Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 4 April 2023 00:35 - - {{hitsCtrl.values.hits}}

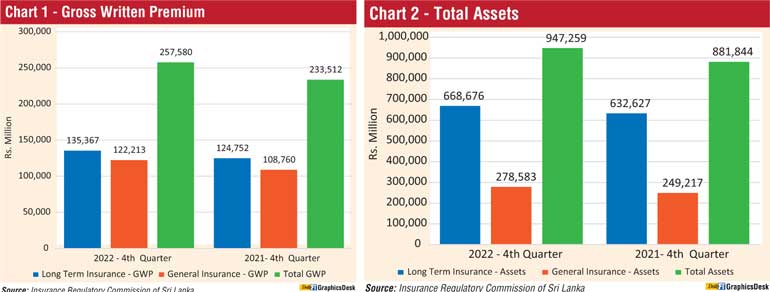

Gross Written Premium

The total Gross Written Premium (GWP) of the insurance industry for Long Term and General Insurance Businesses for the period ended 31 December 2022 was Rs. 257,580 million (Q4, 2021: Rs. 233,512 million), recording a growth of 10.31%, and a premium increase of Rs. 24,068 million when compared to the same period in the year 2021.

The GWP of Long-Term Insurance Business amounted to Rs. 135,367 million (Q4, 2021: Rs. 124,752 million) recording a growth of 8.51%. The GWP of General Insurance Business amounted to Rs. 122,213 million (Q4, 2021: Rs. 108,760 million) recording a growth of 12.37%

Chart 1- Gross Written Premium Income

Total Assets

The value of the total assets of insurance companies has increased to Rs. 947,259 million at the end of 4th Quarter 2022, when compared to Rs. 881,844 million recorded as at the end of Q4 2021, reflecting a growth of 7.42%.

The assets of the Long-Term Insurance Business amounted to Rs. 668,676 million (Q4, 2021: Rs. 632,627 million) depicting a growth rate of 5.70%, mainly due to an increase in business volume which is represented by investments in Government debt securities. The assets of the General Insurance Business amounted to Rs. 278,583 million (Q4, 2021: Rs. 249,217 million) depicting a growth of 11.78%.

Chart 2- Total Assets

Investment in Government Securities

Investments in Government Debt Securities for the period ended Q4, 2022 amounted to Rs. 324,362 million representing 53.76% (Q4, 2021: Rs. 262,411 million) of the total investments of Long-Term Insurance Business and increased by 23.61%, while such investment of the total investment of General Insurance Business amounted to Rs. 88,899 million representing 51.33% (Q4, 2021: Rs. 76,226 million) and increased by 16.63%.

Accordingly, the total investment in Government Securities in the two businesses for the period ended Q4, 2022 amounted to Rs. 413,262 million (Q4, 2021: Rs. 338,637 million), showing an overall increase of 22.04%.

