Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 11 November 2022 00:02 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

Today’s Treasury bond auctions, conducted in lieu of a Treasury bond maturity of Rs. 90.59 billion due on 15 November will see a total amount of Rs. 130 billion on offer consisting of Rs. 50 billion on a new 15.11.2024 maturity, Rs. 40 billion on a 01.05.2027 maturity and a further Rs. 40 billion on a 01.07.2032 maturity.

Today’s Treasury bond auctions, conducted in lieu of a Treasury bond maturity of Rs. 90.59 billion due on 15 November will see a total amount of Rs. 130 billion on offer consisting of Rs. 50 billion on a new 15.11.2024 maturity, Rs. 40 billion on a 01.05.2027 maturity and a further Rs. 40 billion on a 01.07.2032 maturity.

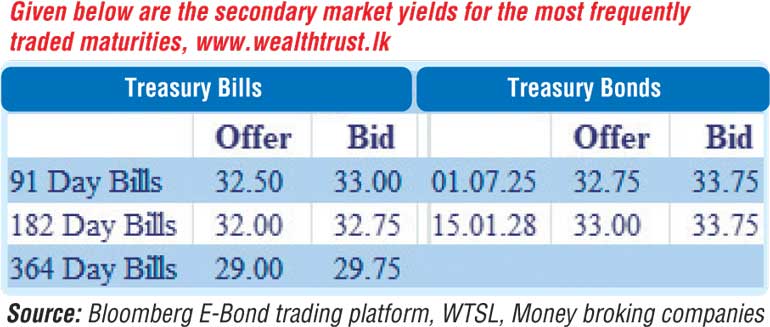

The bond auctions conducted on 28 October saw the 15.01.2028 maturity record a weighted average rate of 31.78% while its total offered amount of Rs. 17.5 billion was successfully accepted at its 1st Phase.

Furthermore, an additional amount of Rs. 0.59 billion was also taken up under its direct issuance window. However, the other maturity of 01.07.2025 saw only an amount of Rs. 0.64 billion accepted in successful bids against its offered amount of Rs. 12.5 billion at a weighted average rate of 32.63%.

Meanwhile, the secondary market for bonds remained at a standstill yesterday.

The total secondary market Treasury bond/bill transacted volume for 09 November 2022 was Rs. 58.68 billion.

In money markets, the weighted average rate on overnight Repo stood at 15.50% while an amount of Rs. 617.11 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 15.50%. The net liquidity deficit stood at Rs. 276.54 billion yesterday as an amount of Rs. 340.57 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 14.50%.

Forex Market

In the Forex market, the middle rate for USD/LKR spot contracts remained steady at Rs. 363.50 yesterday. The total USD/LKR traded volume for 9 November was $ 14.85 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)