Thursday Feb 26, 2026

Thursday Feb 26, 2026

Friday, 23 October 2020 00:00 - - {{hitsCtrl.values.hits}}

By The Insurance Regulatory Commission of Sri Lanka

The insurance sector in Sri Lanka comprised of 27 insurance companies, 67 insurance brokering companies and 16 loss adjusters at the end of 2019. Out of the 27 insurers, 13 operated as life insurers carrying on long term insurance business, 12 engaged in general insurance business and two operated as composite insurers.

During the year, a composite insurer, Seemasahitha Sanasa Rakshana Samagama segregated its long term and general insurance businesses into two separate entities, namely Sanasa Life Insurance Company Ltd. and Sanasa General Insurance Company Ltd.

Over the last two years, new registrations of insurance brokering companies have slightly increased from 60 to 67.

With intensifying competition between market players, customer retention and cost effectiveness have become more critical, forcing insurance companies to seek ways to increase sales and customer satisfaction while keeping costs low and maintaining profitability. This has led to the emergence of new alternative distribution channels, such as online platforms, mobile applications and social media, etc., which drive premium growth at lower costs.

Premium income and growth rate

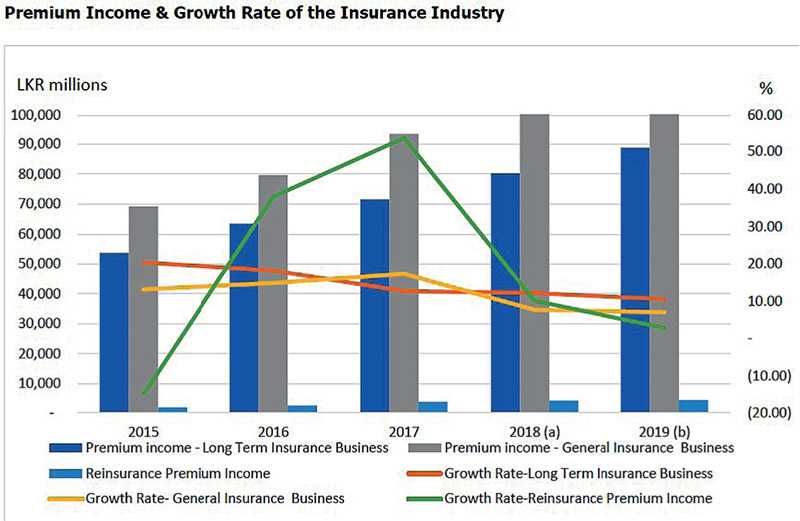

The Sri Lankan insurance industry achieved a growth rate of 8.64% in terms of overall Gross Written Premium (GWP) for both long term and general insurance business sectors in 2019. The total GWP income for both sectors was Rs. 196,513 million compared to Rs. 180,880 million in 2018, recording an increase of Rs. 15,633 million.

The long term insurance sector generated a GWP of Rs. 88,781 million in 2019, up by 10.57% against the GWP of Rs. 80,294 million generated in 2018. The general insurance sector recorded a GWP of Rs. 107,732 million in 2019, posting a growth of 7.10% compared to Rs. 100,586 million recorded in 2018.

The reinsurance premium income generated by the National Insurance Trust Fund (NITF) from the compulsory reinsurance cession of general insurance business amounted to Rs. 4,174 million during 2019, recording an increase of 2.91% against the reinsurance premium of Rs. 4,056 million generated in 2018. (Refer chart 1)

Insurance penetration and density

Insurance penetration which is reflected by the insurance premium as a percentage of GDP amounted to 1.31% in 2019. Although insurance penetration had slightly increased in 2019 compared to 1.26%, which was recorded in 2018, it is still low compared to other countries in the Asian region. Penetration of the long term insurance business in 2019 stood at 0.59% (2018: 0.56%) and the penetration of the general insurance business was 0.72% (2018: 0.70%), recording a slight increase in both long term and general insurance businesses compared to the penetration ratio recorded in 2018.

Over the last few years, consumer confidence on insurance and behavioral pattern to purchase insurance products have gradually increased due to increased public awareness and improved services and product developments introduced by insurance companies

Insurance density reflects the insurance premium income per person of the population. This has increased to Rs. 9,013 in 2019 compared to Rs. 8,347 recorded in 2018, growing by 7.98%.

