Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 15 December 2022 02:14 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

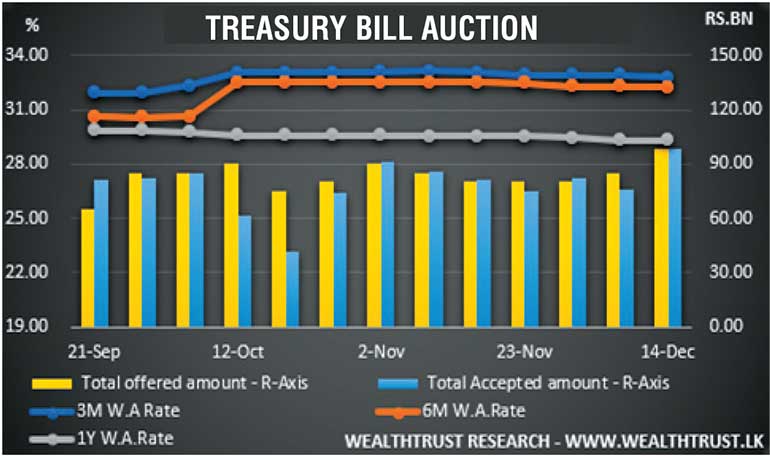

The weekly Treasury bills auction conducted yesterday reflected a strong outcome as weighted averages reduced across all three maturities while the total offered amount was accepted after a lapse of one week.

The weekly Treasury bills auction conducted yesterday reflected a strong outcome as weighted averages reduced across all three maturities while the total offered amount was accepted after a lapse of one week.

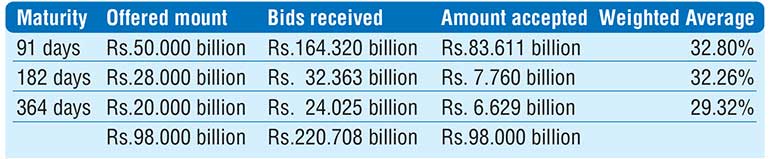

The 91-day Treasury bill weighted average was seen decreasing the most by 11 basis points to 32.80% while it dominated the auction, representing 85.32% of the total offered and accepted volume of Rs. 98 billion. The 182-day and 364-day bills weighted average slid by a single basis point each to 32.26% and 29.32% respectively.

The phase 2 of the auction will be opened for the 182-day and 364-day maturities at its weighted average rates until close of business on the day prior to settlement (i.e., 3.30 pm on 15.12.22).

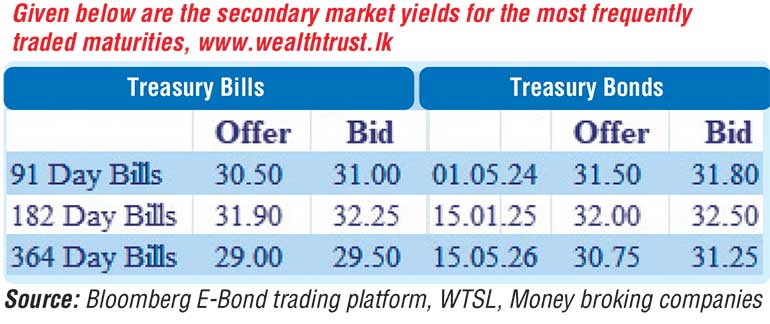

Meanwhile, activity in the secondary bond market remained moderate yesterday while two-way quotes reduced subsequent to the bill auction outcome. Limited trades were reported on the 01.05.24 and 15.05.26 maturities at levels of 31.50% to 32.20% and 30.95% respectively.

In the secondary bill market, the latest 91-day bill was seen changing hands at a low of 31.00% while trades on January to February and June 2023 maturities were seen at levels of 25.00% to 28.50% and 32.00% to 32.45% respectively.

The total secondary market Treasury bond/bill transacted volume for 13 December was Rs. 11.80 billion.

In money markets, the weighted average rates on overnight call money and REPO stood at 15.50% each while an amount Rs. 614.73 billion was withdrawn from Central Bank’s Standard Deposit Facility Rate (SDFR) of 15.50%. The net liquidity deficit stood at Rs. 262.77 billion yesterday as an amount of Rs. 351.97 billion been deposited at Central Bank’s Standard Deposit Facility Rate (SDFR) of 14.50%.

Forex market

In the forex market, the middle rate for USD/LKR spot contracts remained steady at Rs. 363.18 yesterday.

The total USD/LKR traded volume for 13 December was $ 92.50 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)