year leasehold rights to a land extent of 30,776 sqm. Further plans to invest $ 43 million in the Port City Marina Hotel Development Project and secured 99-year leasehold rights to a land extent of 13,006 sqm.

The Port City Marina is a destination along the marina-walk which consists of the marina square, marina promontory, marina park and marina village. The marina precinct is expected to attract super luxury yacht owners as the only marina in the country which can have private yachts operate.

The marina also consists of facilities for docking sailing boats and small boats providing sports and entertainment. The Yacht Marina is expected to have the facility to anchor 200 yachts making it one of the largest such venues in the region.

Browns Investment PLC expects to expand its large portfolio of investment properties and Leanage noted that Leisure segment expanded to be amongst the top 3 leisure players with over 1,200 rooms in Sri Lanka and they have aggressively expanded overseas leisure footprint with a pipeline of 800 plus rooms.

Moreover, Browns Investment PLC invested in the largest agricultural project in West Africa with $ 30 million worth investment. They have acquired 66.67% stake in Sunbird Bio Energy in Sierra Leone during June 2019 and assets to be worth its original investment of 500 million euros once ramped up to its full capacity.

Browns Investment PLC operates first privately owned solar power plant pf 10 MW in Sri Lanka and the plant produces approximately 19 GWh per year. HNB to be considered as an associate company of Browns Investments Ltd. from 4QFY22.

Capital Trust Research forecasted Rs. 30,100 million profit for Browns Investments PLC in FY2022 and stock currently trades at an attractive PER of 2.91x FY22F net earnings.

Hasitha Leanage went through the earnings forecast and the company insights about LOLC Holdings PLC. According to him LOLC holdings PLC is the largest beneficiary of $ denominated asset base and revenue. Group with largest Land, Property and Equipment base of over Rs. 131 billion and Investment Properties of Rs. 52 billion denominated in both dollars and rupees. Will benefit significantly from Revaluations and Exchange Gains due to high currency depreciation and high inflation.

Capital Trust Research forecast the Revaluation Gain in 4QFY22 to amount to c. Rs. 15 billion and Net Profit Attributable to Equity Holders to record Rs. 52 billion through recurring operations in FY22F. Given the current stock price of Rs. 437.50, the share is trading at a PER of only 4.00x FY22F Earnings. MP/TCI in FY22F is only 2.02x assuming an average exchange rate of Rs. 299.00/USD.

Given the extremely high ROE achieved on a continuous basis, Management is of the view the Company can achieve exponential increase in Earnings by reinvesting internally generated cash flows. This is a similar model followed by global MILLIONC’s such as Amazon, Google, Alibaba, Facebook, Berkshire Hathaway and Tesla. Hence, where the companies do not declare dividends.

- Pix by Upul Abayasekara