Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 23 January 2024 00:19 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The weekly Treasury bill auction due today, which will be conducted a day ahead due to a shortened trading week, will have in total an amount of Rs. 130 billion on offer, which will consist of Rs. 30 billion on the 91-day maturity, Rs. 70 billion on the 182-day maturity and a further Rs. 30 billion on the 364-day maturity. This reflects an increase of Rs. 35 billion in the offered amount on a week-on-week basis.

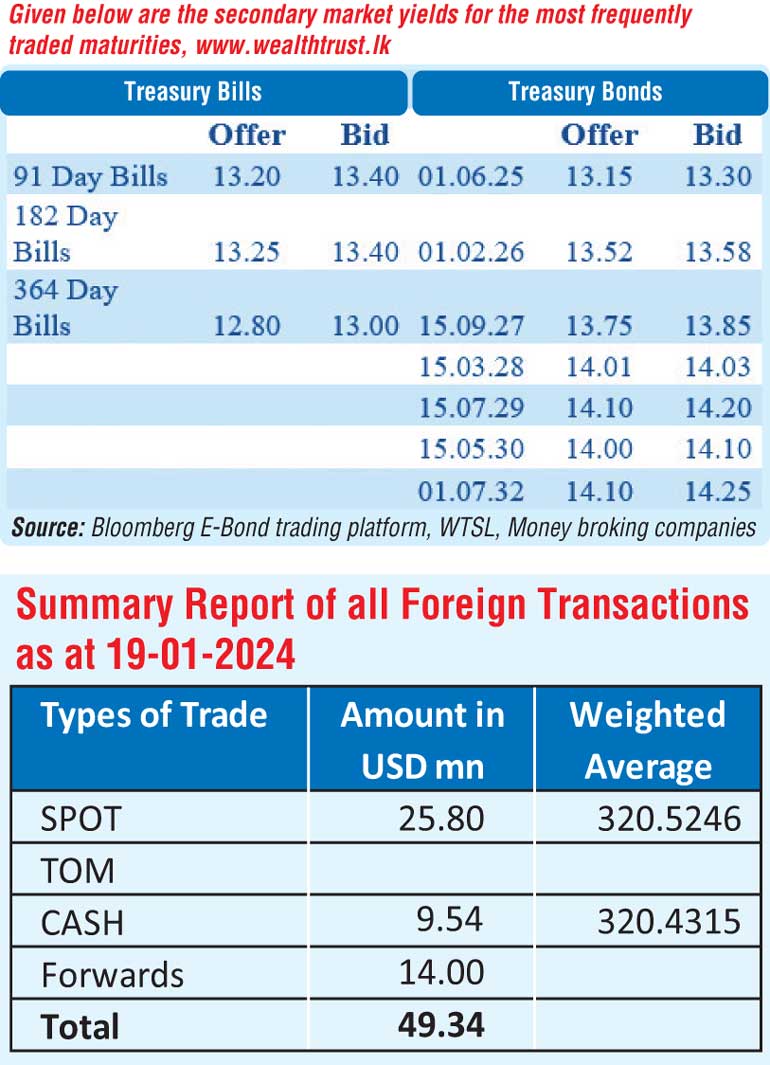

At last week’s Treasury bill auction, the weighted average yields continued on a declining trajectory. The 91-day bill recorded a steep decline of 36 basis points to 13.91%, while the 182-day also dipped by 26 basis points to 13.83%. However, the 364-day bill registered only a marginal reduction of 01 basis point to 12.92%.

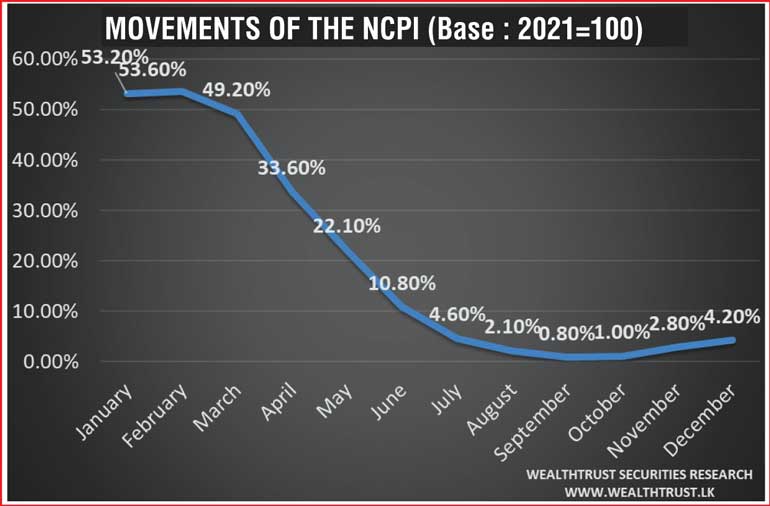

On the inflation front, the National Consumer Price Index -NCPI (Base: 2021=100) or National inflation for the month of December 2023 was recorded at 4.20% on its point to point as against 2.80% recorded in November 2023.

Meanwhile, the first monitory policy announcement for the year 2024 is due today at 7.30 a.m. At the last monitory policy announcement in November 2023, CBSL was seen reducing policy rates by a further 100 basis points to 9.00% and 10.00% on the Standard Deposit Facility (SDF) and Standard Lending Facility (SLF) respectively. The secondary bond market yesterday, saw yields edge down, with particular emphasis on 2026 durations. The maturities of 01.02.26 and 01.06.26 were seen dropping from opening highs of 13.60% to intraday lows of 13.52%, on the back of moderate volumes. The 2028 durations (15.03.28, 01.07.28 and 15.12.28) were traded from a high of 14.05% to a low of 14.00%. Trades were also seen on the 01.05.27 maturity at 13.85%.

Meanwhile, secondary market Treasury bill maturities of March, April and June 2024 transacted at 12.90%, 13.70% to 13.20% and 13.25% respectively.

The total secondary market Treasury bond/bill transacted volume for 19 January was Rs. 25.68 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 9.10% and 9.54% respectively while the net liquidity deficit stood at Rs. 56.42 billion yesterday.

The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight Repo auction for Rs. 40.00 billion at a weighted average rate of 9.35%. An amount of Rs. 16.42 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 10.00%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed appreciating further to Rs. 319.90/320.05 against its previous day’s closing level of Rs. 320.20/320.40.

The total USD/LKR traded volume for 19 January was $ 49.34 million.