Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 11 August 2021 00:05 - - {{hitsCtrl.values.hits}}

Sri Lankan insurance market

A total of 27 insurance companies operated in Sri Lankan insurance sector by the end of 2020 with 13 long term insurance companies, 12 general insurance companies and two composite insurers who provide both long term and general insurance services. Eight companies are listed in the Colombo Stock Exchange and six companies function with major foreign shareholdings.

The economic and social impacts of the COVID-19 pandemic created numerous challenges and opportunities to the Sri Lankan insurance market. The public awareness on life protection is believed to be increased due to the circumstances evolved by the pandemic. In addition, the pandemic has improved the level of awareness on risks that can be mitigated through life insurance which again positively impacted the performance of the life insurers.

Lockdowns and other containment measures imposed by the Government subdued the demand for most general insurance products. In particular, insurance classes like motor, marine, travel and aviation have mainly affected and reported premium declines compared to previous year.

Industry has undergone certain developments recently in order to enhance smooth functioning of its key operations. The need for robust information technology infrastructures became vital for insurers as many companies have shifted to remote working environment during the year. Usage of digital and virtual platforms enhanced the effectiveness of some of the functions like, customer servicing, premium collection and claims handling.

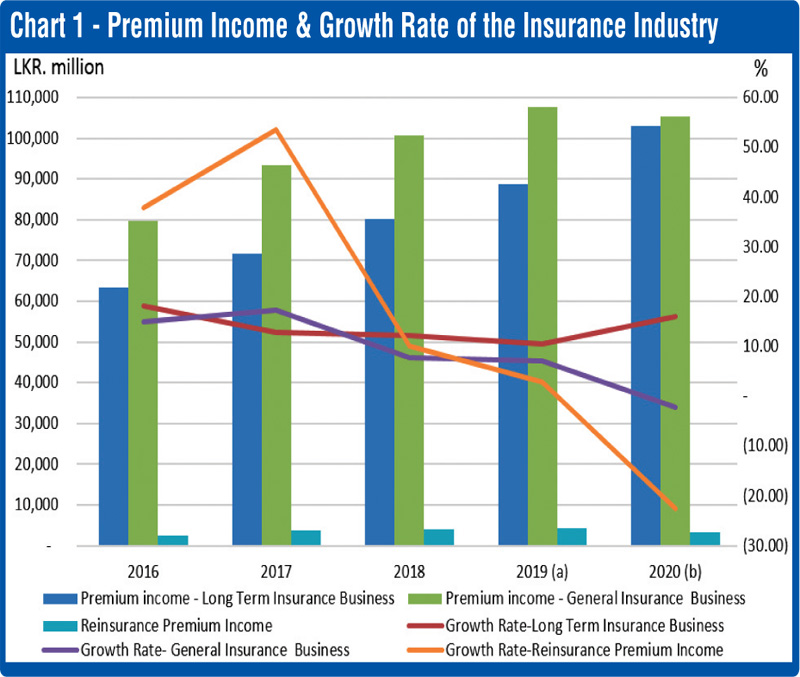

Premium income and growth rate

Overall, the insurance industry reported total Gross Written Premium (GWP) income of Rs. 208,250 million in 2020 compared to Rs. 196,472 million reported in 2019, recording an increase of Rs. 11,778 million and demonstrated a growth rate of 5.99% (2019: 8.62%).

The long term insurance sector generated a GWP of Rs. 102,974 million in 2020, up by 15.98% against the GWP of Rs. 88,787 million generated in 2019. Product innovation, digitisation of operations, remodelling distribution channels, and usage of customer-centric operating models were few of the key strategies used by long term insurers to achieve business growth during the year.

Premium generated from Decreasing Term Assurance (DTA)/Mortgage Protection Policies saw a considerable rise during the year due to increased loan grants by the banking and financial institutions, supported by monetary policy relaxation measures of Central Bank.

In contrast, the general insurance sector recorded a GWP of Rs. 105,276 million in 2020, posting a decline of 2.24% compared to Rs. 107,685 million recorded in 2019 and this restrained performance was mainly due to the sharp decline in motor vehicle imports. Releasing the limited new vehicle stocks into the market and significant rise in vehicle prices were insufficient to offset the contraction in new business premiums general insurance business.

The reinsurance premium income generated by the National Insurance Trust Fund (NITF) from the compulsory reinsurance cession of general insurance business amounted to Rs. 3,235 million during 2020, recording a decline of 22.49% against the reinsurance premium of Rs. 4,174 million generated in 2019 (Refer chart 1).

Insurance penetration and density

Insurance penetration which is reflected by the insurance premium generated by licensed insurance companies as a percentage of GDP amounted to 1.39% in 2020. Although insurance penetration had slightly increased in 2020 compared to 1.31%, which was recorded in 2019, it is still low compared to other countries in the Asian region.

