Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 13 November 2024 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

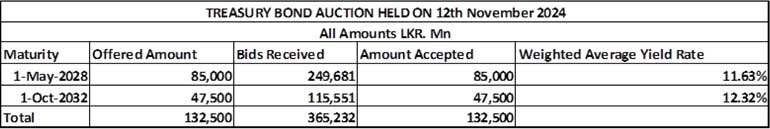

The Rs. 132.50 billion Treasury bond auction conducted yesterday, recorded a resoundingly bullish outcome. A 01.05.28 maturity (bearing a 09.00% coupon) was issued at a weighted average yield of 11.63% and with the entire Rs 85.00 billion offered raised at the 1st phase of subscription.

The Rs. 132.50 billion Treasury bond auction conducted yesterday, recorded a resoundingly bullish outcome. A 01.05.28 maturity (bearing a 09.00% coupon) was issued at a weighted average yield of 11.63% and with the entire Rs 85.00 billion offered raised at the 1st phase of subscription.

In addition, a 01.10.32 maturity (bearing a 9.00% coupon) was issued at a weighted average rate of 12.32% also raising the entire Rs. 47.50 billion offered at the 1st phase itself.

In conclusion, the auction overall saw total bids received exceed the offered amount by 2.76 times and the entire Rs. 132.50 billion was successfully raised in competitive bidding

An issuance window for the both maturities is open until close of business of day prior to settlement date (i.e., 4.00 p.m. on 14.11.2024) at the Weighted Average Yield Rates (WAYRs) determined for the said ISINs at the auction, up to 10% of the respective amounts offered. Given below are the details of the auction,

The Secondary bond market yesterday started off bullish, carrying over the momentum from the previous day, with aggressive buying pushing yields lower even as the Treasury bond auction was underway. Following the release of the auction results, the market rallied further, driving yields down to fresh lows on the back of strong demand. This was on the back of a surge in activity that was sustained throughout the day, with robust transaction volumes observed.

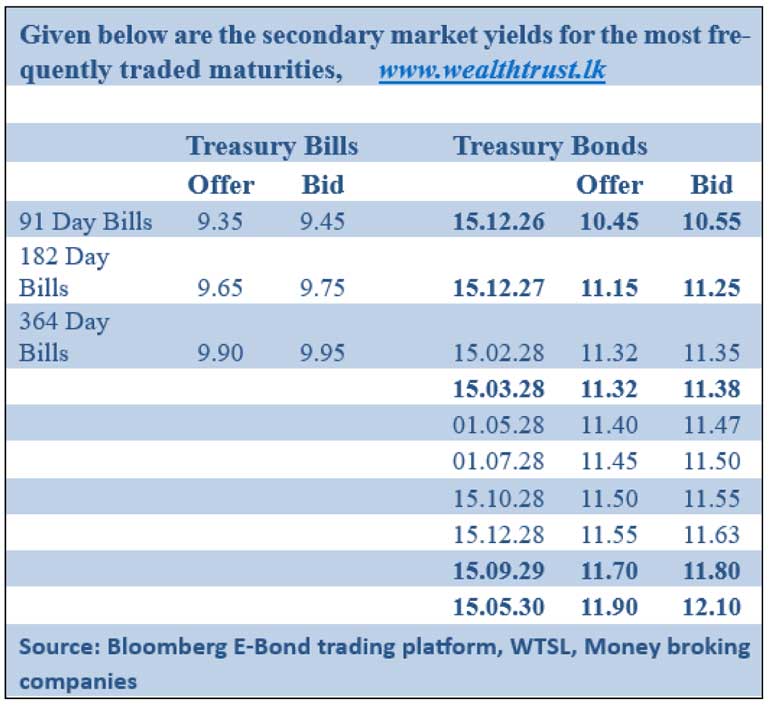

The 2027 tenors of 01.05.27, 15.09.27, 15.12.27 were seen trading down the ranges of 11.20%-11.03%, 11.25%-11.15% and 11.30%-11.26% respectively. The yield on the popular and liquid 15.02.28 and 15.03.28 maturities declined from 11.58% to 11.35% intraday, with sizeable volumes transacted. The 01.05.28 auction bond also saw aggressive demand pushing its yield down from 11.60%, prior to the announcement of the auction results, to 11.46% after the auction results were released. The other 2028 tenors followed suit, with the 15.10.28 and 15.12.28 maturities trading down the range of 11.73%-11.54% and 11.70%-11.60% respectively. The 15.06.29 and 15.09.29 maturities changed hands down from intraday highs to lows of 11.90%-11.75% and 11.95%-11.80% respectively. Additionally, the medium tenor 01.06.33 maturity saw trades within the range of 12.30%-12.25%.