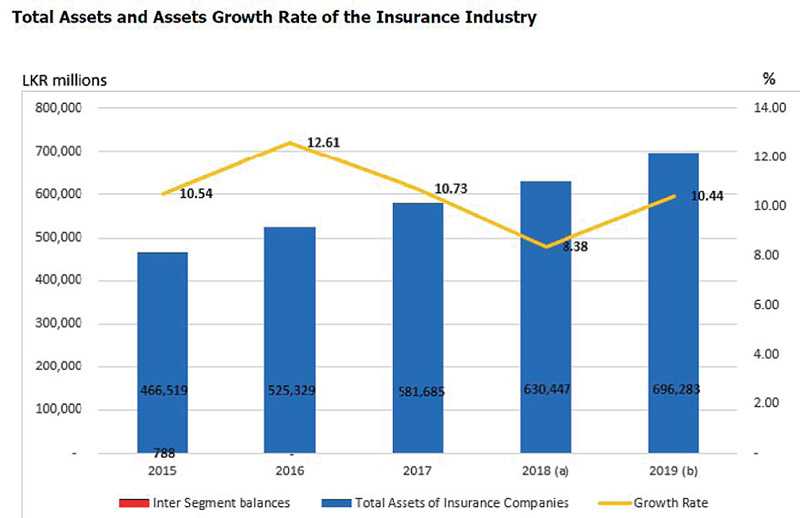

Assets of the sector

As depicted in Chart 2, the value of total assets of insurance companies has increased to Rs. 696,283 million in 2019, when compared to Rs. 630,447 million recorded in 2018, reflecting a growth of 10.44%. The assets of Long Term Insurance Business amounted to Rs. 485,723 million (2018: Rs. 430,759 million) indicating a growth of 12.76% year-on-year. The assets of General Insurance Business amounted to Rs. 203,870 million (2018: Rs. 196,005 million) and recorded a growth of 4.01%.

Despite the constant reduction in assets observed in previous two years, NITF managed to display a notable growth in the assets of their reinsurance business, recording a total of Rs. 6,690 million as at 31 December 2019. This was predominantly driven by the substantial increase in the investments held in Government Debt Securities relating to the reinsurance business of NITF.

Claims incurred by insurance companies

A total of Rs. 36,079 million (2018: Rs. 34,416 million) claims were incurred in the Long Term Insurance Business during the year 2019 recording an increase of 4.83% over 2018. Total claims incurred comprised of disability benefits, death benefits, surrenders, maturity benefits and other benefits paid to policyholders.

Total net claims incurred including Strike, Riot, Civil Commotion and Terrorism (SRCC & T) increased during the last five years in the general insurance segment. However, during 2019 it displayed a moderate increase and amounted to Rs. 58,436 million depicting a year on year growth of 11.28% (2018: 9.85%). Net claims incurred by all sub classes of general insurance business had increased in year 2019 compared to previous year except for miscellaneous insurance business.

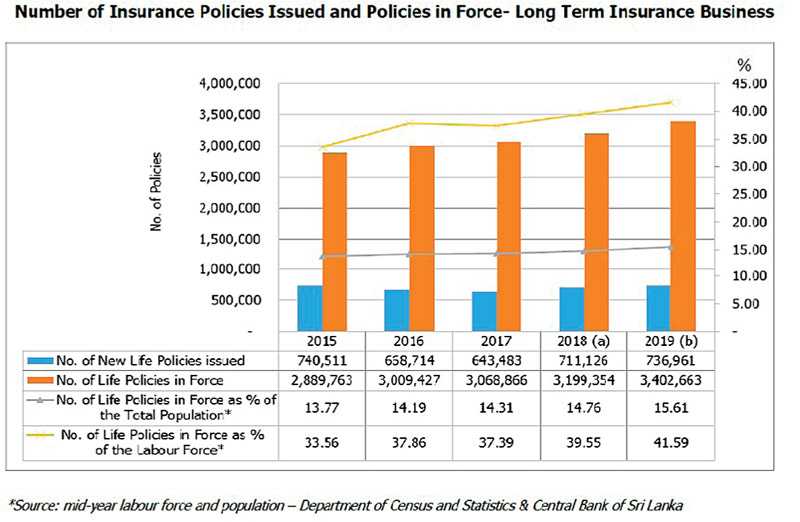

Number of insurance policies issued and policies in force – long term insurance business

At the end of 2019, total number of long term insurance policies in force was 3,402,663 and increased by 6.35% compared to 3,199,354 policies in force at the end of 2018. The life insurance industry in Sri Lanka continued to expand during year 2019 and issued 736,961 new life insurance policies, increasing by 3.63% compared to 711,126 new policies issued in 2018 as indicated in Chart 3.

Number of life insurance policies in force as a percentage of total population was 15.61% in 2019 compared to 14.76% recorded in 2018. Number of life policies in force as a percentage of labour force has continued to rise over time except in year 2017. This trend continued in 2019 and increased to 41.59% which demonstrates the fact that the sector as a whole continues to thrive.

The trend line reflects the way forward for life insurance business in Sri Lanka and the potential of expansion in a market known for its low penetration rates.

