Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Thursday, 30 January 2025 00:00 - - {{hitsCtrl.values.hits}}

By WealthTrust Securities

The secondary Bond market yesterday saw yields decline on the back of renewed demand, as the impressive outcome of the Treasury Bill auction sparked a rally. Activity and transaction volumes were seen at elevated levels. Aggressive buying interest was observed across the yield curve resulting in a marked reduction in rates across tenors.

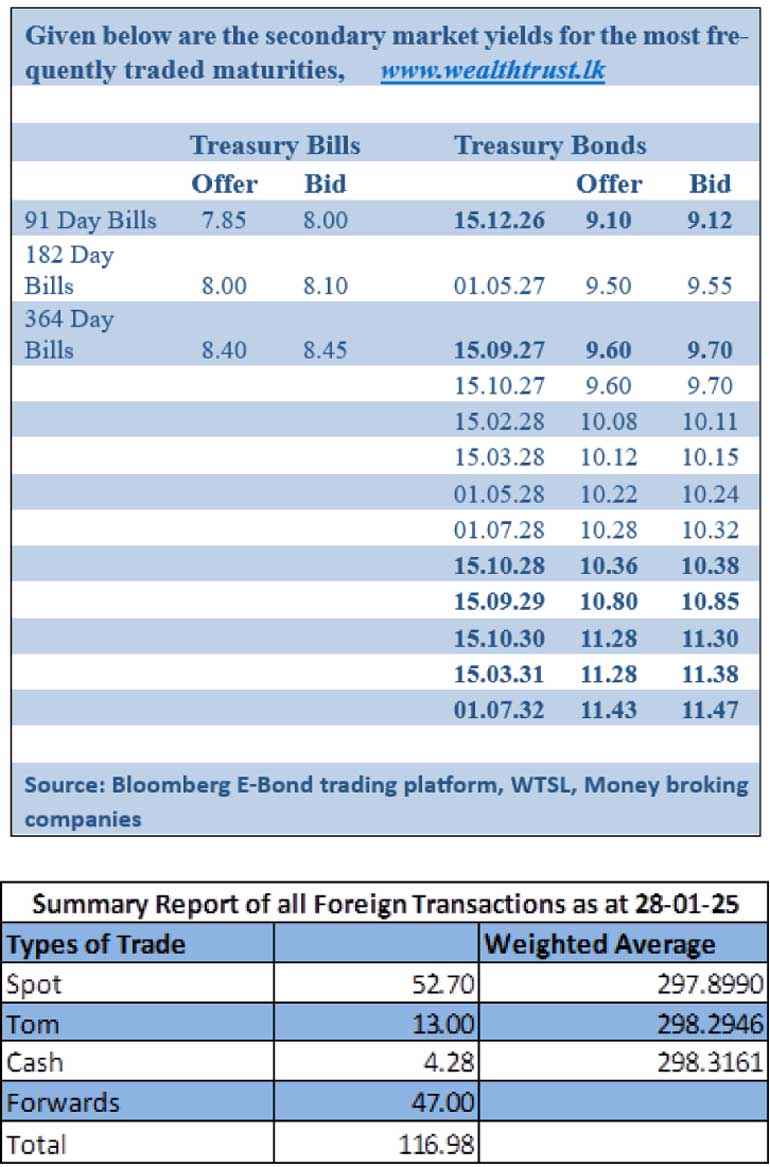

The yields on the 2026 tenors, which had consistently been on a downward trajectory, were seen dropping further. The 15.12.26 maturity was seen trading down at the range of 9.16%-9.12%. The 01.05.27 and 15.09.27 maturities were seen trading down the ranges of 9.65%-9.55%, and 9.70%, respectively. The early 2028 tenor 15.02.28 and 15.03.28 maturities were seen trading down the ranges of 10.12%-10.10% and 10.18%-10.13%, respectively. The mid-2028 tenor 01.05.28 and 01.07.28 were seen changing hands down from intraday highs to lows of 10.28%-10.25% and 10.35%-10.30%, respectively. The late-2028 tenor 15.10.28 maturity was seen transacting down the range of 10.41%-10.38%. The 15.09.29 maturity traded between intraday highs and lows of 10.88% to 10.85%. The 15.10.30 maturity changes hands down the range of 11.36%-11.30%.

At the inaugural Monetary Policy Announcement for 2025, the Central Bank of Sri Lanka (CBSL) decided to hold all key rates unchanged. In particular, the monetary policy rate, the Overnight Policy Rate (OPR), was maintained at the current level of 8%. In addition, the Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR), which are linked to the OPR with predetermined margins of ± 50 basis points, remain unchanged at 7.50% and 8.50%, respectively. The statutory reserve rate also remained at 2%.

