Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Thursday, 5 October 2023 01:29 - - {{hitsCtrl.values.hits}}

By The Insurance Regulatory Commission of Sri Lanka

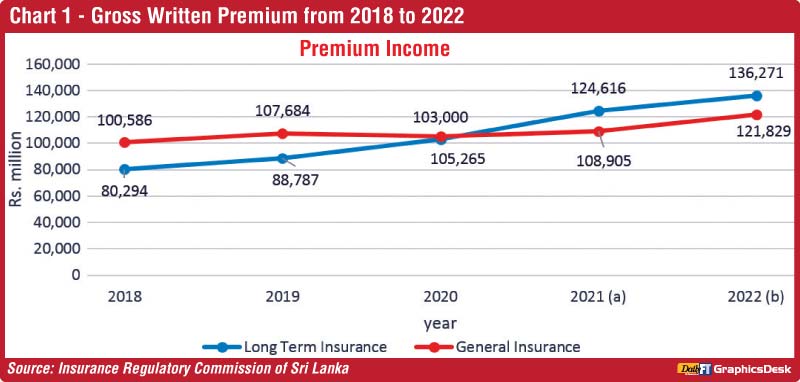

Gross Written Premium

The Gross Written Premium (GWP) of both long-term and general insurance business increased to Rs. 258,100 million in 2022 demonstrating a subdued growth of 10.5% in comparison to the previous year’s overall premium growth of 12.1%. The hindrance observed in overall premium growth was largely contributed by the passive progress in premium income of long-term insurance business as it displayed the lowest premium growth rate reported in the last five years.

Regardless of the formidable challenges that unfolded in the post-pandemic era of the year 2022, the long-term insurance industry sustained by recording a moderate growth of 9.4% (2021: 21.0%) with an overall GWP of Rs. 136,271 million. Rising interest rates hampered the loan granting facility and adversely affected the premium growth of loan protection insurance covers. Depleted real income of households due to soaring inflation has resulted in significant drop in new long term insurance policies issued during the year, resulting in subdued premium growth.

The premium income of general insurance business demonstrated a significant improvement during the year by recording an 11.9% growth rate in comparison to 3.5% growth reported in the last year. While overall premium income of general insurance business reached Rs. 121,829 million, the major share of the reported premium income was attributed to motor insurance.

Insurance penetration declined to 1.1% from 1.3% year-over-year mainly as a result of subdued total premium growth and relative increase in gross domestic product at current market price. Nevertheless, the protection gap is considerably wide in the country which requires proactive measures such as spreading awareness about the benefits of insurance, increasing the accessibility and affordability of insurance services, development of innovative products, improved customer service through technological advancements etc. to bridge the gap and enhance the penetration level.

Yet, the implications of current macro-economic turbulences would hamper the growth of the insurance sector in the country mainly as disposable income of the public has reduced. The insurance premium per person exhibited positive movement from Rs. 10,540 to Rs. 11,636 during the year on account of comparatively stable population growth in the country in 2022.

