Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 31 January 2025 03:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The round of Treasury Bond auctions conducted yesterday successfully raised the entire Rs. 40 billion on offer. The total bids received exceeded the offered amount by a staggering 3.57 times. This mirrored both the aggressive bidding at the Treasury Bill auction conducted the day before and the bullish sentiment in the Secondary Bond market. The bidders were seen aggressively chasing down the auction.

The round of Treasury Bond auctions conducted yesterday successfully raised the entire Rs. 40 billion on offer. The total bids received exceeded the offered amount by a staggering 3.57 times. This mirrored both the aggressive bidding at the Treasury Bill auction conducted the day before and the bullish sentiment in the Secondary Bond market. The bidders were seen aggressively chasing down the auction.

In particular, the 15.12.29 maturity (11.00% coupon) recorded a resoundingly bullish outcome and was issued at a weighted average yield of 10.73%. This was well below market expectations as a similar 15.09.29 maturity was seen quoted at the two-way rate of 10.78%/10.80% prior to the auction. Maturity-wise the entire Rs. 25.00 billion offered was snapped up at the 1st phase of subscription in competitive bidding.

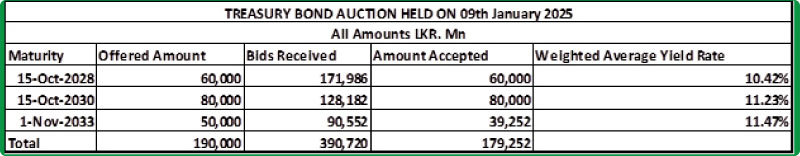

The medium tenor 01.06.33 maturity (09.00% coupon) also raised the entire maturity-wise offered amount of Rs. 15.00 billion at the 1st phase and was issued at the weighted average rate of 11.47%. This was in line with market expectations as a medium tenor 01.07.32 maturity was observed quoted at the market two-way rate of 11.42%/11.47% prior to the auction. This incidentally also matched the weighted average of a similar 2033 tenor which was issued at the previous round of auctions on 9 January. However, at the previous auction the 2033 tenor went undersubscribed, as such this displayed increased appetite for the relatively longer tenor maturities.

An issuance window for the 15.12.29 and 01.06.33 maturities is open until close of business of day prior to settlement date (i.e., 3 p.m. on 31.01.2025) at the respective Weighted Average Yield Rate (WAYR), up to 10% of the amount offered.

Meanwhile, the Secondary Bond market continued to rally with aggressive buying interest pushing yields lower. Trading activity and transaction volumes continued to be seen at elevated levels. The market saw strong demand even as the Treasury Bond auction was underway. Following the release of the auction results, the market gained further traction, extending its rally despite some minor profit taking pressure witnessed at the tail-end of yesterday’s run.

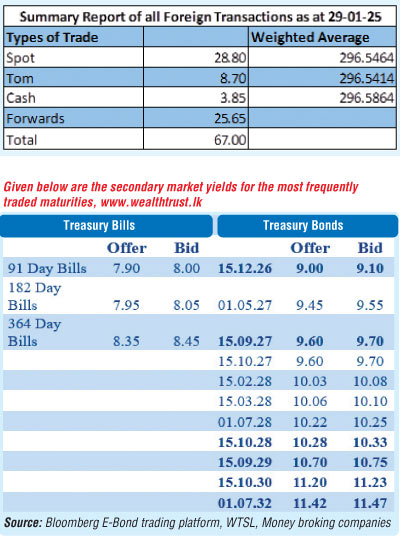

The 15.12.26 was seen trading at the rate of 9.10%.

The 15.02.28 and 15.03.28 maturities saw rates decline down the rates of 10.10%-10.00% collectively. The mid-2028 tenors 01.05.28 and 01.07.28 maturities saw rates drop down the ranges of 10.20%-10.12% and 10.30%-10.20% respectively. The late-2028 tenor 15.10.28 and 15.12.28 saw rates slide down the ranges of 10.35%-10.28% and 10.40%-10.37%

respectively.

The 15.09.29 maturity saw aggressive buying push rates down an intraday high of 10.85% to an intraday low of 10.69%. Incidentally this was subsequent to hitting an intraweek high of 10.92% earlier on in the week, marking a sharp recovery. The 15.12.29 maturity auction maturity was seen trading at the rate of 10.70% post-auction. The 15.10.30 maturity also saw strong demand with yields dropping sharply from an intraday high of 11.29% to an intraday low of 11.20%.

The total secondary market Treasury Bond/Bill transacted volume for 29 January was Rs. 91.03 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.00% and 8.08% respectively.

The net liquidity surplus stood at Rs. 194.56 billion yesterday. Rs. 0.62 billion was withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 8.50%, while an amount of Rs. 195.18 billion was deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 7.50%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day depreciating to Rs. 297.70/297.85 as against 296.40/296.70 the previous day.

The total USD/LKR traded volume for 29 January was

$ 67.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)