Penetration of the long-term insurance business in 2020 stood at 0.69% (2019: 0.59%) and the penetration of the general insurance business was 0.70% (2019: 0.72%), recording a slight increase in long term insurance and slight decrease in general insurance businesses respectively.

Over the last few years, consumer confidence on insurance and behavioural pattern to purchase insurance products have gradually increased due to increased public awareness and improved services and product developments introduced by insurance companies

Insurance density reflects the insurance premium income per person of the population. This has increased to Rs. 9,501 in 2020 compared to Rs. 9,011 recorded in 2019, growing by 5.44%.

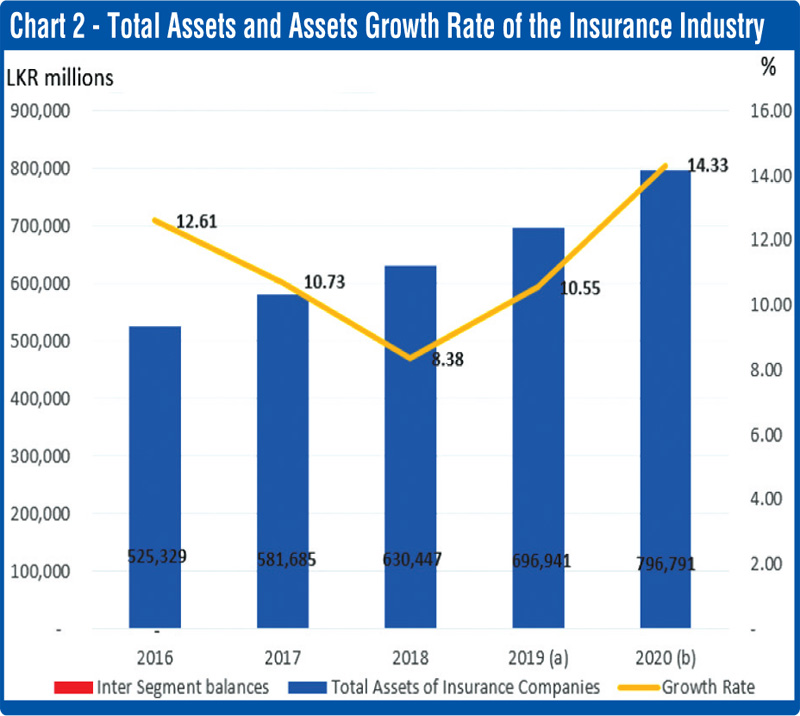

As depicted in Chart 2, the value of total assets of insurance companies has increased to Rs. 796,791 million in 2020, when compared to Rs. 696,941 million recorded in 2019, reflecting a fair growth of 14.33% in comparison to 10.55% growth recorded in 2019. The assets of Long Term Insurance Business amounted to Rs. 563,769 million (2019: Rs. 485,121 million) indicating a growth of 16.21%. The assets of General Insurance Business amounted to Rs. 225,956 million (2019: Rs. 205,130 million) and recorded a growth of 10.15%.

NITF managed to maintain the growing trend in total assets of reinsurance business displaying a slight increase of 5.62% persuaded by the upturns in government securities and premium receivables.

Expansion of business volumes and rising policyholder liabilities, demanded insurance companies to maintain adequate asset portfolio while maximising investment returns and complying with regulatory requirements.

Claims incurred by insurance companies

A total of Rs. 37,903 million (2019: Rs. 35,139 million) claims were incurred in the Long Term Insurance Business during the year 2020 recording an increase of 7.86% over 2019. Total claims incurred comprised of disability benefits, death benefits, surrenders, maturity benefits and other benefits paid to policyholders.

Overall net claims incurred by the general insurance sector unveiled a drop of 26.88% to Rs. 41,517 million (2019: Rs. 58,149 million). Hence, overall net claims ratio dropped to 49.16% which is the lowest recorded in the past five years.

Moreover, it is notable that each and every sub class of general insurance sector exhibited contractions in net claims incurred during the year 2020. Major factors behind this noticeable decline of net incurred claims are mobility restrictions implemented during the 1st and 2nd waves of COVID-19 which directly reduced the motor claims and sharp decline in travel and tourism industries in the wake of the pandemic.

