Saturday Feb 07, 2026

Saturday Feb 07, 2026

Friday, 28 June 2024 00:20 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

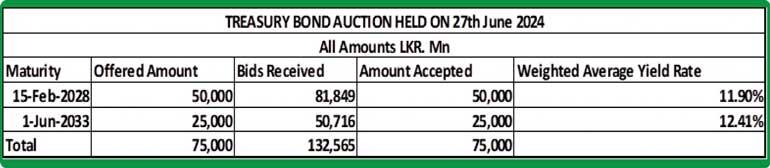

The Rs. 75 billion round of Treasury bond auctions conducted yesterday was fully subscribed at its 1st and 2nd phases. The total bids received exceeded the offered amount by 1.77 times. However, yields were seen moving up considerably on the 15.02.28 maturity, issued at a weighted average yield of 11.90%, well above its pre-auction market two-way quote of 11.50/60 on a similar maturity. The 01.06.33 maturity, issued at a weighted average of 12.41% was also above a two-way quote of 12.10/30 on similar maturities. This auction results reflected the increasing trend in market interest rates for Government Securities, both in the primary and secondary market.

The Rs. 75 billion round of Treasury bond auctions conducted yesterday was fully subscribed at its 1st and 2nd phases. The total bids received exceeded the offered amount by 1.77 times. However, yields were seen moving up considerably on the 15.02.28 maturity, issued at a weighted average yield of 11.90%, well above its pre-auction market two-way quote of 11.50/60 on a similar maturity. The 01.06.33 maturity, issued at a weighted average of 12.41% was also above a two-way quote of 12.10/30 on similar maturities. This auction results reflected the increasing trend in market interest rates for Government Securities, both in the primary and secondary market.

A direct issuance window is open, only on the 2033 tenor, until close of business of the day prior to the settlement date (i.e., 4.00 p.m. on 14.06.2024) at the Weighted Average Yield Rate (WAYRs) determined for the said ISIN at the auction and up to 10% of the respective amount offered.

In the run up to yesterday’s auction, the secondary bond market was characterised by a trend of subdued activity, with thin volumes transacted on limited transactions and rising yields. Since the last auction held on 13 June, market participants were observed adopting a cautious stance, resulting in a standstill for much of the trading days, with sporadic activities mostly confined to selected maturities.

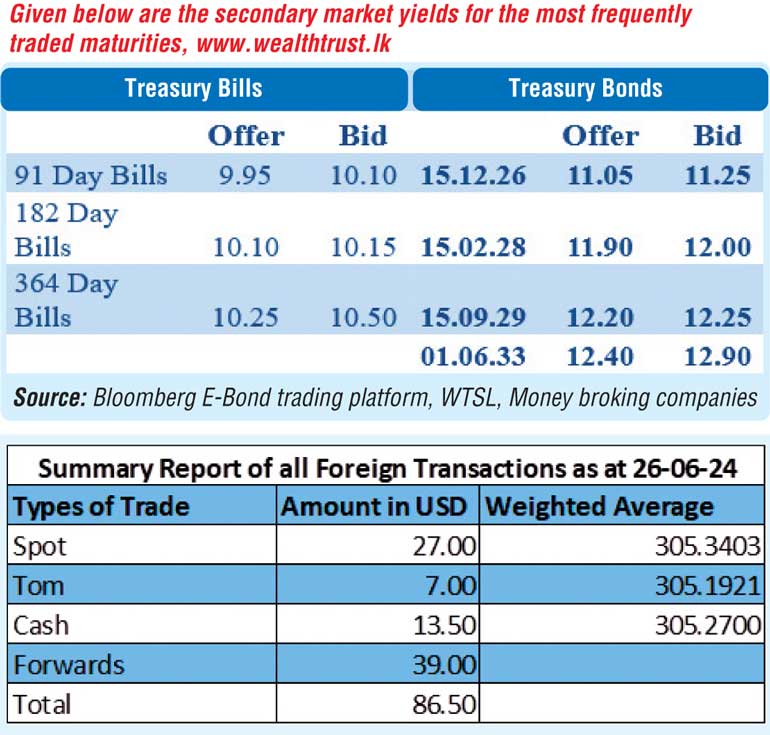

Accordingly, the secondary bond market yesterday remained muted, with limited trades on selected maturities. The 15.03.28 maturity initially dropped to an intraday low of 11.48% due to renewed buying interest before the auction results were released. However, after the results were announced, it climbed to an intraday high of 11.85%. The liquid 15.12.26 maturity was also seen moving up to a high of 11.05%, post announcement from a low of 10.95%. Similarly, the other 2026 tenors of 01.06.26 and 01.08.26 were also seen trading at the elevated levels of 10.75% to 10.95%, while the 15.01.27 maturity was observed trading at 11.00% to 11.05%. In the same vein the 15.09.29 maturity was transacted up from 12.10% to 12.20%.

The total secondary market Treasury bond/bill transacted volume for 26 June was Rs. 19.87 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.73% and 9.23% respectively as the DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight reverse repo auction for Rs. 25.00 billion at a weighted average rate of 8.73%.

The net liquidity surplus stood at Rs. 110.82 billion yesterday as an amount of Rs. 7.11 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 9.50% against an amount of Rs. 142.93 billion being deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.50%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day depreciating further to Rs. 305.70/305.90 as against its previous day’s closing level of Rs. 305.35/305.55.

The total USD/LKR traded volume for 26 June was $ 86.50 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)