The 2027 tenors of 01.05.27, 15.09.27, 15.12.27 were seen trading down the ranges of 11.20%-11.03%, 11.25%-11.15% and 11.30%-11.26% respectively. The yield on the popular and liquid 15.02.28 and 15.03.28 maturities declined from 11.58% to 11.35% intraday, with sizeable volumes transacted. The 01.05.28 auction bond also saw aggressive demand pushing its yield down from 11.60%, prior to the announcement of the auction results, to 11.46% after the auction results were released. The other 2028 tenors followed suit, with the 15.10.28 and 15.12.28 maturities trading down the range of 11.73%-11.54% and 11.70%-11.60% respectively. The 15.06.29 and 15.09.29 maturities changed hands down from intraday highs to lows of 11.90%-11.75% and 11.95%-11.80% respectively. Additionally, the medium tenor 01.06.33 maturity saw trades within the range of 12.30%-12.25%.

This comes ahead of the Treasury bill auction due today, which will have a total amount of Rs. 147.50 billion on offer, a decrease of Rs. 27.50 billion over the previous week. This will consist of Rs. 62.50 billion on the 91-day, Rs. 65.00 billion on the 182-day and Rs. 20.00 billion on the 364-day maturities. For reference, at the weekly Treasury bill auction held last Wednesday: Weighted average rates were seen edging up on the shorter tenors for the second consecutive week. Accordingly, the weighted average rate on the 91-day tenor increased by 02 basis points to 9.37%, while the 182-day tenor also rose by 02 basis points to 9.70%. However, the weighted average rate on the 364-day tenor remained unchanged at 9.95%. The bulk or 86.35% of the funds raised were on the 91-day and 182-day maturities. Total bids received exceeded the offered amount by 1.72 times, and the entire Rs. 175.00 billion on offer was successfully raised at its 1st phase. An additional amount of Rs. 3.10 billion was raised on the 2nd phase. The total secondary market Treasury bond/bill transacted volume for 08 November was

Rs. 17.63 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.55% and 8.71% respectively. The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight and 7-day term reverse repo auctions for Rs. 6.81 billion and Rs. 40.00 billion at the weighted average rate of 8.40% and 8.65% respectively.

The net liquidity surplus stood at Rs. 110.49 billion yesterday. An amount of Rs. 2.42 billion was withdrawn from the Central Banks SLFR (Standing Lending Facility Rate) of 9.25%, while an amount of Rs. 159.72 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.25%.

Forex market

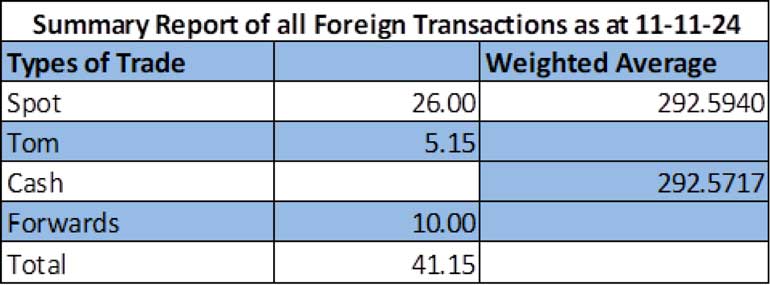

In the Forex market, the USD/LKR rate on spot contracts closed the day appreciating to Rs. 292.45/292.55 as against

Rs. 292.65/292.75 the previous day.

The total USD/LKR traded volume for 11 November was

$ 41.15 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)