Sunday Mar 01, 2026

Sunday Mar 01, 2026

Monday, 13 May 2024 00:13 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The round of Treasury Bond auctions due today, Monday 13 May, will have in total Rs. 70.00 billion on offer. The auction will comprise of Rs. 15 billion from a bond due on 1 May 2028 bearing a coupon of 09.00%, Rs. 25.00 billion from a new bond issue of 15 October 2030 bearing a coupon of 11.00% and Rs. 30.00 billion from a bond due on 1 October 2032 with a coupon rate of 9.00%.

The round of Treasury Bond auctions due today, Monday 13 May, will have in total Rs. 70.00 billion on offer. The auction will comprise of Rs. 15 billion from a bond due on 1 May 2028 bearing a coupon of 09.00%, Rs. 25.00 billion from a new bond issue of 15 October 2030 bearing a coupon of 11.00% and Rs. 30.00 billion from a bond due on 1 October 2032 with a coupon rate of 9.00%.

For context, at the previous round of Treasury bond auctions conducted on 29 April 2024, strong demand for the shorter tenor 15.03.28 bond was witnessed, and recorded a weighted average of 11.72%. In addition, Rs. 30.00 billion was raised from a 15.05.30 maturity at a weighted average of 12.38% and Rs. 44.73 billion from a 01.10.32 maturity at a weighted average of 12.47%. A further Rs. 5.5 billion was raised on the 2028 and 2030 maturities at the direct issuance window at the respective weighted averages as well.

At the weekly Treasury bill auction conducted last week, weighted average yields declined across all three maturities for a fifth consecutive week, reaching its lowest levels in over two years. The 91-day bill fell by 18 basis points to 9.43%, 182-day bill by 13 basis points to 9.76% and the 364-day by 09 basis points to 9.90%.

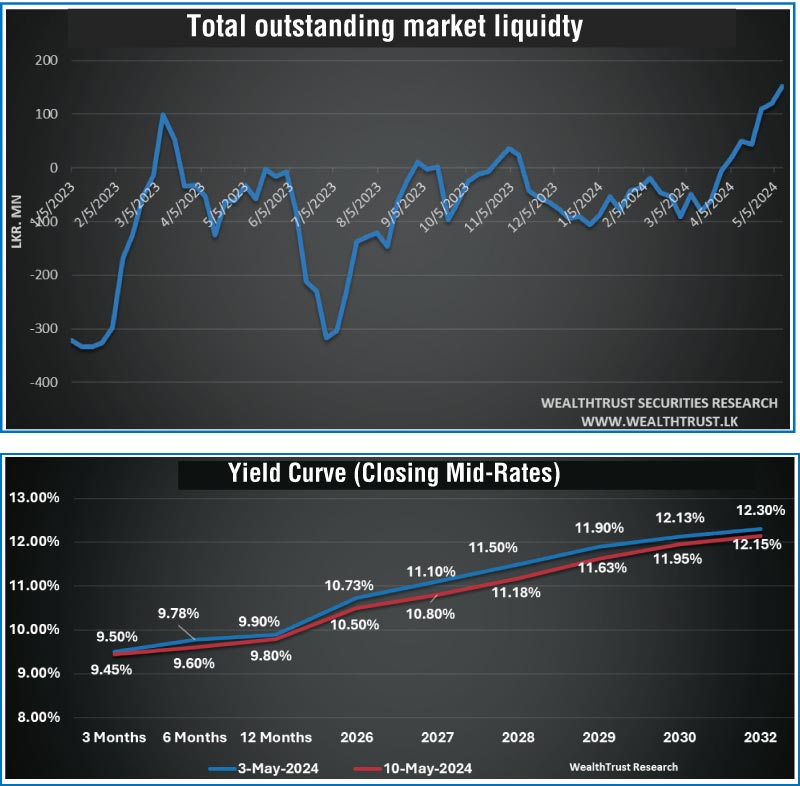

Furthermore, the secondary bond market commenced the week ending 10 May 2024 on a positive note, with the bullish momentum from the previous week carrying over. The local market participants continued to rally throughout the week as yields were seen declining considerably on the back of bouts of aggressive buying interest and healthy transaction volumes.

