Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 18 October 2023 02:07 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The weekly Treasury bill auction conducted today, will have in total an amount of Rs. 65 billion on offer, which will consist of Rs. 30 billion on the 91-day maturity, Rs. 20 billion on the 182-day maturity and a further Rs. 15 billion on the 364-day maturity.

The weekly Treasury bill auction conducted today, will have in total an amount of Rs. 65 billion on offer, which will consist of Rs. 30 billion on the 91-day maturity, Rs. 20 billion on the 182-day maturity and a further Rs. 15 billion on the 364-day maturity.

The previous week’s auction held on 11 October, saw weighted average yields reduced across the board to 16.64%, 14.96% and 13.10% on the three maturities respectively.

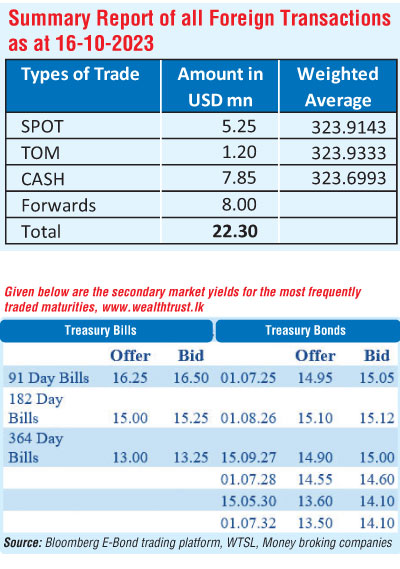

The secondary market bond yields were seen closing the day broadly steady yesterday on the back of continued activity. Accordingly, trading remained predominantly on the 2026 tenors of 01.06.26 and 01.08.26 which saw yields decline marginally during the day from levels of 15.16% to 15.12%. Trades were also seen on the two 2025’s (i.e., 01.06.25 and 01.07.25), and 01.05.27 at levels of 15.00% to 14.95% and 15.05% respectively.

In secondary market bills, November and December 2023 maturities traded at levels between 15.85% to 16.30%. The total secondary market Treasury bond/bill transacted volume for 16 October 2023 was Rs. 17.04 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 10.52% and 10.66% respectively while the net liquidity stood at a deficit of Rs. 106.62 billion yesterday.

The Domestic Operations Department (DOD) of Central Bank injected liquidity by way of an overnight and 30-day term reverse repo auction for Rs. 50.15 billion and Rs. 36.25 billion at the weighted average rates of 10.26% and 13.29% respectively. An amount of Rs. 56.47 billion was withdrawn from Central Bank’s Standard Lending Facility Rate (SLFR) of 11.00% as well.

Forex Market

In the forex market, the USD/LKR rate on spot contracts closed at Rs. 324.10/324.40, depreciating marginally against its previous day’s closing level of Rs. 323.90/324.10.

The total USD/LKR traded volume for 16 October was $ 22.30 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)