Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Friday, 2 August 2024 00:00 - - {{hitsCtrl.values.hits}}

By The Insurance Regulatory Commission of Sri Lanka

Gross Written Premium

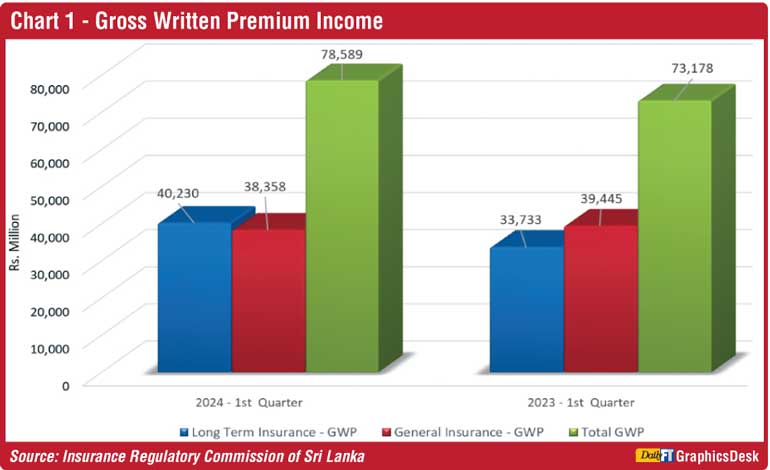

As illustrated in Chart 1, the total Gross Written Premium (GWP) of the insurance industry for Long-Term and General Insurance Businesses for the period ended 31 March 2024 was Rs. 78,589 million (Q1, 2023: Rs. 73,178 million), recording a growth of 7.39%. The premium growth is Rs. 5,411 million when compared to the same period in the year 2023.

The GWP of Long-Term Insurance Business amounted to Rs. 40,230 million (Q1, 2023: Rs. 33,733 million) recording a remarkable growth of 19.26%. The GWP of General Insurance Business amounted to Rs. 38,358 million (Q1, 2023: Rs. 39,445 million) recording a decline of 2.75%.

