Friday Feb 20, 2026

Friday Feb 20, 2026

Thursday, 5 September 2024 00:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

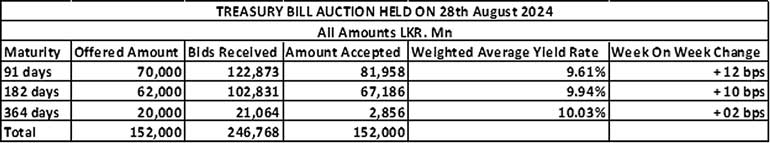

The Treasury bill auction conducted yesterday, saw weighted average yields on the shorter tenor securities increasing for the fifth consecutive week. Accordingly, the rate on the 91-day tenor increased by 12 basis points to 9.61% and the 182-day tenor by 10 basis points to 9.94%. The 364-day tenor saw its weighted average also increase by 02 basis points to 10.03%, for the first time in four consecutive weeks. The entire Rs. 152.00 billion on offer was raised at the 1st phase. The total bids received exceeded the offered amount by 1.62 times.

The bulk of the funds raised continued to be from the shorter tenors, with 98% of the total accepted amount attributable to the 91- and 182-day tenors. In particular, maturity-wise the 91- and 182-day raised more than their respective offered amounts, while the take up on the 364-day maturity was below the offered amount.

The 2nd phase of the auction will be opened across all 3 maturities at its weighted average rates until close of business of the day prior to settlement (i.e., 4.00 p.m. on 05.09.2024).

Given below are the details of the auction.

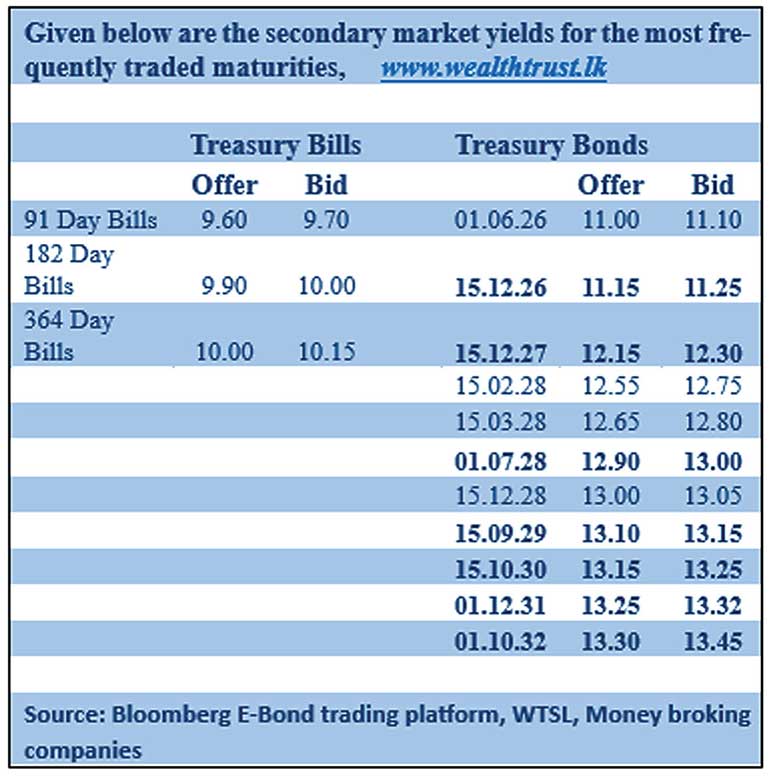

The secondary bond market yesterday remained active; however, yields experienced a notable uptick.

Accordingly, the 15.05.26, 01.06.26 and the 15.12.26 maturities were seen trading at the rates of 10.95% to 11.05%, 11.00% to 11.15% and 11.20% respectively. The yield on the 01.07.28 and 15.12.28 maturities increased from 12.85% to 12.95% and 12.95% to 13.05% respectively. The 15.06.29 and 15.09.29 maturities were observed trading at the rates of 13.05% and 13.10% to 13.15% respectively. Additionally, trades were seen on the medium tenor 15.05.30 and 01.12.31 maturities at the rates of 13.15% to 13.20% and 13.27% and 13.3150% respectively.

The total secondary market Treasury bond/bill transacted volume for 3 September was Rs. 11.11 billion.

In money markets, the weighted average rates on overnight call money and were 8.55% and 8.70%, respectively.

The net liquidity surplus stood at Rs. 98.54 billion yesterday as an amount of Rs. 114.19 billion was deposited at Central Bank’s SDFR (Standing Deposit Facility Rate) of 8.25% as against an amount of Rs. 0.65 billion been withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 9.25%. The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight reverse repo auction for Rs. 15.00 billion at the weighted average rate of 8.52%.

Forex market

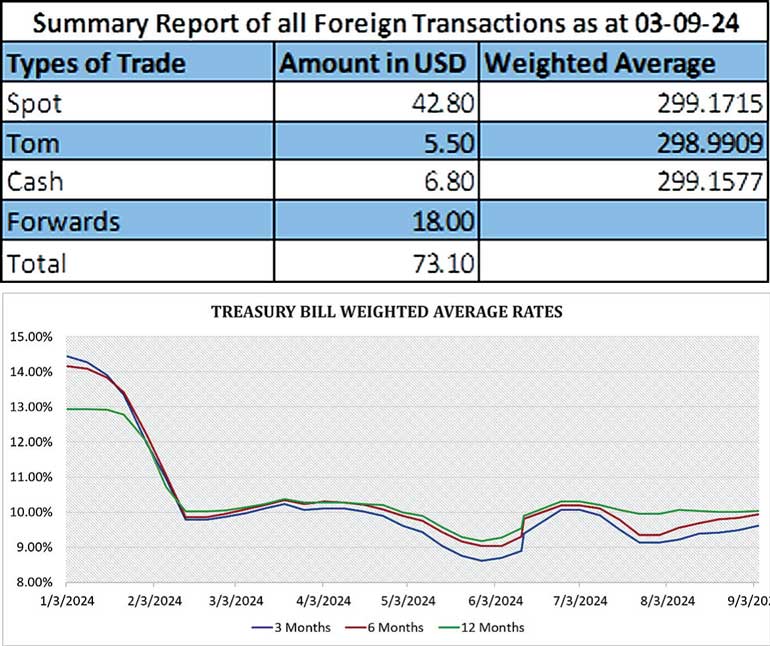

In the Forex market, the USD/LKR on spot contracts closed the day appreciating marginally to Rs. 298.90/299.00 against its previous day’s closing level of Rs. 299.10/299.20.

The total USD/LKR traded volume for 3 September was $ 73.10 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)