Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 1 January 2024 04:27 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

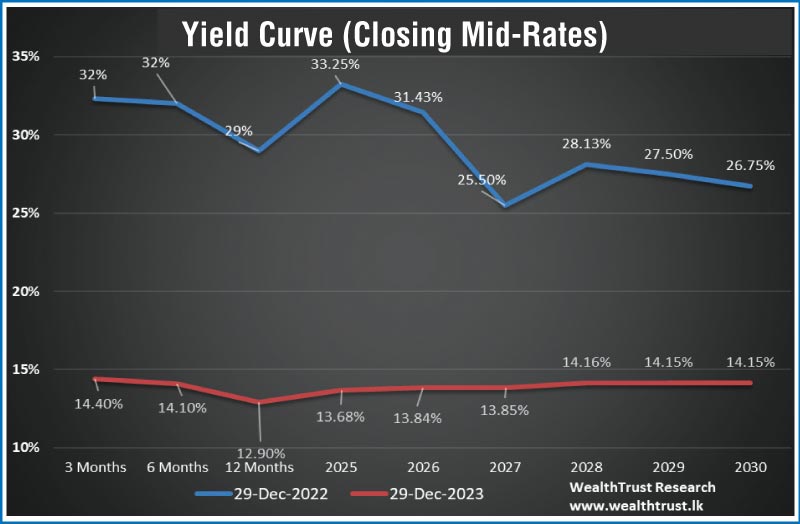

The year 2023 was truly a historical one for the Sri Lankan Government Securities market as the events that unfolded led to some major developments and industry firsts. The year started off with elevated yields, which were at unprecedented levels due to a default risk premium attached to Treasury Bills and Bonds following the economic crisis and political crisis of 2022 and ensuing halt on external debt servicing. This brought about concerns of the possibility of local debt restructuring and it lingered during the first half of the year 2023.

The year 2023 was truly a historical one for the Sri Lankan Government Securities market as the events that unfolded led to some major developments and industry firsts. The year started off with elevated yields, which were at unprecedented levels due to a default risk premium attached to Treasury Bills and Bonds following the economic crisis and political crisis of 2022 and ensuing halt on external debt servicing. This brought about concerns of the possibility of local debt restructuring and it lingered during the first half of the year 2023.

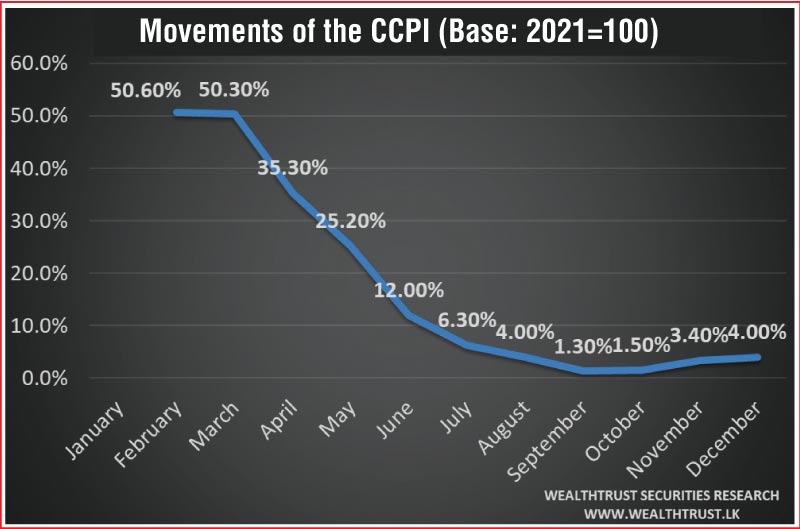

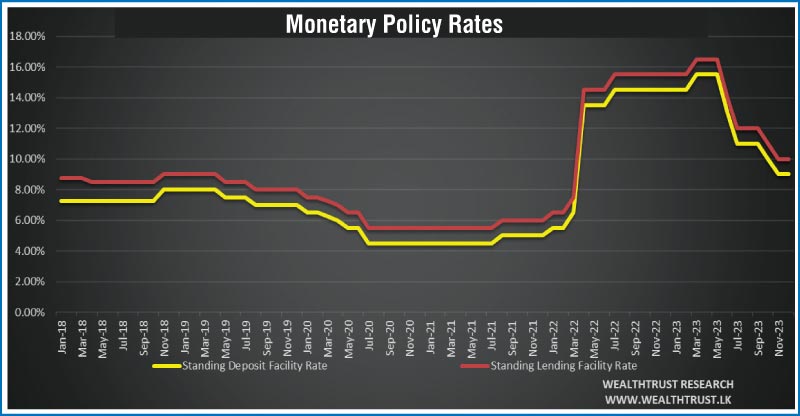

The yield curve stated of the year with a steep inversion, typical of an economic downturn. The inversion was against the backdrop of a drastic 950-basis point increase in policy interest rates from the previous year. This resulted in the year 2023 commencing with tight monetary policy conditions, with the Standing Deposit Facility Rate (SDF) and Standing Lending Facility Rate (SLF) at 14.50% and 15.50% respectively. In addition, the rate of inflation was high, with CCPI (Base:2021=100) registered at +50.60% YoY at the start of the year, as of February 2023.

