Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 14 October 2024 00:28 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

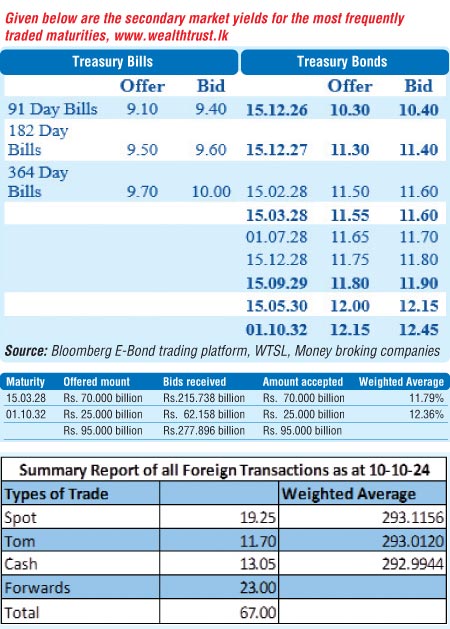

The Rs. 95 billion Treasury bond auction conducted last Friday (11) recorded a bullish outcome, reflecting the recent upward trend observed in the secondary market. The new 15 March 2028 maturity bearing a coupon 10.75% was issued at a weighted average yield of 11.79% and with the entire Rs. 70 billion offered, raised.

The Rs. 95 billion Treasury bond auction conducted last Friday (11) recorded a bullish outcome, reflecting the recent upward trend observed in the secondary market. The new 15 March 2028 maturity bearing a coupon 10.75% was issued at a weighted average yield of 11.79% and with the entire Rs. 70 billion offered, raised.

For context, at the previous auction just a month ago (on 12 September), a very similar 15 February 2028 maturity was issued at the weighted average rate of 13.79%. In addition, a 1 October 2032 maturity bearing a coupon 9% was issued at a weighted average rate of 12.36% significantly below market expectations and here too the entire Rs. 25 billion offered was snapped up.

As such, the auction was fully subscribed at the first phase of subscription. This was against the backdrop of positive market news such as the World Bank saying the Sri Lankan economy had stabilised and had revised the GDP growth forecast up to 4.4%.

The direct issuance window of 10% each will be on offer on both maturities until close of business of the day prior to settlement (i.e.,4:00 p.m. on 14.10.2024). Given below are the details of the auction,

Meanwhile, at the weekly Treasury bill auction held last Wednesday; yields were seen declining for the third consecutive week, mirroring the positive sentiment in the secondary market. In particular the shorter tenor securities saw rates fall steeply to register averages below 10.00%, reaching levels last seen in early September 2024.

Accordingly, the weighted average rate for the 91-day tenor dropped by 37 basis points to 9.69%, while the 182-day tenor decreased by 42 basis points to 9.95%. The 364-day tenor saw a marginal decline of 4 basis point, bringing the rate to 10.00%.

Total bids received exceeded the offered amount by 2.86 times, and the entire Rs. 85 billion on offer was successfully raised at the 1st phase. An additional Rs. 8.5 billion offered through the 2nd phase was fully subscribed as well.

The secondary bond market last week started off slow, activity was subdued, and transaction volumes were relatively thin, as market participants adopted a cautious approach ahead of the Primary auctions. Yields were seen edging up in the run up to the auctions; however renewed buying interest at the elevated levels kept a cap on rates. Following the release of both the auction results, the market turned bullish, resulting in a recovery and subsequent dips in yields.