Accordingly, the yield on the liquid 2026 tenor of 15.12.26 was seen nosediving to an intraweek low of 10.50% from its intraweek high of 10.70%. Similarly, the relatively shorter 2026 tenors of 15.05.26, 01.06.26 and 01.08.26 were seen trading within the range of 10.60% to 10.45%. Likewise, the liquid 2027 tenors of 01.05.27 and 15.09.27 were seen declining to intraweek lows of 10.75% from intraweek highs 11.05%. The popular 15.03.28 tenor saw frenzied buying in particular, which led it to its yield dropping to an intraweek low of 11.20%, down from its opening highs of 11.58%. This interest was also reflected on the other 2028 tenors of 01.05.28, 01.07.28, 01.09.28 and 15.12.28 which changed hands within the range of 11.60% down to 11.27%. Additionally, demand was observed on the medium tenor 15.05.30 and 01.10.32 maturities, with yields declining from of 12.10% to 11.90% and 12.35% to 12.14% respectively as well.

The continued increase in money market liquidity was seen as the main reason behind the bullish momentum in the primary and secondary bill and bond markets. The week ending 10 May 2024 saw net liquidity hitting a high of Rs. 151.90 billion, its highest level since March 2021 and against its previous weeks Rs. 120.03 billion. Call money and Repo averaged 8.64% and 8.95% respectively for the week.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 33.34 billion.

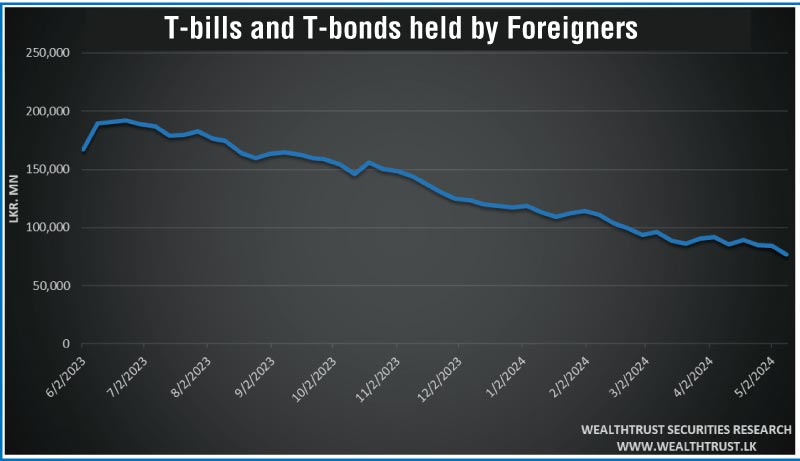

Meanwhile, the foreign holding in rupee Treasuries decreased by Rs. 7.13 billion for the week ending 8 May 2024, and the overall holding stood at Rs. 77.00 billion, its lowest level since April 2023.

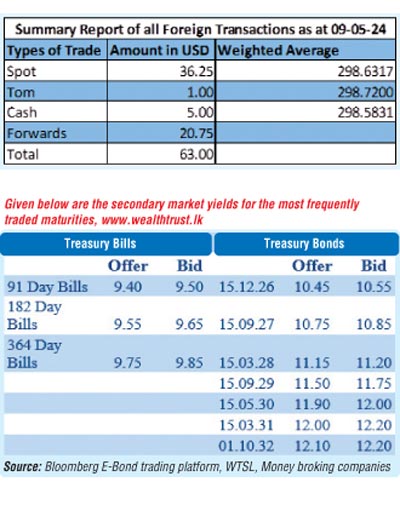

In the Forex market, the USD/LKR rate on spot contracts was seen depreciating during the week to close at Rs 299.00/299.30. This is as against its previous week’s closing level of Rs. 297.15/297.35 and subsequent to trading at a high of Rs. 297.50 and a low of Rs. 300.75.

Forex Market

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 61.55 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)