As per the official press release for the previous MPA:

The Board arrived at this decision following a careful analysis of the current and expected macroeconomic developments on the domestic and global fronts. This decision was made with a medium-term view of ensuring that inflation converges to the target of 5%, while supporting the economy to reach its potential. The Board observed that the current period of deflation, as projected earlier, has largely been an outcome of administratively determined energy price reductions. This trend is expected to continue over the next few months before inflation begins adjusting towards the targeted level in the second half of 2025.

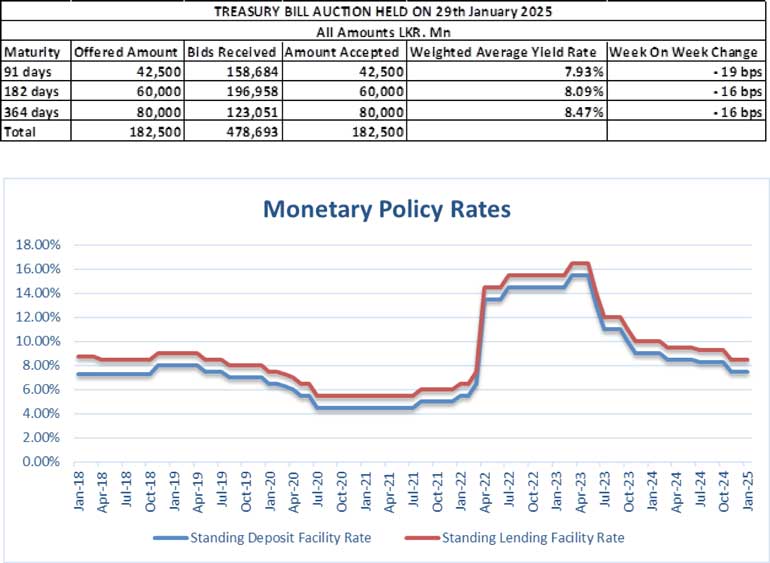

Despite this, at the weekly Treasury bill auction held yesterday (29 January), the weighted average rates declined across all three offered maturities for the eighth consecutive week. As such rates were seen continuing on a downward trajectory, with a reduction in yields observed on at least one tenor over the last 12 weeks. Accordingly, the weighted average rates on the 91-day tenor dropped by 19 basis points to 7.93%, the 182-day tenor by 16 basis points to 8.09%, and the 364-day tenor by 16 basis points to 8.47%. This week’s drop was particularly steep, with the rate on the three-month tenor falling to an over three-year low, falling below 8.00% for the first time since late December 2021.

Total bids received exceeded the offered amount by 2.62 times, and the entire Rs. 182.50 billion on offer was successfully raised at the first phase in competitive bidding.

The second phase of subscription for the auction will be opened across all three tenors at the weighted average rates until close of business of the day prior to settlement (i.e., 3 p.m. today).

This comes ahead of the Treasury bond auction, with a total offered amount of Rs. 40 billion, scheduled for today, 30 January (Thursday). The auction will be comprised of:

nRs. 25 billion: Maturing on 15 December 2029, with a coupon rate of 11.00%.

nRs. 15 billion: Maturing on 1 June 2033, with a coupon rate of 9.00%.

For context, the previous round of Treasury bond auctions held on 9 January raised Rs. 179.25 billion, or 94.34%, of the Rs. 190 billion offered, despite bids exceeding the offering by 2.06 times.

Maturity-wise, the 15.10.28 maturity (11.00% coupon) saw strong demand, raising the entire Rs. 60 billion offered at a weighted average yield of 10.42%. The 15.10.30 maturity (11.00% coupon) raised the entire Rs. 80 billion offered at a weighted average yield of 11.23%. The 01.11.33 maturity (9.00% coupon) achieved a weighted average yield of 11.47%, in line with market expectations, but raised only 78.50% or Rs. 39.25 billion across both phases.

The total secondary market Treasury bond/bill transacted volume for 28 January 2025 was Rs. 27.16 billion.

In money markets, the weighted average rates on overnight call money and repo stood at 7.99% and 8.07%, respectively.

The net liquidity surplus stood at Rs. 184.05 billion yesterday. No funds were withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 8.50%, while an amount of Rs. 184.05 billion was deposited at the Central Bank’s SDFR (Standard Deposit Facility Rate) of 7.50%.

Forex market

In the Forex market, the USD/LKR rate on spot contracts closed the day depreciating to Rs. 296.40/296.70 as against its previous day’s closing level of Rs. 297.05/297.15.

The total USD/LKR traded volume for 28 January was $ 116.98 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)