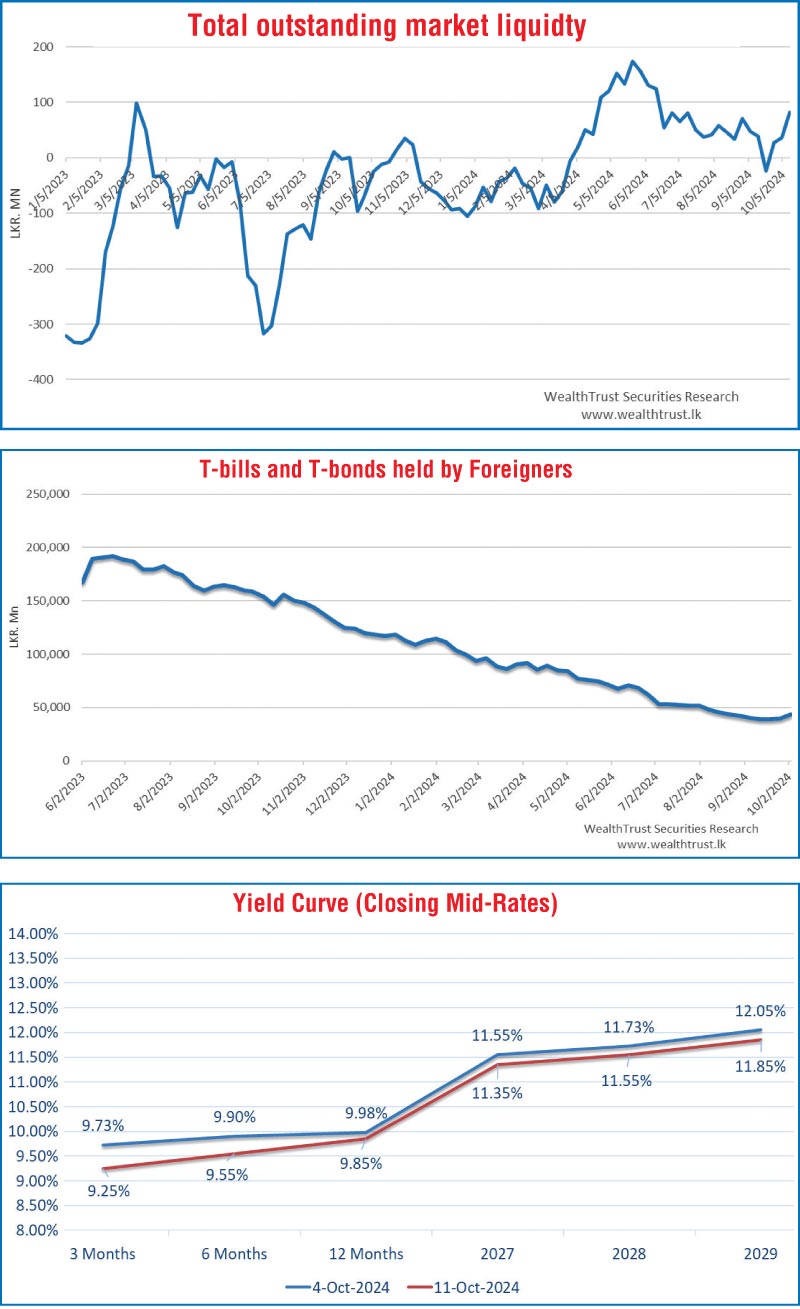

Accordingly, yields on the 2028 tenors, specifically the liquid 15.02.28 dropped to an intraweek low of 11.55%, subsequent to hitting an intraweek high of 11.90%. This pattern was observed across the yield curve. The 15.09.29 dropped from a high of 12.10% to a low of 11.85%. The shorter tenor 01.06.26 saw its yield drop from 10.45% to 10.30% while the 2027 tenor 15.12.27 maturity from an intraweek high of 11.50% to a low 11.30%. Additionally, trades were observed on the medium tenor 15.05.30/15.10.30 maturities with yields declining down the range of 12.20% to 12.00%. As such, the at the close of the week the yield curve was observed recording a parallel downward shift.

For the week ending 10 October 2024, the foreign holdings in Sri Lankan rupee-denominated Treasury securities saw a sizeable net inflow of Rs 6.85 billion, the largest in almost one year. This marked the fourth consecutive week of positive inflows. As a result, total foreign holdings surpassed Rs. 50 billion for the first time since August, reaching Rs. 50.65 billion – a 15.65% increase compared to the previous week.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 22.91 billion.

In money markets, total outstanding liquidity rose sharply to Rs. 81.83 billion by the close of the week ending 11 October, the highest level since mid-June 2024. This marks a significant jump from Rs. 35.92 billion recorded just the previous week.

The Domestic Operations Department (DOD) of Central Bank injected liquidity during the week by way of overnight reverse repo auctions and a 7-day term reverse repo auctions at weighted average rates of 8.36% to 8.65% respectively. The weighted average interest rate on call money and repo ranged between 8.50% to 8.61% and 8.69% to 8.82% respectively.

The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,515.62 billion as at 11 October 2024, unchanged from the previous week’s level.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts was seen appreciating during the week to close the week at Rs. 292.75/292.95 against its previous week’s closing level of Rs. 294.00/294.35 and subsequent to trading at a high of Rs. 292.70 and a low of Rs. 294.00.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 71.17 million.

(References: Central Bankof Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)