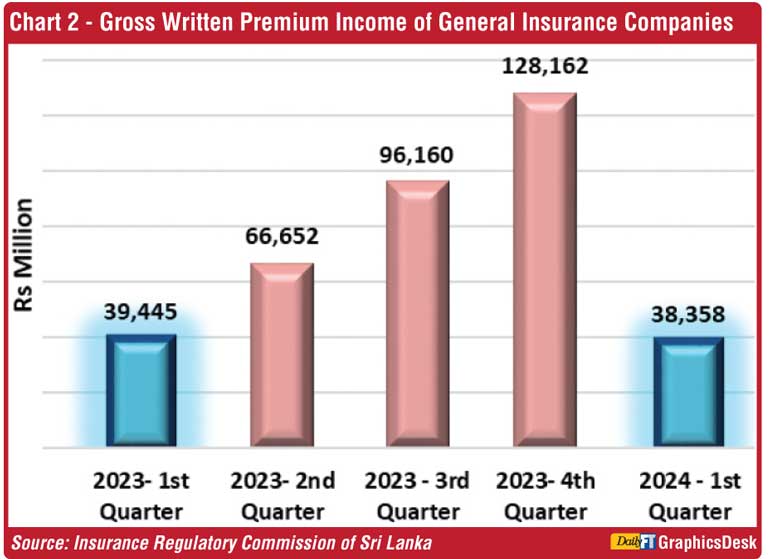

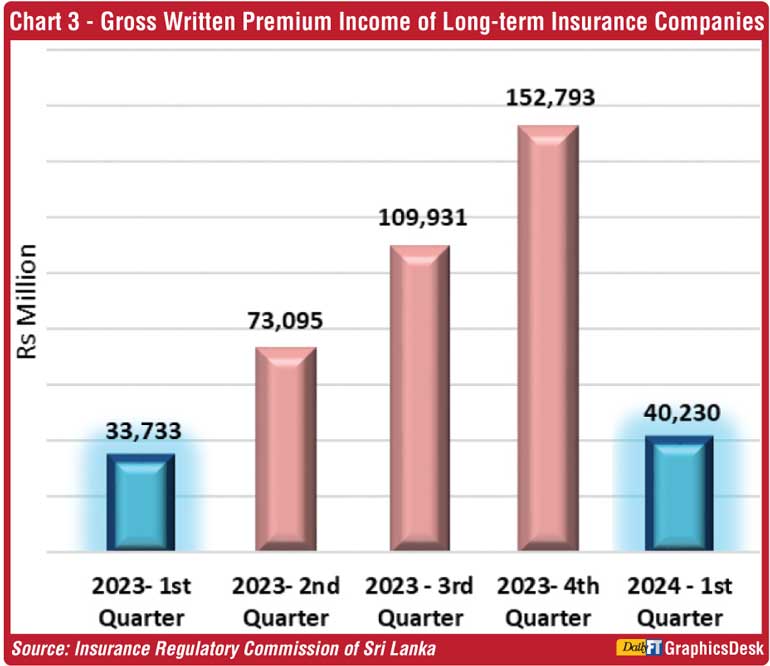

Charts 2 and 3 show further details of the quarter-wise Gross Written Premium for the period from Q1, 2023 to Q1, 2024 of the General Insurance business and Long-term Insurance business respectively.

