Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 31 December 2024 01:07 - - {{hitsCtrl.values.hits}}

By WealthTrust Securities

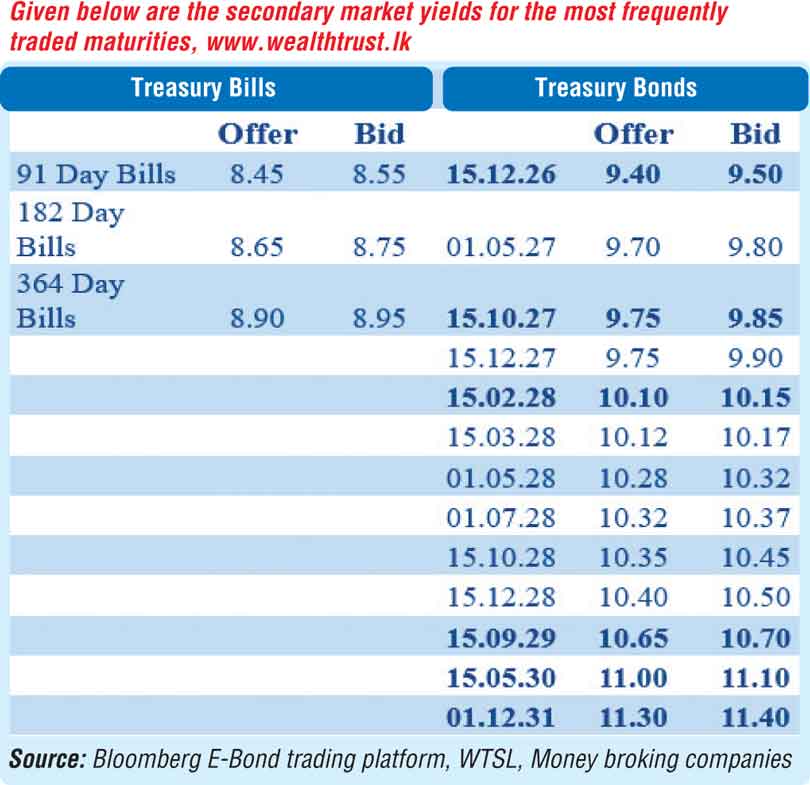

The secondary Bond market yesterday saw activity at subdued levels and moderate transaction volumes. Yields were seen edging down slightly following the release of the auction results; however, two-way quotes closed the day broadly steady.

The 01.07.28 maturity was seen trading at the rate of 10.35%. The 15.10.28 auction maturity, which was seen trading at the rate of 10.45% earlier in the day, was seen dropping to an intraday low of 10.40% post-auction. In addition, the medium tenor 01.07.32 maturity was seen trading within the range of 11.45%-11.43%.

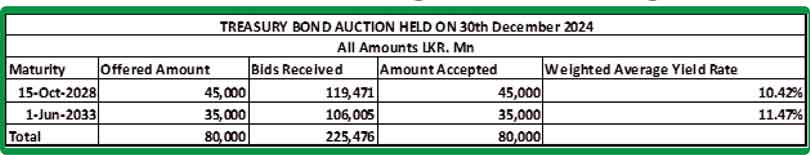

The round of Treasury bond auctions conducted yesterday managed to successfully raise the entire offered amount of Rs. 80 billion. The total bids received exceeded the offered amount by 2.82 times.

In particular, the 15.10.28 maturity (bearing an 11.00% coupon) recorded a resoundingly bullish outcome and was issued at a weighted average yield of 10.42%. Maturity-wise, the entire Rs. 45 billion offered was snapped up at the first phase of subscription in competitive bidding. This maturity was traded at 10.45% prior to the auction.

A 01.06.33 maturity (bearing a 9.00% coupon) was issued at a weighted average yield of 11.47% – incidentally, the same rate it was issued at at the immediately previous auction held on 12 December, only managing to raise 33.23% or Rs. 11.63 billion at the first phase of competitive bidding. This prompted the opening of a second phase which saw the entire maturity-wise offered amount of Rs. 35 billion raised.

An issuance window for the 15.10.28 maturity is open until close of business of day prior to the settlement date (i.e., 4 p.m. today) at its Weighted Average Yield Rate (WAYR) up to 10% of the amount offered.

The total secondary market Treasury bond/bill transacted volume for 27 December was Rs. 4.22 billion.

In money markets, the weighted average rates on overnight call money and repo stood at 8.00% and 8.07%, respectively.

The net liquidity surplus stood at Rs. 158.37 billion yesterday. Rs. 1.40 billion was withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 8.50%, while an amount of Rs. 159.76 billion was deposited at the Central Bank’s SDFR (Standard Deposit Facility Rate) of 7.50%.

The DOD (Domestic Operations Department) of the Central Bank abstained from conducting any auction yesterday.

Forex market

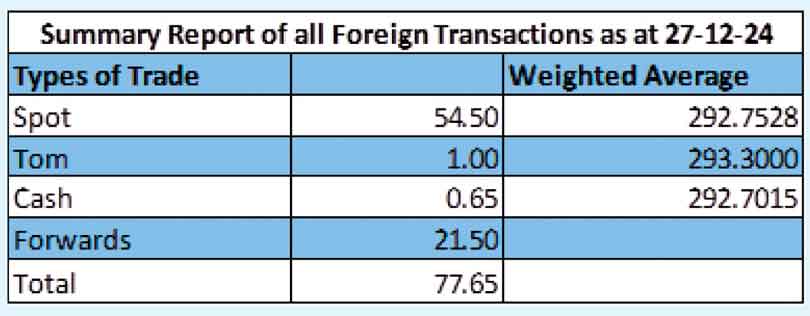

In the Forex market, the USD/LKR rate on spot contracts closed the day broadly steady at Rs. 292.55/292.75 as against 292.40/292.70 the previous day. The total USD/LKR traded volume for 27 December was $ 77.65 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)