However, in March 2023 (Q1) upon the news that the IMF had approved a 48-month Extended Fund Facility (EFF) of about $ 2.9 billion to support Sri Lanka’s economic policies and reforms, yields were seen dropping on the back of renewed confidence in Rupee Treasuries. This development paved the way for further funding from multilateral agencies such as the World Bank and ADB. Additionally, on a preliminary basis the CBSL and the MOF (Ministry of Finance) jointly shared indicative plans for a Domestic Debt Optimisation (DDO) program, which would only restructure T. Bills held by the CBSL and a voluntary debt optimisation program for major

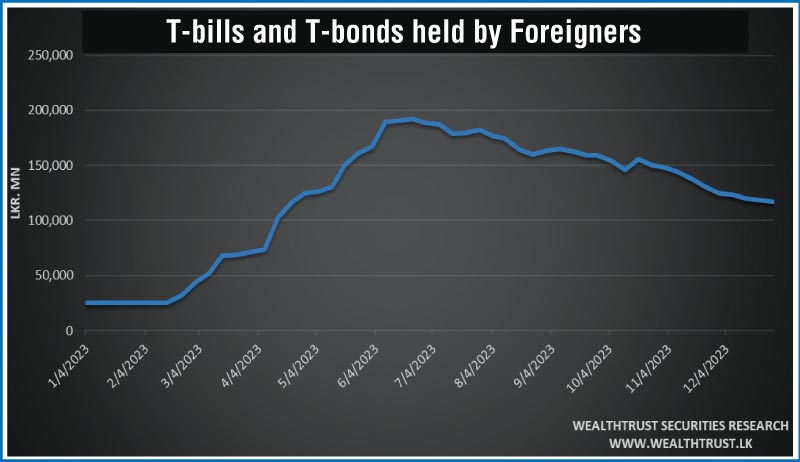

T. Bond holders after consultation. The positive sentiment overshadowed the coinciding policy rate hike earlier in the month of March, that saw the policy rates reach all-time highs of 15.50% and 16.50% on the SDF and SLF respectively. Similarly, on the exchange rate front things began to improve with the LKR appreciating from USD/LKR levels of around Rs. 360 at the start of the year to Rs. 320, reflecting an appreciation of around 11% in March. The yield curve continued to be inverted but recorded a parallel shift down. A surge in foreign interest in Rupee Treasuries was also observed following these developments.

Nevertheless, after an initial reduction in yields following the news, yields were seen reversing gains during second quarter (Q2) as fears of domestic debt restructuring spreading over to all investor categories began to weigh down on the market, dampening demand. However, in early June a steep policy rate cut of 250 basis points, which signalled the start of a monetary easing cycle, and rapidly and steadily cooling inflation that had reduced to + 12.00% YoY (CCPI Base 2021=100) as well in the month of June, was seen supporting the market. Subsequently in late June of 2023, the finalised terms of the DDO were announced. It was decided that banks would be left out of the debt optimisation program and only T. Bonds held by superannuation funds would be restructured by way of a voluntary exchange program. Upon the finalisation of the DDO, yields plummeted drastically, nosediving around 1000 basis points (10%) on selected maturities, as the market opened following the news. The renewed optimism following the better than anticipated DDO outcome resulted in frenzied buying as the default risk premium on Government Securities was no more in play. Foreign holdings in Government Securities were seen peaking in June of 2023 at Rs. 192 billion. The yield curve continued to be inverted but began to show signs of flattening. Q2 also saw the rupee advance further to USD/LKR Rs 290 levels, which was its highest value for the year. Further monetary easing in Q3 of 200 basis points, for a cumulative 450 basis point reduction from peak levels, saw yields decline further until mid-August. As such the policy corridor was at 11.00% and 12.00% as at end Q3. However, September saw the first review of the IMF’s EFF program get underway, but a delay in approving and disbursing the second tranche on the basis of an underperformance on government revenue targets, was experienced. This weighed down on the market causing yields to move back up. Meanwhile, CCPI inflation bottomed out at +1.30% supported by the statistical base effects and a significant moderation in prices, giving further space for rate cuts. The yield curve continued to show signs of flattening, however a slight inversion persisted in Q3. Foreign holdings in Government Securities since peaking in

Q2 experienced a steady decline. Q3 saw the rupee lose ground and drop from its position as the best performing currency in the world in the first half to about Rs. 320-330 levels. Q3 saw in early September the completion of the finalised DDO plan as all envisaged measures were realised.