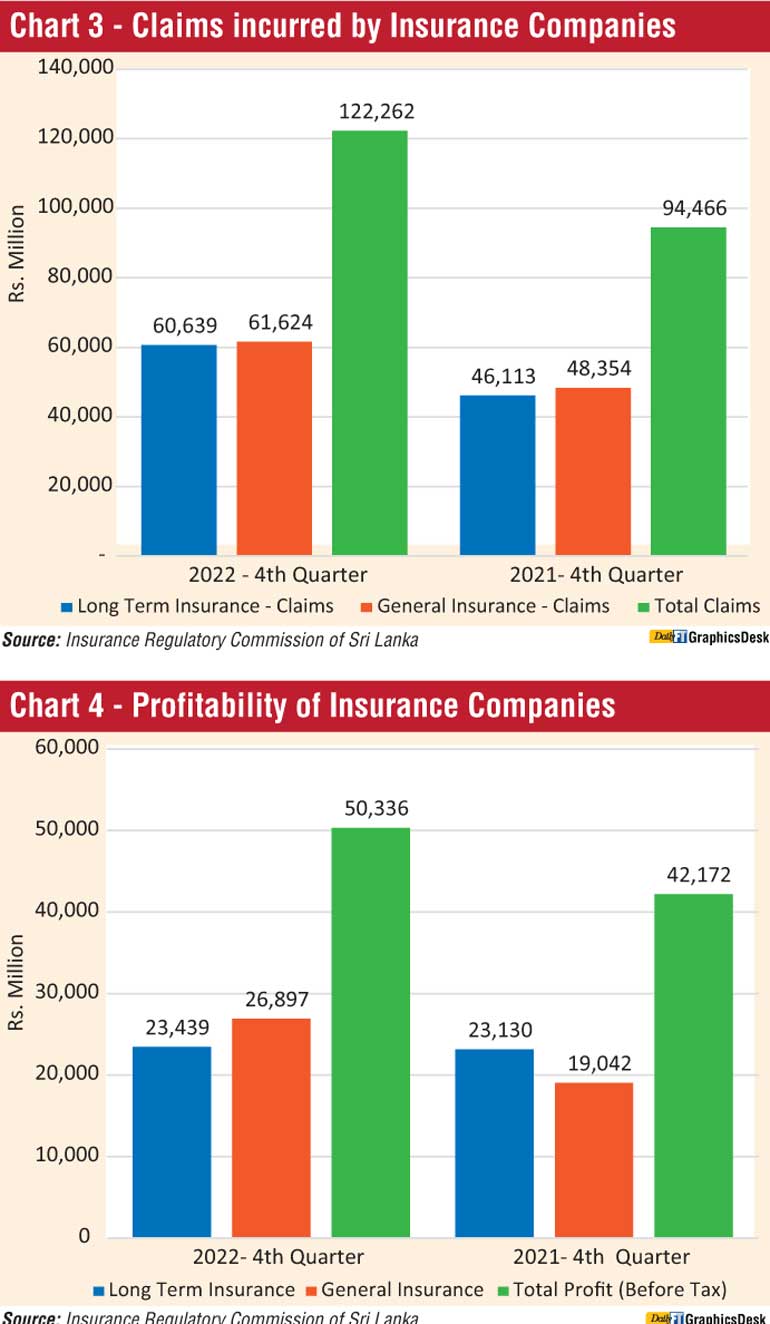

Claims incurred by Insurance Companies

Claims incurred by insurance companies for the period ended Q4, 2022 in both Long-Term Insurance Business and General Insurance Business was Rs. 122,262 million (Q4, 2021: Rs. 94,466 million) showing an increase in total claims incurred amount by 29.42% year-on-year. The Long-Term Insurance claims, including maturity and death benefits, amounted to Rs. 60,639 million (Q4, 2021: Rs. 46,113 million).

The claims incurred in the General Insurance Business, including Motor, Fire, Marine and other categories, amounted to Rs. 61,624 million (Q4, 2021: Rs. 48,354 million). Hence, there is an increase in claims incurred by 31.50% and 27.44% for Long Term Insurance and General Insurance Businesses respectively, when compared to the same period in 2021.

Chart 3- Claims incurred by Insurance Companies

Profit (Before Tax) of Insurance Companies

The Profit Before Tax (PBT) of insurance companies for the period ended Q4, 2022 in both Long-Term Insurance Business and General Insurance Business amounted to Rs. 50,336 million (Q4, 2021: Rs. 42,172 million) showing an increase in total profit amount by 19.36%.

The PBT of Long-Term Insurance Business amounted to Rs. 23,439 million (Q4, 2021: Rs. 23,130 million) while the PBT of General Insurance Business amounted to Rs. 26,897 million (Q4, 2021: Rs. 19,042 million) showing an increase of 1.34% and 41.25% for Long-Term and General Insurance business respectively when compared to the same period in 2021.

Chart 4- Profitability of Insurance Companies

Insurers

Out of twenty-eight (28) Insurance Companies (Insurers) in operation as of 31 December 2022, fourteen (14) companies are engaged in Long-Term (Life) Insurance Business, twelve (12) companies are engaged in General Insurance Business and two (02) companies function as composite companies (transacting in both Long Term and General Insurance Businesses).

Insurance Brokers

Seventy-seven (77) insurance brokering companies were registered with the Commission as of 31st December 2022. Total Assets of insurance brokering companies have increased to Rs. 9,230 million as at the end of 4th Quarter 2022, when compared to Rs. 8,509 million recorded at the same period of 2021, indicating a growth of 8.47%.

However, the total assets of the insurance brokering companies for the 4th Quarter 2022 do not include the asset value of seven (07) brokering companies due to non-submission of quarterly returns.

(Source: Insurance Regulatory Commission of Sri Lanka)