Saturday Feb 21, 2026

Saturday Feb 21, 2026

Wednesday, 21 December 2022 00:40 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

Today’s Treasury bill auction will have on offer, a total amount of Rs. 85 billion, consisting of Rs. 40 billion of the 91-day, Rs. 25 billion of the 182-day and Rs. 20 billion of the 364-day maturities.

Today’s Treasury bill auction will have on offer, a total amount of Rs. 85 billion, consisting of Rs. 40 billion of the 91-day, Rs. 25 billion of the 182-day and Rs. 20 billion of the 364-day maturities.

At last week’s auction, the weighted average yield of the preferred 91-day maturity decreased by 11 basis points to 32.80% while the 182-day and 364-day maturities decreased by 1 basis point each to 32.26% and 29.32% respectively, with the total offered amount of Rs. 98 billion being fully subscribed. Furthermore, an additional Rs. 16.89 billion was taken through the 2nd phase bidding process.

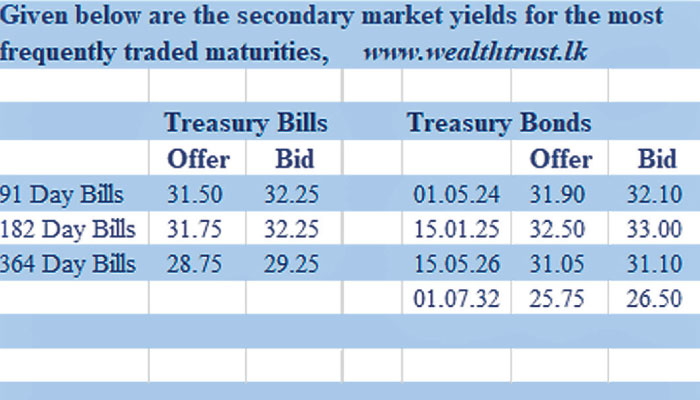

In the secondary bond market, the liquid 01.05.24 and 15.05.26 maturities traded at levels of 32.02% and 31.00% to 31.15% respectively, as against its previous day’s closing levels of 31.90/32.10 and 31.05/15.

The total secondary market Treasury bond/bill transacted volume for 19 November 2022 was Rs. 1.3 billion.

In money markets, overnight call money was at 15.50%, with the net liquidity deficit standing at Rs.229.03 billion. An amount of Rs. 346.79 billion was placed with the Central Bank’s Standard Deposit Facility Rate (SDFR facility) at 14.50% while an amount of Rs. 575.83 billion was withdrawn from the Standard Lending Facility Rate (SLFR facility) of 15.50%.

Forex Market

In the Forex market, the middle rate for USD/LKR spot contracts appreciated very marginally to Rs. 363.1612 yesterday against its previous day’s closing level of Rs. 363.1800.

The total USD/LKR traded volume for 19 December was $ 41.70 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)