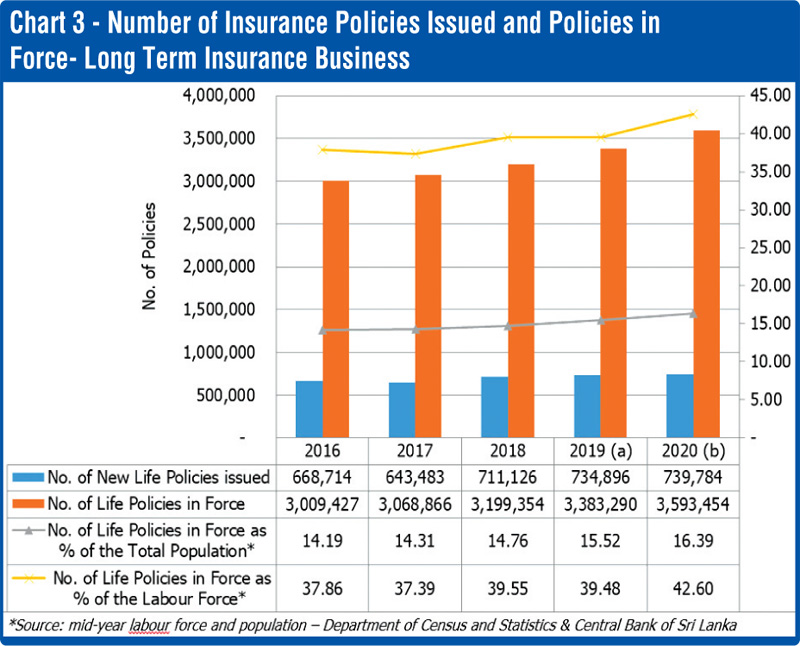

Number of insurance policies issued and policies in force – long-term insurance business

At the end of 2020, total number of long-term insurance policies in force was 3,593,454 an increase of 6.21% compared to 3,383,290 policies in force at the end of 2019. The new policies issued marked 739,784 in 2020 (2019: 734,896) with a slight improvement compared to 2019 despite the challenges emanated from the pandemic.

Number of life policies in force as a percentage of the total population and number of life policies in force as a percentage of the labour force amounted to 16.39% (2019: 15.52%) and 42.60% (2019: 39.48%) respectively. The upward trend depicted by above two ratios during the past few years continued to maintain during the year under review emphasising on the ability of life insurers to thrive in the market by innovating and adapting to emerging realities.

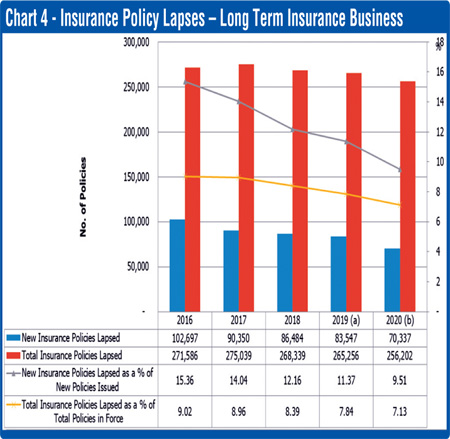

Insurance policy lapses – long-term insurance business

Chart 4 depicts insurance policy lapses at the due date or within the grace period because of non-payment of premium, amounted to 256,202 (2019: 265,256) policies with a slight reduction of 3.41% during the year under review. The new insurance policies lapsed stood at 70,337 (2019: 83,547) with a significant drop by 15.81% and claimed for 27.45% of the total insurance policies lapsed.

Total insurance policies lapsed as a percentage of total policies in force and new insurance policies lapsed as percentage of new policies issued were 7.13% (2019: 7.84%) and 9.51% (2019: 11.37%) respectively demonstrating a decline compared to 2019. It is noteworthy to mention that above two ratios were experiencing a downward trend over last five years, with 2020 being the least.

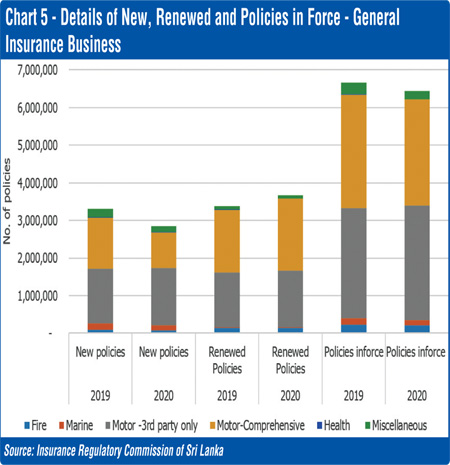

Number of insurance policies issued and policies in force – general insurance business

Number of insurance policies issued and policies in force – general insurance business

New policies issued during the year 2020 reduced by 13.90% comparing to previous year and totalled to 2,850,308 and the decline majorly triggered by motor insurance policies. As aforementioned, new comprehensive motor policies reduced and third party motor policies increased and all together new policies issued under the category of motor stood at 2,471,051. In addition, new policies under health insurance business also presented an increase of 3,725 policies.

