Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 24 December 2024 02:02 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The Secondary Bond market kickstarted the week on a positive note following news that Fitch Ratings had issued credit rating upgrades on Sri Lanka’s Foreign Currency and Local Currency Debt Issuances. The Foreign-Currency Issuer Default Rating (IDR) was raised to ‘CCC+’ from ‘RD’ (Restricted Default), while the Local-Currency IDR was promoted to ‘CCC+’ from ‘CCC-’. This coincided with the stock market continuing to rally and hitting new all-time highs. Initially, yields were seen declining sharply on the back of aggressive buying interest. Trading activity and transaction volumes were seen at healthy levels earlier in the day but subsequently moderated to a virtual standstill during the latter part of the day. As activity slowed down, the momentum shifted, and yields were seen moving back up as profit taking pressure led to a reversal. As a result, two-way quotes actually closed the day broadly steady.

The 15.09.27 maturity initially hit an intraday low of 9.68% subsequent to hitting an intraday high of 9.75%. The bulk of the trading was centred on 2028 durations. The 15.02.28 and 15.03.28 maturities were initially seen hitting intraday lows of 10.00% prior to trading back up to intraday highs of 10.10%. The other 2028 tenors followed a similar V-shaped trading pattern. The 01.05.28 and 01.07.28 maturities were seen hitting intraday lows of 10.07% and 10.20% prior to moving back up to trade at intraday highs of 10.30% each respectively. The 15.09.29 maturity traded up from an intraday low of 10.65% to a high of 10.70%. The 15.05.30 maturity was seen changing hands at the rates of 11.00%-11.05%. The 01.07.32 maturity was seen trading within the narrow band of 11.47%-11.48%.

Furthermore, it was reported yesterday that Moody’s had also upgraded Sri Lanka’s long-term foreign currency issuer rating to Caa1 from Ca with a stable outlook.

This comes ahead of the Treasury bill auction due today, which will have a total amount of Rs. 120.00 billion on offer, a decrease of Rs. 65.00 billion over the previous week. This will consist of Rs. 30.00 billion on the 91-day maturity and Rs. 40.00 billion on the 182-day and Rs. 50.00 billion on the 364-day maturity.

For reference, at the weekly Treasury Bill auction conducted last Wednesday (18 December), weighted average rates declined across all three maturities for the second consecutive week. The 91-day rate fell by 3 basis points to 8.66%, the 182-day by 7 basis points to 8.81%, and the 364-day by 1 basis point to 9.02%. Total bids exceeded the offered amount by 2.22 times, raising Rs. 185 billion in the 1st phase. An additional Rs. 18.50 billion (being the maximum offered) was raised in the 2nd phase, which saw strong oversubscription of Rs. 111.4 billion.

On the inflation front, the National Consumer Price Index - NCPI (Base: 2021=100) or National inflation for the month of November 2024 was recorded at -1.70% on its point to point as against -0.70% recorded in October 2024, while the annual average inflation was recorded at 2.20%. This marked the third consecutive month that the NCPI has recorded deflation.

The total secondary market Treasury bond/bill transacted volume for 20 December was Rs. 8.80 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.00% and 8.09% respectively yesterday.

The net liquidity surplus stood at Rs. 197.51 billion yesterday. Rs 1.29 billion was withdrawn from Central Bank’s SLFR (Standing Lending Facility Rate) of 8.50%, while an amount of Rs. 198.80 billion was deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 7.50%.

Forex Market

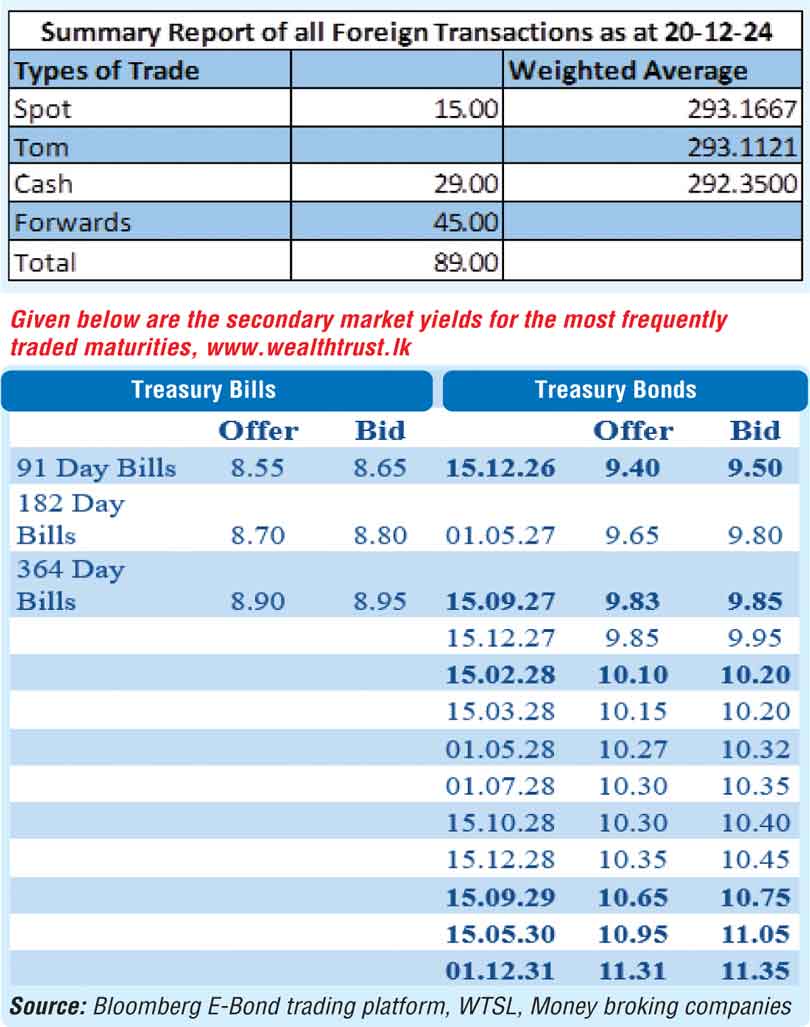

In the Forex market, the USD/LKR rate on spot contracts closed the day depreciating Rs.296.25/296.75, subsequent to trading at a low of 297.00 and a high of 294.00, against its previous day’s closing level of Rs. 293.50/294.00.

The total USD/LKR traded volume for 20 December was $ 89.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)