Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 18 November 2024 03:38 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The Secondary Bond market last week started off strong and continued to rally. This was spurred by the bullish outcomes at both primary auctions, with buying happening even as the bond auction was underway. Yields were pushed down, to hit fresh lows driven by strong demand. This was on the back of robust market activity and transaction volumes, with trades observed across the yield curve. The market sustained its bullish momentum through until mid-week, only slowing down amidst some marginal profit taking and the Parliamentary elections which resulted in a slight reversal at the tail-end of the week. Despite this, two-way quotes were seen closing the week significantly lower.

The Secondary Bond market last week started off strong and continued to rally. This was spurred by the bullish outcomes at both primary auctions, with buying happening even as the bond auction was underway. Yields were pushed down, to hit fresh lows driven by strong demand. This was on the back of robust market activity and transaction volumes, with trades observed across the yield curve. The market sustained its bullish momentum through until mid-week, only slowing down amidst some marginal profit taking and the Parliamentary elections which resulted in a slight reversal at the tail-end of the week. Despite this, two-way quotes were seen closing the week significantly lower.

The Treasury bond auction conducted last Monday (11 November), recorded a resoundingly bullish outcome. A 01.05.28 maturity (bearing a 9.00% coupon) was issued at a weighted average yield of 11.63% and with the entire Rs. 85 billion offered was raised at the first phase of subscription. In addition, a 01.10.32 maturity (bearing a 9.00% coupon) was issued at a weighted average rate of 12.32%, also raising the entire Rs. 47.50 billion offered at the first phase itself. In conclusion, the auction overall saw total bids received exceed the offered amount by 2.76 times and the entire total offered amount of Rs. 132.50 billion was successfully raised in competitive bidding.

At the weekly Treasury bill auction conducted last Wednesday (13 November), weighted average rates were seen declining across the board for the first time in four weeks. This reversed the previous trend of yields creeping up on the shorter tenors over the past two consecutive weeks. Accordingly, the weighted average rates on the 91-day tenor decreased by two basis points to 9.35%, the 182-day tenor dropped by six basis points to 9.64% and the 364-day tenor declined by seven basis points to 9.88%. Total bids received exceeded the offered amount by 2.16 times, and the entire Rs. 147.50 billion on offer was successfully raised at its first phase.

In the secondary bond market, the shorter tenor 01.06.26 and 15.01.27 maturities were seen trading at a low of 10.15% and 10.35% respectively. The rate on the 01.05.27 and the 15.12.27 maturities were seen declining from intraweek highs to lows of 11.20%-10.80% and 11.30%-10.90% respectively. The yield on the 15.02.28 and 15.03.28 maturities declined from an intraweek high of 11.58% to a low 11.14%. The other 2028 tenors also followed suit. The recently auctioned 01.05.28 maturity traded down the range of 11.60% pre-auction to 11.23% post auction intraweek, a steep decline from the 11.62% weighted average that the bond was issued at auction. The 01.10.28 and 15.12.28 maturities also saw yields decline from 11.75%-11.35% and 11.80%-11.40% respectively. The 15.06.29 and 15.09.29 maturities also saw a steep drop from intraweek highs to lows of 11.95%-11.50%. The medium tenor 01.10.32 maturity saw rates decline down the range of 12.31%-11.95%. In conclusion, at the close of the week the yield curve was seen shifting downwards.

For the week ending 13 November 2024, the foreign holdings in Sri Lankan rupee-denominated Treasury securities saw a marginal net inflow of Rs. 30 million. This marked the ninth consecutive week of positive inflows. As a result, total foreign holdings reached Rs. 54.84 billion.

The daily secondary market Treasury bond/bill transacted volumes for the first three days of the week averaged at Rs. 49.74 billion.

In money markets, total outstanding liquidity declined to Rs. 112.535 billion by the end of the week ending 14 November, up from Rs. 123.37 billion recorded the previous week. The Domestic Operations Department (DOD) of the Central Bank injected liquidity during the week by way of overnight reverse repo auctions and a seven-day term reverse repo auctions at weighted average rates of 8.39% to 8.67% respectively. The weighted average interest rate on call money and repo ranged between 8.53% to 8.56% and 8.63% to 8.69% respectively.

The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,515.62 billion as at 14 November, unchanged from the previous week’s level.

Forex market

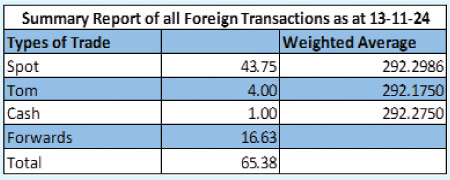

In the Forex market, the USD/LKR rate on spot contracts was seen appreciating, to close the week at Rs. 292.25/292.30 as against its previous week’s closing level of Rs. 292.50/292.65 and subsequent to trading at a high of Rs. 292.13 and a low of Rs. 292.67.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 60.29 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)