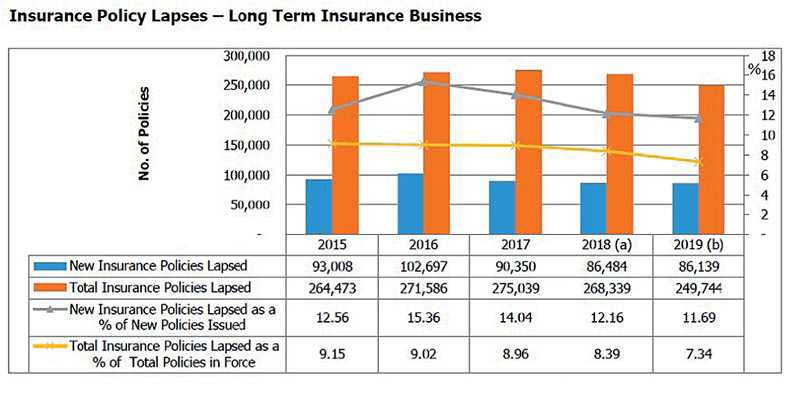

Insurance policy lapses – long term insurance business

Chart 4 depicts a slight reduction in lapse rates in terms of new insurance policies and total insurance policies in year 2019. Total lapsed life insurance policies amounted to 249,744 (2018: 268,339) in year 2019 and 86,139 (2018: 86,484) out of same consists of new lapsed policies. Accordingly, new insurance policy lapses have slightly decreased by 345 policies during the year 2019.

Further, total policy lapses as a percentage of total policies in force was 7.34% (2018: 8.39%) while new policy lapses as a percentage of new policies issued was 11.69% in 2019 (2018: 12.16%).

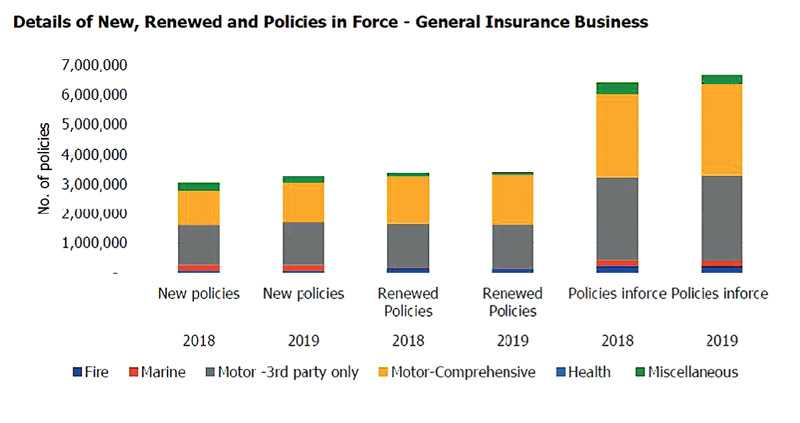

Number of insurance policies issued and policies in force – general insurance Business

The total number of policies in force pertaining to all classes of general insurance business amounted to 6,672,241 in 2019 (2018: 6,393,900) and increased by 4.35% compared to 2018.

In the year 2019, insurance companies had underwritten 3,285,509 new policies by recording 7.12% increase compared to previous year. Total renewed policies stood at 3,414,769 compared to 3,394,775 policies renewed in year 2018.

Chart 5 illustrates the details of new, renewed and policies in force for years 2018 and 2019.

Similar to previous years, motor insurance represented the largest number of insurance policies in force as at end of the year 2019 by recording 5,935,214 policies (2018: 5,571,194). This amount comprised of third party policies of 2,897,534 (2018: 2,819,590) and 3,037,680 comprehensive policies (2018: 2,751,604). During the year, policies in force for marine, fire and miscellaneous have decreased by 3.55%, 5.65% and 18.89% respectively compared to previous year. Health policies in force have increased by 40.37% in 2019 compared to 2018.

Profitability of insurance companies

Long term insurance business displayed an increasing trend in its profitability during last two years mainly as a result of surplus transfers made by many insurers, including the One-off Surplus and the substantial profit earned by Janashakthi Life in 2018 from selling of its subsidiary investment of Janashakthi General to Allianz Gen. However, in 2019, the profitability showed a decline of 24.92% compared to 2018, after certain life insurers namely SLIC, Union Life, Sanasa Life, HNB Life, Arpico and Allianz Life reporting decreased profits for the year, largely driven by escalated claims and contracted surplus transfers. The profitability of long term insurance business amounted to Rs. 19,540 million (2018: Rs. 26,027 million) mainly driven by Ceylinco Life.