Total assets

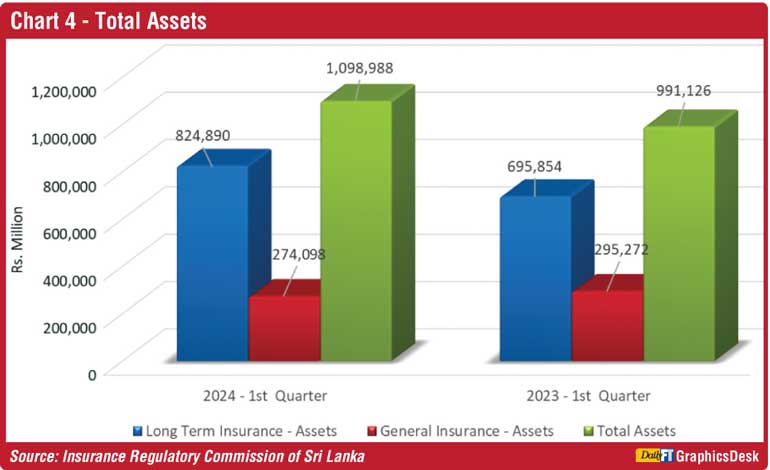

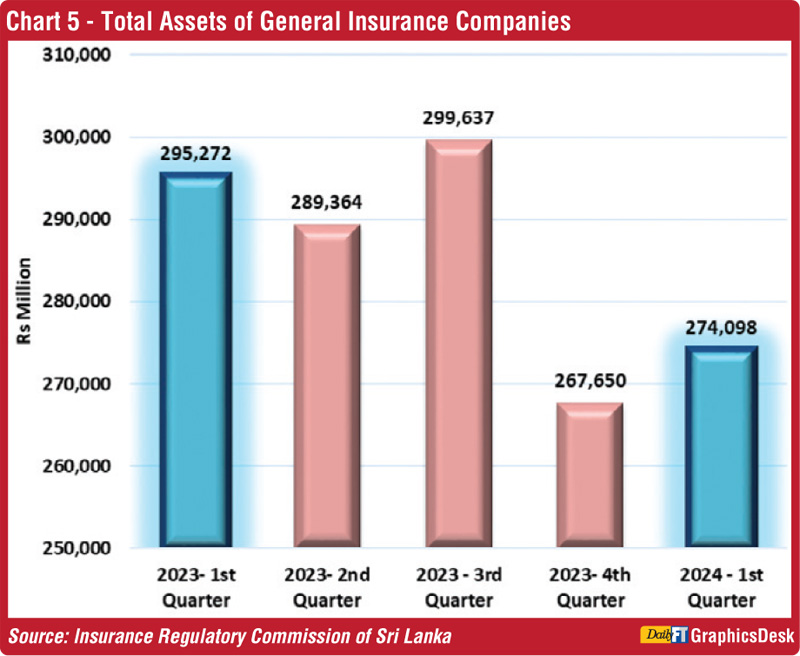

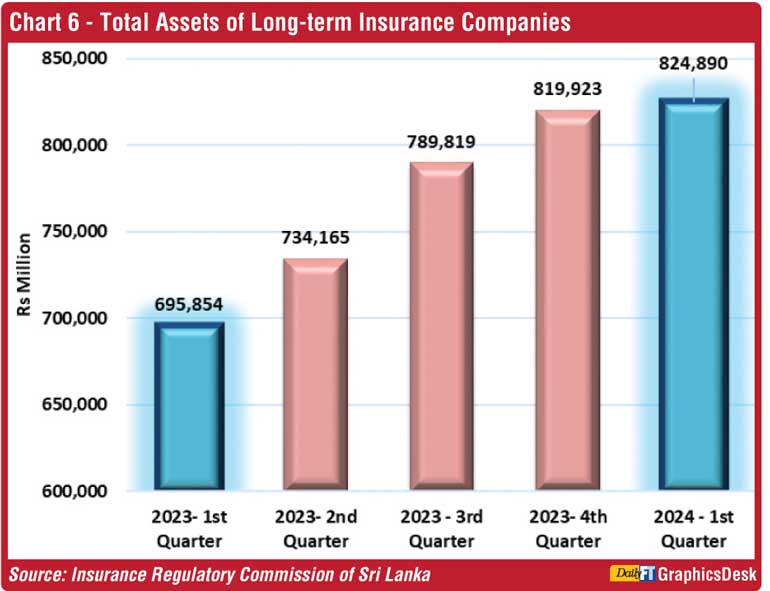

As depicted in Chart 4, the value of the total assets of insurance companies has increased to Rs. 1,098,988 million at the end of 1st Quarter 2024, when compared to Rs. 991,126 million recorded as at the end of Q1 2023, reflecting a growth of 10.88%. The assets of the Long-Term Insurance Business amounted to Rs. 824,890 million (Q1, 2023: Rs. 695,854 million) depicting a growth rate of 18.54%. The assets of the General Insurance Business amounted to Rs. 274,098 million (Q1, 2023: Rs. 295,272 million) showing a drop of 7.17%.

Charts 5 and 6 show further details of the quarter-wise information on total assets for the period from Q1, 2023 to Q1, 2024 of the General Insurance business and Long-term Insurance business respectively.

Investment in Government Securities

Investments in Government Debt Securities as at the end of 1st Quarter 2024, amounted to Rs. 450,070 million (Q1, 2023: Rs. 335,377 million) representing 60.39% of the total investments of Long-Term Insurance Business and increased by 34.20%, while the total investment of General Insurance Business in Government Debt Securities amounted to Rs. 102,088 million (Q1, 2023: Rs. 89,144 million) representing 59.93% of the total investment of General Insurance and increased by 14.52%. Accordingly, the total investment in Government Securities in the two businesses at the end of 1st Quarter 2024 amounted to Rs. 552,158 million (Q1, 2023: Rs. 424,521 million), showing an overall increase of 30.07%.