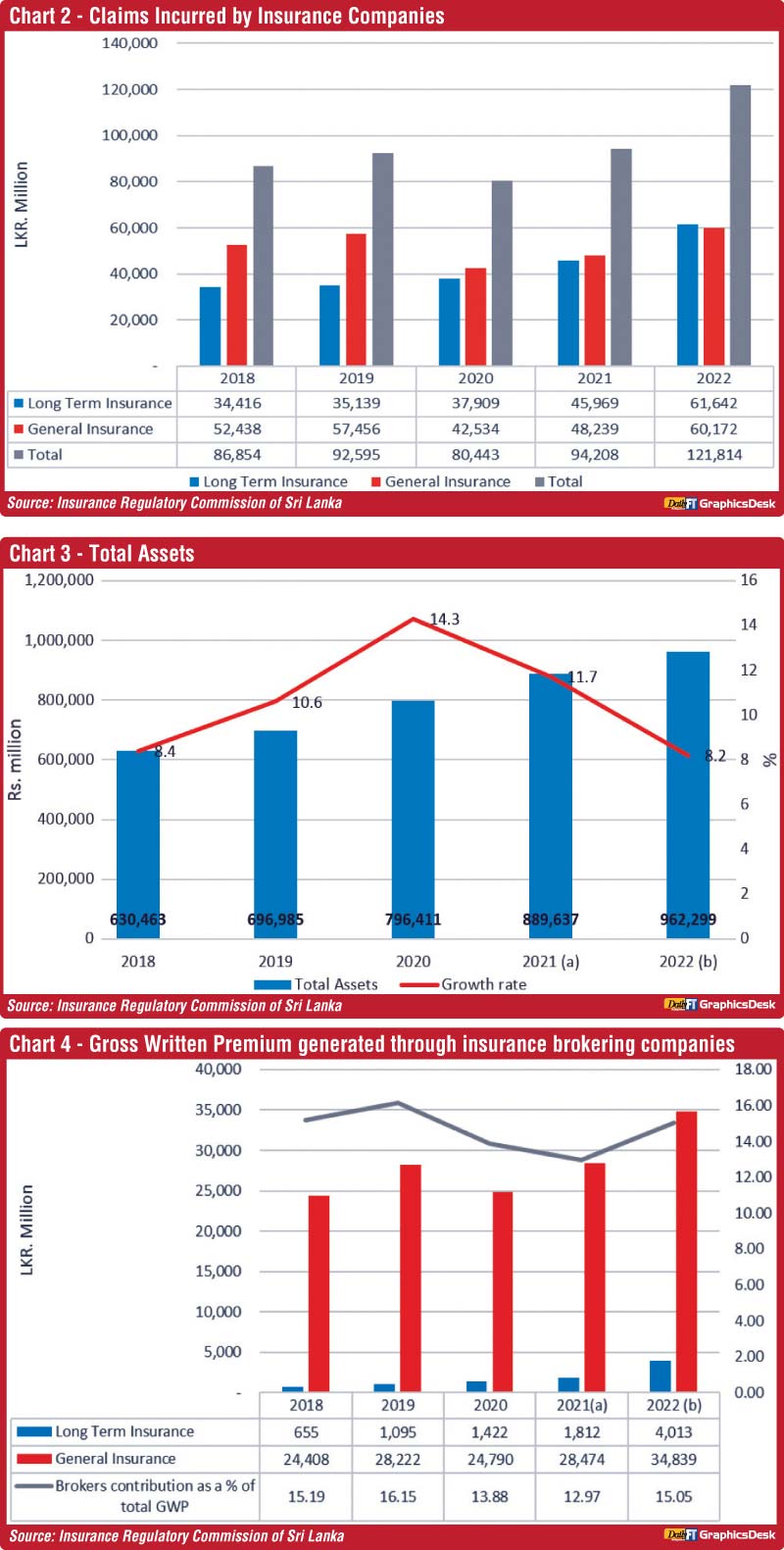

Claims incurred by insurance companies

The net claims incurred in the long-term insurance industry recorded Rs. 61,642 million during the year 2022. The growth rate was recorded at 34.1%, which is the highest growth rate recorded for the past five years. The increase emanated basically from maturity benefits, surrenders, and others.

In 2022, the general insurance industry witnessed a significant increase in total net claims, reaching Rs. 60,172 million (excluding SRCC & T). This indicates a substantial surge of 24.7% compared to the amount of Rs. 48,239 million reported in 2021. The claims of the general insurance sector have witnessed a surge due to multiple factors. Firstly, there has been an increase in costs for repairs and replacements resulting from high inflationary conditions prevailed in the country. Additionally, unforeseen riot claims arising from protests have added to the financial burden faced by insurers. Furthermore, the recent lift of pandemic restrictions has resulted in an upswing in mobility, leading to a rise in accidents and subsequent insurance claims. Together, these factors have significantly contributed to the increased claims experienced by the general insurance sector.

Net Claims incurred by insurance companies over the last five years from 2018 to 2022 for long term and general insurance business are illustrated in Chart 2.

The total net claims incurred by the long-term insurance sector amounted to Rs. 61,642 million in 2022 when compared to Rs. 34,398 million recorded in 2018. The total claims incurred by life insurers continued to grow over the last five years. Claims incurred to policyholders by the long-term insurers can be categorised into Disability Benefits, Death, Surrenders, Maturity Benefits and Other benefits. The net claims incurred by the general insurance sector increased by 14.75% from 2018 to 2022.

