Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 27 August 2024 01:57 - - {{hitsCtrl.values.hits}}

The Securities and Exchange Commission of Sri Lanka (SEC) successfully conducted an industry awareness session dedicated to Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT).

The program which was conducted by the Finance Intelligence Unit (FIU) of the Central Bank of Sri Lanka (CBSL) was attended by over 80 industry professionals including compliance officers of stockbrokers, managing companies and investment managers.

The SEC aims to aid the licensed Market Intermediaries for effective implementation of measures for AML and CFT and hence brought together key stakeholders from across the capital market industry to reinforce best practices and compliance standards in the fight against Money Laundering (ML) and Financing Terrorism (FT). With the Asia Pacific Group Mutual Evaluation that is due to take place in early 2025, implementation of measures for AML and CFT to the Sri Lankan economy.

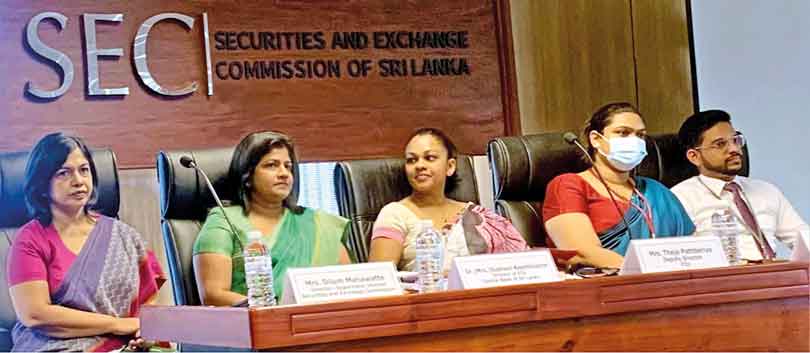

The session provided an in-depth exploration of the regulatory framework applicable to AML and CFT. The session started off with SEC Director, Supervision Dilum Mahawatte welcoming the gathering and FIU Director Dr. Subhani Keerthiratne, pondering upon the importance of AML and CFT for our economy.

During three dynamic and in-depth presentation sessions conducted by FIU Deputy Director Theja Pathberiya, FIU Senior Assistant Director Supun Gunasekara, and FIU Assistant Director Kasuni Alahakoon, delved into the intricacies of AML and CFT compliance for stockbrokers and ways and means of identifying suspicious transactions and the related reporting procedure. These sessions also focused on practical techniques for recognising and reporting suspicious financial activities, enhancing participants’ knowledge to detect potential risks and regulatory compliance concerning United Nations Security Council Resolutions (UNSCRs).

These engaging sessions highlighted the crucial need of aligning national AML and CFT measures with international standards, underscoring the significance of integrating global regulatory frameworks into local practices.

Through these insightful presentations and interactive discussions, participants gained valuable insights into the effective implementation of measures for AML and CFT. As a Supervisory Authority, the SEC will continue to provide support and guidance to the industry participants relating to AML and CFT aspects.