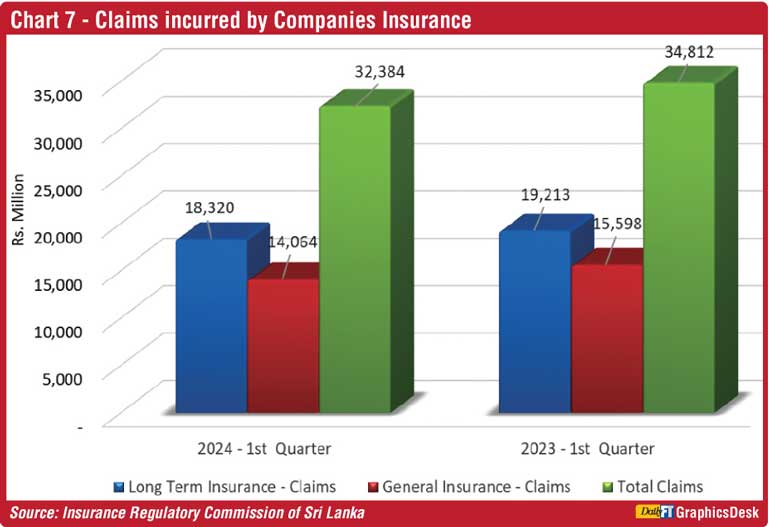

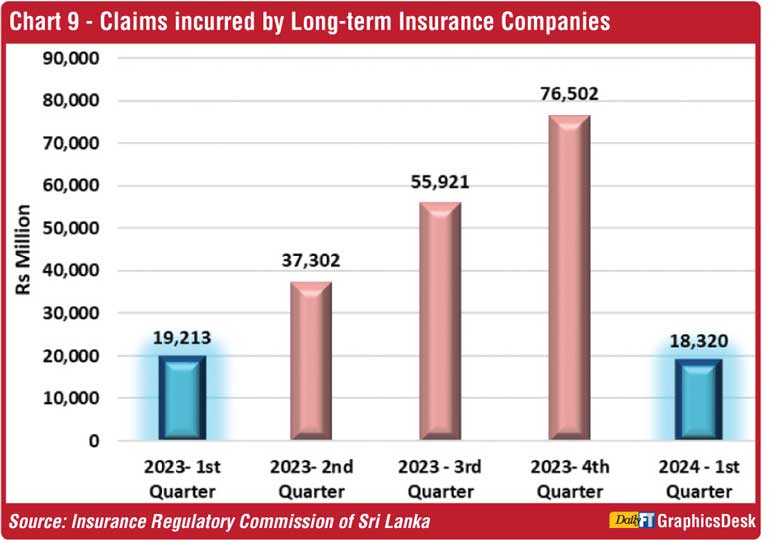

Claims incurred by insurance companies

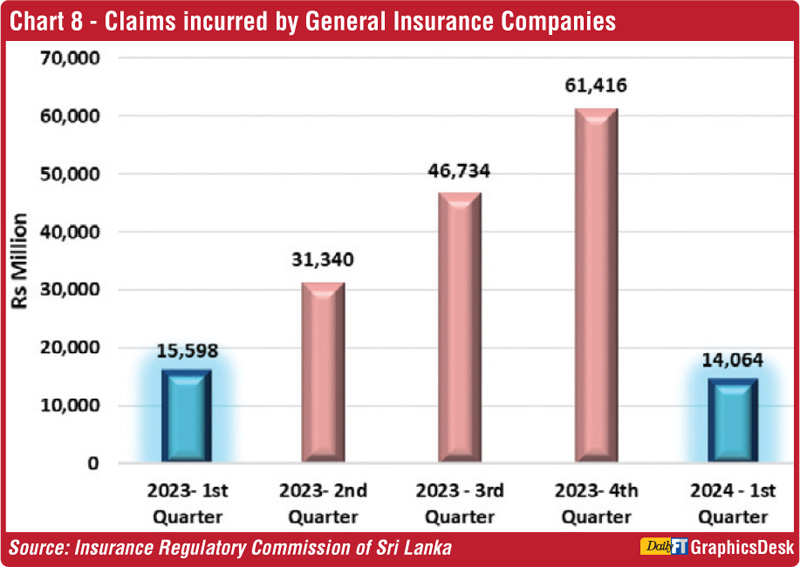

Chart 7 presents the claims incurred by insurance companies. The claims incurred by both the Long-Term Insurance Business and General Insurance Business were Rs. 32,384 million (Q1, 2023: Rs. 34,812 million) showing a drop of 6.97% year-on-year. The Long-Term Insurance claims, including maturity and death benefits, amounted to Rs. 18,320 million (Q1, 2023: Rs. 19,213 million). The claims incurred in the General Insurance Business, including Motor, Fire, Marine and other categories, amounted to Rs. 14,064 million (Q1, 2023: Rs. 15,598 million). Hence, during the 1st quarter of 2024, claims incurred in Long Term Insurance decreased by 4.65% and claims incurred in General Insurance decreased by 9.84%, when compared to the same period in 2023.

Charts 8 and 9 show further details of the quarter-wise information on claims for the period from Q1, 2023 to Q1, 2024 1f the General Insurance business and Long-term Insurance business respectively.