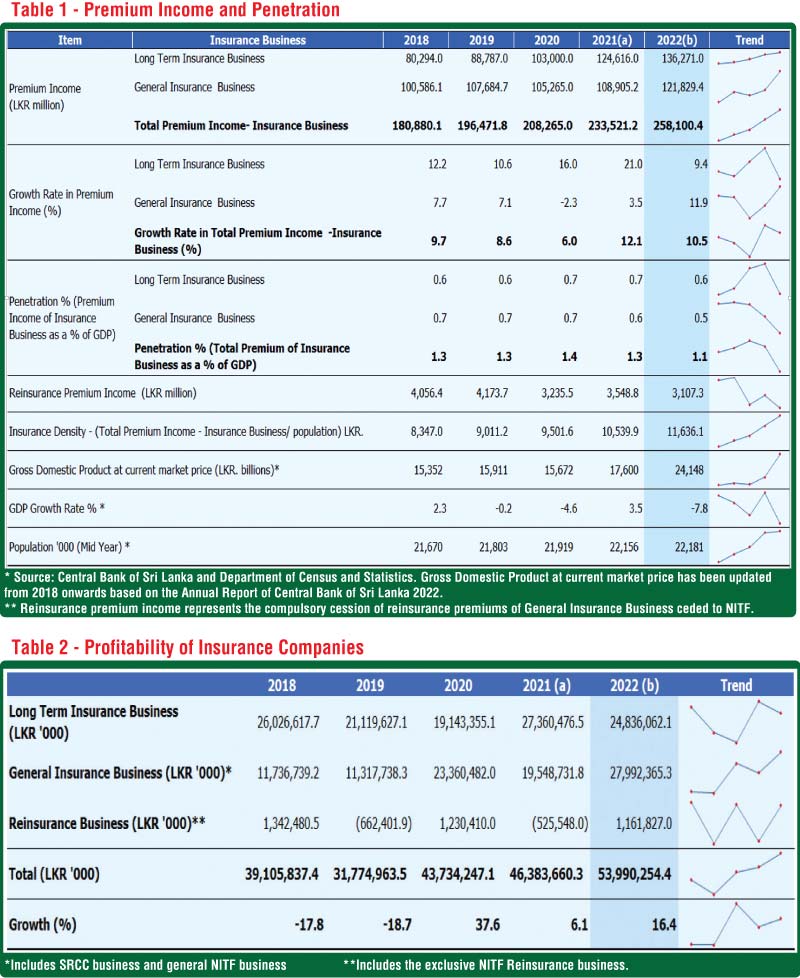

Total assets

The value of total assets reached Rs. 962,299 million by the end of year 2022 reporting a year-over-year growth of 8.2%. Total assets grew in parallel to business growth but at a comparatively reduced rate compared to the preceding years. This was largely due to the effect of depleted asset values of insures in the face of the high interest rate environment prevailed in the year.

Long term insurance business accounted for Rs. 671,611 million worth of assets, representing the major contribution to assets of insurance industry. Subdued business growth and significant mark-to-market losses in financial investments depressed the growth of long-term insurance assets to 6.2% in 2022, making it the lowest growth rate reported in the last five years. However, general insurance business managed to maintain favourable progress in total asset portfolio, marking a 12.0% growth in 2022. This was largely backed by the increased financial investments, particularly the government debt securities due to significant high yield rates offered during the year.

As depicts in Chart 3, the total asset portfolio of the insurance industry reached Rs. 962,299 million by the end of 2022, displaying growth over the last five years. However, the rate of growth has slowed in 2021 and 2022.

Profitability of insurance industry

The profitability of the insurance industry in Sri Lanka unveiled a moderate growth of 16.4% by reporting Rs. 53,990 million profitability for the year 2022. Every long-term insurer except two, achieved favourable profitability results for the year amidst the hectic socio-economic environment, which was prevalent in the country. However, profits were notably lesser than the preceding year primarily owing to weak GWP growth and substantial mark-to-market losses induced by high interest rate environment.

General insurance business demonstrated a remarkable year-over-year profit growth of 43.2% in 2022, which was largely influenced by promising expansion in overall premium income and noteworthy foreign exchange gains reported by several general insurers which emerged from foreign currency denominated investments.

The profitability of the insurance industry over the last five years, from 2018 to 2022 is depicted in Table 2. The highest recorded profitability was in 2022, while the lowest was in 2019. Unfavourable economic conditions prevailed in the country, coupled with negative effects created by Easter Sunday attacks challenged the performance of the insurance industry during the year 2019. During 2020, the insurance industry displayed a significant financial performance by posting a year-over-year profit growth of 37.64%. The contribution of general insurers to overall profitability exceeded the long-term insurers in 2022 and recorded Rs. 27,992 million.

No. of insurance companies

As at 31 December 2022, 28 insurers were registered with the Insurance Regulatory Commission of Sri Lanka. Two of them were composite companies transacting both Long Term Insurance and General Insurance business, whilst 14 of them engaged in Long Term Insurance Business and 12 companies engaged only in General Insurance Business. In terms of ownership, six insurance companies operated with major foreign shareholdings. 10 insurers are listed on the Colombo Stock Exchange.

Insurance brokers

Seventy-seven insurance brokering companies were registered with the Commission as at 31 December 2022. The total GWP generated through the insurance brokering business amounted to Rs. 38,852 million and recorded an increase of 28.28% in 2022 compared to Rs. 30,286 million generated in 2021. The long-term insurance business contributed to Rs. 4,013 million, while the general insurance business contributed Rs. 34,839 million.

Chart 4 depicts the Gross Written Premium generated through insurance brokering companies over the last five years from 2018 to 2022.