On the flip side, number of policies renewed by the policyholders with the same insurer presented a moderate growth of 8.39% and recorded as 3,663,655 and exclusively driven by motor and health insurance policies. Number of policies in force at the end of year 2020 declined by 2.82% and stood at 6,474,623. During the year, policies in force for miscellaneous, marine, fire and motor have decreased by 24.23%, 24.19, 6.92%% and 6.29% respectively compared to previous year hindering the growth prospects of the general insurance sector.

Profitability of insurance companies

Profitability of insurance companies

During 2020, the insurance industry displayed a significant financial performance by posting a year-over -year profit growth of 29.26%. Accordingly, the total profitability (profit before tax) of the industry reported as Rs. 41,767 million for year 2020, whereas same was amounted to Rs. 32,311 in 2019.

Contrasting to previous years, the contribution of general insurers to overall profitability exceeded the long term insurance companies during the year, as a result of a remarkable profit growth demonstrated by general insurance business by recording a total profit amounting to Rs. 23,040 million for year 2020. NITF and Allianz General were the key drivers of profit growth while SLIC also remained among highest profit generators despite displaying a slight contraction in profits compared to last year.

The profits of long term insurance business contracted by 17.89% in 2020 and this reduction was a result of decreased surplus transfers and enlarged claim provisions of major long term insurers. As a result of this, nine companies engaged in long term insurance business have reported reduced profitability in 2020. Ceylinco Life was the highest contributor to overall long term profitability, reporting a profit of Rs. 8,767 million while Softlogic Life, Union Life and SLIC exhibited subsequent highest profits respectively.

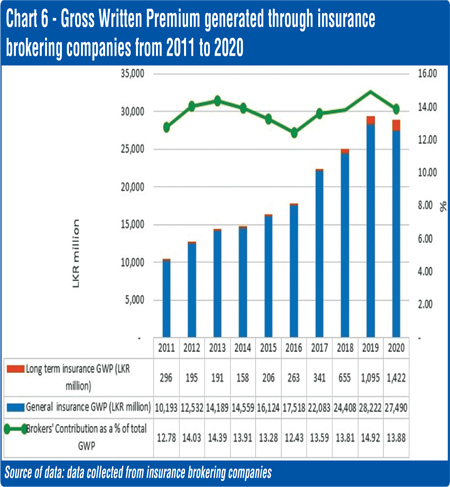

Insurance brokering companies

By the end of 2020, 68 insurance brokering companies operated in the market and generated a Gross Written Premium (GWP) amounting to Rs. 28,912 million (2019: Rs. 29,317 million). This total GWP consisted of premium income generated through long term insurance business and general insurance business which amounted to Rs. 1,422 million (2019: Rs. 1,095 million) and Rs. 27,490 million (2019: Rs. 28,222 million) respectively. Out of the total GWP generated, 95.08% represented GWP of general insurance business and only 4.92% represented GWP of long term insurance business.

Even though the total GWP generated through insurance brokering business recorded a decline of 1.38% in 2020 compared to Rs. 29,317 million generated in 2019, a noticeable increase in the GWP of long term insurance business, which is 29.85%was noticed during the year mainly due to the increased demands for life insurance policies with the pandemic situation of the country.

As intermediaries, insurance brokering companies have contributed in generating a considerable GWP of general insurance business (Rs. 105,276 million) including SRCC and T premium. Similar to previous years, the contribution of insurance brokering companies towards long term insurance business during 2020 was insignificant. As per the details provided by the brokering companies, only 1.38 % of the total GWP of long term insurance business (Rs. 102,974 million) was generated through them.

In 2020, 31 insurance brokering companies procured GWP exceeding Rs. 100 million each and these insurance brokering companies collectively generated GWP amounting to Rs. 27,462 million. The remaining 37 insurance brokering companies generated GWP amounting to only Rs. 1,450 million.

In addition, insurance brokering companies have extended their intermediary services in the area of reinsurance and accordingly few brokering companies have earned considerable commissions during year 2020 which amounted to Rs. 463 million. (2019: Rs. 1,551 million).

Challenges for the future

Challenges for the future

Along with the disruptions created by the pandemic, opportunities have emerged for insurers to reinvent themselves and provide insurance services fulfilling new social requirements and market needs and to adopt digital channels in lieu of face-to-face sales, accelerate product developments to better align with public demand for protection, as the interest of younger generations in life, health and other protections products has notably increased with the outbreak of the pandemic.

Beyond the impact of COVID-19, the insurance industry is occupied with other key challenges such as rise in consumer expectations, cyber threats, increasing climate risk and catastrophe events, sustainability imperatives, and vast retirement savings and protection gaps which will require insurers to think bigger and differently in the years to come.

(Source: Insurance Regulatory Commission of Sri Lanka).