The overall profitability of general insurance business was largely impacted by the decreased performance of Allianz General, Ceylinco General and Amana General during the year mainly driven by the increased claims especially in ‘Suraksha Scheme’ of Allianz General. Accordingly, the total profit before tax of general insurance business amounted to Rs. 11,130 million in 2019 (2018: Rs. 11,737 million), exhibiting a decline of 5.17% compared to year 2018.

However, NITF, LOLC General and SLIC reported notable upturns in profitability compared to last year. The improved profitability of NITF was predominantly driven by the GWP increase of Agrahara (health insurance scheme for the public sector employees), National Natural Disaster Insurance Scheme (NNDIS) and SRCC & T schemes. Further, insurance claims pertaining to NNDIS scheme fell down notably compared to 2018.

Dispute resolution and Investigations

The IRCSL, under its overall objective of safeguarding the interests of policyholders, inquiries into policyholders’ grievances in connection with insurance claims pertaining to life and general insurance policies. The IRCSL also investigates into any other complaints referred to it against any insurer, broker, loss adjuster or agent. During 2019, 315 new matters were referred to the Commission. A total of 352 matters (including matters carried forward) were settled/closed during the period. Aggregate value of the claims settled during the period, with the intervention of the Commission, is around Rs. 139 million.

Insurance brokering companies

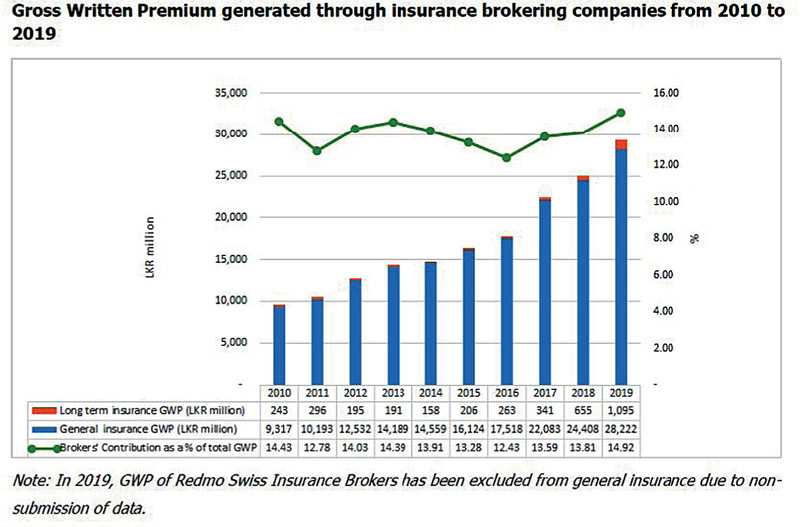

By the end of 2019, 67 insurance brokering companies operated in the market and generated a Gross Written Premium (GWP) amounting to Rs. 29,317 million. Accordingly, total GWP generated through insurance brokering business recorded a growth of 16.97% in 2019 when compared to Rs. 25,063 million generated in 2018.

This total GWP consisted of premium income generated through long term insurance business and general insurance business which amounted to Rs. 1,095 million and Rs. 28,222 million respectively. Out of the total GWP generated by insurance brokers, 96.26% represented GWP of general insurance business and only 3.74% represented GWP of long term insurance business. Insurance brokering companies have generated 26.20% of the total GWP of general insurance business which amounted to Rs. 107,732 million (including SRCC & T premium). Similar to previous years, the contribution of insurance brokering companies towards long term insurance business was insignificant in 2019. As per the details provided by the brokering companies, only 1.23% of the total GWP of long term insurance business (Rs. 88,781 million) was generated through brokers.

In 2019, thirty-one insurance brokering companies procured GWP exceeding Rs.100 million each and these insurance brokering companies collectively generated GWP amounting to Rs. 27,897 million. The remaining thirty-six insurance brokering companies generated GWP amounting to Rs. 1,420 million representing around 5% of the GWP of brokers.

Challenges for the future

Industry analysts predict that the general insurance sector would face a fundamental structural change over the next few decades, with a possible decline in premiums from motor class, the main line of general insurance business of today as a result of technological advances.

The insurance industry is about to face unprecedented effects of COVID-19 pandemic, which has currently put the entire world at an enormous threat. Even the healthcare systems of most powerful and richest nations in the world are struggling to cope up with the situation. As many countries and regions had been locked down for months, the adverse impact on economies is widening continuously.

The pandemic-led business interruptions and volatility in the equity markets would likely to distress the pricing of instruments and hinder the investment yields of insurance companies. Death benefits and hospital benefits would be a main concern for long term insurance companies, whereas the general insurers would face losses arising out of mainly travel, employee liability, business interruption and health insurance policies. Thus, the insurers worldwide should adjust their budgets and implementation plans, and even limit the dividend distributions, as the maintenance of adequate reserves and capital positions is vital to face this situation.