Sunday Feb 22, 2026

Sunday Feb 22, 2026

Friday, 20 December 2024 00:04 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The Secondary Bond market continued to witness healthy trading activity and transaction volumes yesterday. However, yields moved back up due to profit-taking pressure, reversing some of the gains from the recent market rally, which had seen three consecutive days of declining rates.

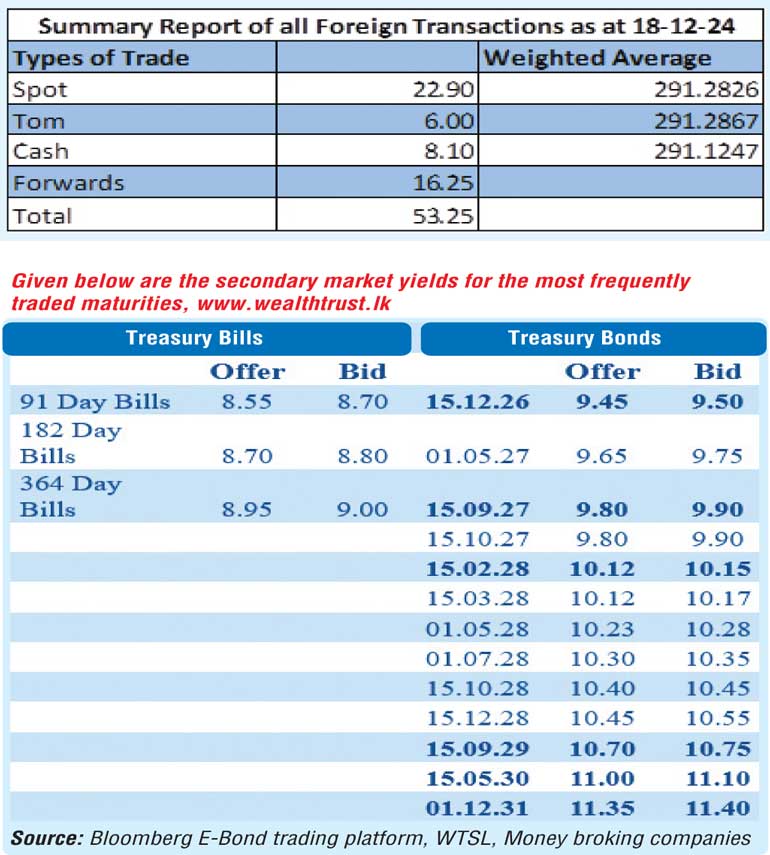

The 15.09.27 was seen trading up the range of 9.84%-9.90%. The 15.02.28 and 15.03.28 maturities were seen trading up from an intraday low of 10.08% to a high of 10.15%. The other 2028 tenors followed suit with the yield on the 01.05.28 and 01.07.28 maturities moving up from intraday lows to highs of 10.17%-10.26% and 10.25%-10.35% respectively. The 15.06.29 and 15.09.29 maturities were seen moving up the range of 10.73%-10.75%. The medium tenor 01.12.31, 01.10.32 maturities were seen trading at the rates of 11.37%-11.40% and 11.50% respectively.

The total secondary market Treasury Bond/Bill transacted volume for 18 December was Rs. 111.83 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.00% and 8.03% respectively. The DOD (Domestic Operations Department) of Central Bank abstained from conducting any auction yesterday.

The net liquidity surplus stood at Rs. 186.66 billion. Rs. 2.42 billion was withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 8.50%, while an amount of Rs. 189.08 billion was deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 7.50%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day down at Rs. 292.90/293.30 as against 291.55/291.85 the previous day. On 18 December 2024, the Federal Reserve reduced its key interest rate by 0.25% points to a range of 4.25% to 4.5%. Despite this cut, the Fed signalled a slower pace of rate reductions for the upcoming year, indicating a more cautious approach to monetary easing. The Fed’s hawkish stance, despite the rate cut, led to a strengthening of the US dollar. Investors interpreted the slower pace of future rate cuts as a sign of confidence in the US economy’s resilience, prompting increased demand for the dollar. This demand drove the dollar to its highest value against a basket of other currencies since November 2022.

The total USD/LKR traded volume for 18 December was $ 53.25 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)