Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 7 August 2023 00:35 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

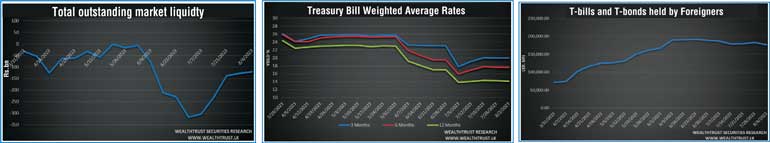

The foreign holding in rupee Treasury bills and bonds recorded a significant decrease of Rs. 5.97 billion for the week ending 3 August. This was against a net inflow of Rs. 3.10 billion last week, reversing the trend of two consecutive weeks of increases. The total foreign holding stands at Rs. 176.49 billion.

The CCPI (2021 = 100) fell notably month over month, rising 6.3% YoY in July and down from 12.0% YoY in June, marking its lowest level since the index’s rebase in February 2023. This was below market expectations and a 7.50% forecast, as per a Bloomberg survey of economists, which had projections spanning from 7.0% to 8.1%.

The secondary bond market remained active during the week ending 4 August, as aggressive buying interest throughout the week led to yields decreasing across the yield curve, particularly on the medium tenures. This was on the back of inflation cooling rapidly and news that the Sri Lanka Development Bond Exchange program had achieved 97% acceptance. The yields on the liquid maturities of 01.07.25, 15.05.26, 15.09.27, 01.05.28, 15.05.30 hit intraweek lows of 14.80%, 14.50%, 14.25%, 13.35%, 13.10% respectively against its weeks opening highs of 15.50%, 15.10%, 14.95%, 14.35%, 14.10% to record a parallel shift down of the yield curve, week on week.

The weekly Treasury bill auction saw its weighted average rates marginally decreasing across the board. An amount of Rs. 225 billion was accepted in total against a total offered amount of Rs. 180 billion.

In money markets, the Domestic Operations Department (DOD) of Central Bank continued to inject liquidity during the week by way of overnight to seven-day Reverse repo auctions at weighted average yields ranging from 11.49% to 12.00% while the total outstanding liquidity deficit improved to Rs. 121.278 billion by the end of the week against its previous week’s of Rs. 127.82 billion.

The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,699.79 billion against its previous week’s of Rs. 2,676.07 billion.

In the forex market, the USD/LKR rate on spot contracts was seen depreciating marginally during the week to close the week at Rs. 322.00/324.00 against its previous week’s closing level of Rs. 328.00/329.00, subsequent to trading at a high of Rs. 313.00 and a low of Rs. 327.00.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 53.49 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)