Q4 saw a further two consecutive rate cuts of 100 basis points each in October and November resulting in policy rates declining to 9.00% and 10.00% respectively to end the year with a cumulative drop of 650 basis points. Inflation started to accelerate as the statistical base effects started to wear off with December CCPI recorded at + 4.00%. This was however in line with the Central Bank of Sri Lanka’s projections. The Central Bank had earlier expressed the view that the disinflation trend might reverse due to increased energy tariffs and higher taxes, but it anticipates price increases stabilising at a 5% target in the medium term. Yields in Q4 continued to decline further with a normalisation of the yield curve as yields on the longer tenure bonds were seen moving up or holding steady while heavy demand on the short to medium tenures drove its yields down sharply. The approval for the second tranche of the IMF program further emphasised the correction on the yield curve. Q4 continued to see an exodus of foreign holdings in rupee treasuries and the rupee marginally appreciate to close at the lower end of

Rs. 320 level.

In conclusion, the Government Securities Market closes the year on a positive note with renewed confidence and optimism and expectations of further reductions in yields in the year 2024.

Weekly Treasury Bill Auctions continues downward trajectory

Meanwhile the last Treasury bill auction for the calendar year, continued to receive a positive response. The total offered amount of Rs. 77.5 billion was taken up at the 1st phase of the auction for the first time in three weeks while weighted average rates decreased. On a week-on-week basis the 182-day bill decreased the most by 8 basis points to 14.16% while the 91-day maturity registered a dip of 6 basis points to 14.51%. The weighted average rate on the 364-day bill held steady at 12.93%. An additional amount of LKR. 8.92 billion was raised at the 2nd phase. For context, the 91, 182 and 364-day T. Bills started the year recording weighted average yields of 32.01%, 32.02% and 29.16% at the first auction of the year 2023.

Rs. 155 billion bond auctions record a bullish outcome

Similarly, the Treasury bond auctions conducted last Thursday recorded positive responses, mainly on the short tenures at its 1st phase, with the entire offered on the 2026 and 2028 durations being fully taken up. The 01.02.2026 maturity recorded a weighted average rate of 13.87% while the 15.03.2028 recorded a weighted average rate of 14.21%. For context at the previous auctions conducted on 12 December, a 2026 duration bond was seen recording a weighted average of 14.07% and a 2028 duration bond was seen recording a weighted average of 14.32%. As such yields on the short end of the yield curve were seen shifting down on the back of significant buying interest. An amount of Rs.150.43 billion was accepted in total against a total offered amount of Rs. 155 billion, leading to the phase 2 of the auction being opened for the 15.05.30 maturity as it was not fully taken up. On the 12 December auction, the medium tenure 2031 maturity offered saw no bids accepted, while the 15.05.30 was previously auctioned at the average of 13.56%.

Secondary bond market steady

The secondary bond market activity on the last trading week of the year 2023 saw yields decline marginally with a spike in activity coinciding with the bond auction but remaining relatively subdued otherwise, on the back of holiday mood.

The daily secondary market Treasury bond/bill transacted volumes for the first two trading days of the shortened trading week averaged at Rs. 54.25 billion.

Foreign holdings in rupee treasuries continue to decline

The foreign holding in Rupee bonds and bills continued to decline for a tenth consecutive week, with a net outflow of Rs. 1.02 billion, bringing the total holding to Rs. 117.44 billion as of 28 December.

The foreign holding opened the year at Rs. 25.5 billion and peaked at Rs. 191.9 billion in June.

Liquidity deficit increases

In money markets, the total outstanding liquidity deficit increased to Rs. 105.99 billion by the week ending 29 December from its previous week’s deficit of Rs. 91.185 billion. The Domestic Operations Department (DOD) of the Central Bank continued to inject liquidity during the week by way of overnight and long-term Reverse repo auctions at weighted average yields ranging from 9.08% to 10.83%. The year opened with a deficit of Rs. 321.19 billion reversed to a surplus of

Rs. 98.43 billion in March at its peak.

The Central Bank of Sri Lankas (CBSL) holding of Gov. Security’s was registered at Rs. 2,743.62 billion, unchanged against its previous week’s level.

Rupee appreciates during the week

In the Forex market, the USD/LKR rate on spot contracts was seen appreciating during the week to close at Rs. 323.90/324.00. This is as against its previous week’s closing level of Rs. 325.25/325.50 and subsequent to trading at a low of Rs. 323.68 and a high of Rs.325.00.

The daily USD/LKR average traded volume for the first two trading days of the week stood at $ 44.84 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)