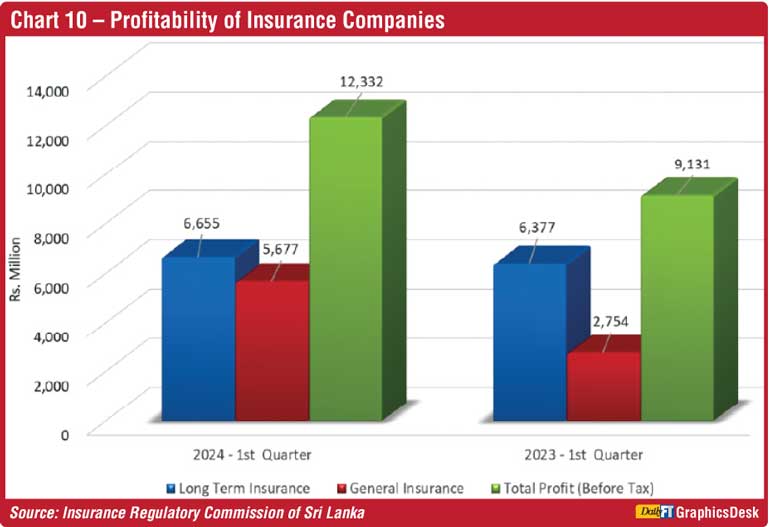

Profit (Before Tax) of insurance companies

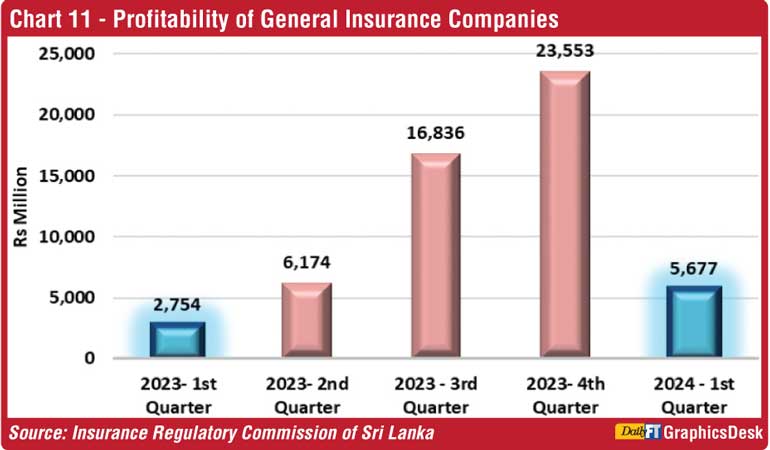

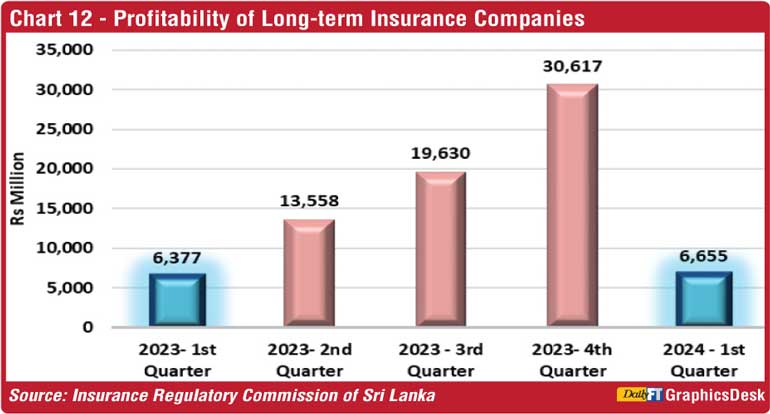

Chart 10 displays the profitability of insurance companies. The Profit Before Tax (PBT) for the period ended 31 March 2024 in both Long-Term Insurance Business and General Insurance Business amounted to Rs. 12,332 million (Q1,2023: Rs. 9,131 million) showing a considerable growth in total profit amount by 35.06%. The PBT of Long-Term Insurance Business amounted to Rs. 6,655 million (Q1, 2023: Rs. 6,377 million) showing a rise of 4.37%, while the PBT of General Insurance Business amounted to Rs. 5,677 million (Q1, 2023: Rs. 2,754 million) indicating a significant growth of 106.11%.

Charts 11 and 12 show further details of the quarter-wise information on Profitability for the period from Q1, 2023 to Q1, 2024 of the General Insurance business and Long-term Insurance business respectively.

Insurers

Out of 29 Insurance Companies (Insurers) in operation as at 31 March 2024, 15 companies are engaged in Long-Term (Life) Insurance Business, 13 companies are engaged in General Insurance Business and one company functions as a composite company.

Insurance brokers

Seventy-eight insurance brokering companies were registered with the Commission as at 31 March 2024. Total Assets of insurance brokering companies have increased to Rs. 13,243 million as at the end of 1st Quarter 2024, when compared to Rs. 10,352 million recorded at the same period of 2023, indicating a significant growth of 27.92%