Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 21 January 2025 02:05 - - {{hitsCtrl.values.hits}}

By WealthTrust Securities

The secondary Bond market began the new trading week on a dull note yesterday, remaining virtually at a standstill during the earlier part of the day, apart from some sparse trades on slim transaction volumes. However, activity picked up slightly towards the latter part of the day. As a result, overall transaction volumes were seen at moderate levels. Meanwhile, yields were seen edging up marginally during the day, with closing market two-way quotes ending the day higher.

The secondary Bond market began the new trading week on a dull note yesterday, remaining virtually at a standstill during the earlier part of the day, apart from some sparse trades on slim transaction volumes. However, activity picked up slightly towards the latter part of the day. As a result, overall transaction volumes were seen at moderate levels. Meanwhile, yields were seen edging up marginally during the day, with closing market two-way quotes ending the day higher.

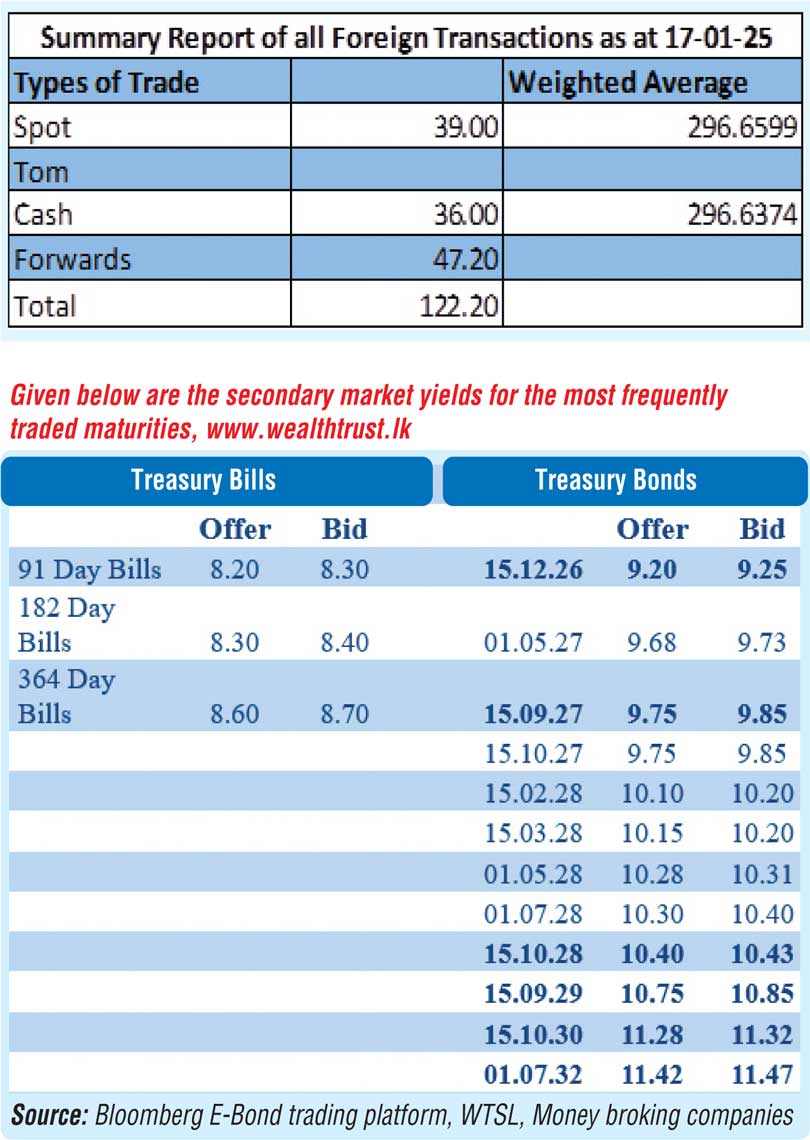

Accordingly, limited trades were observed on select maturities. The 15.05.26 maturity was observed trading at the rate of 8.95%. The 2027 tenor 01.05.27 maturity was seen trading at the rate of 9.70%. The 15.03.28 and 01.05.28 maturities were seen trading within the ranges of 10.17%-10.18% and 10.29%-10.31%, respectively. The 15.10.30 maturity was seen changing hands at the rate of 11.30%.

Meanwhile, in secondary market bills, February/March 2025 maturities were seen changing hands at the rates of 8.20%-8.15% (below three months). June/July 2025 (approximately six months) bills were seen trading at the rate of 8.35%-8.32%. In addition, the 7 November 2025 maturity (close to 12 months) was seen trading at the rate of 8.50%.

The total secondary market Treasury bond/bill transacted volume for 17 December 2024 was Rs. 17.39 billion.

In money markets, the weighted average rates on overnight call money and repo stood at 8.00% and 8.03%, respectively.

The net liquidity surplus stood at Rs. 136.82 billion yesterday. Rs. 2.13 billion was withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 8.50%, while an amount of Rs. 134.69 billion was deposited at the Central Bank’s SDFR (Standard Deposit Facility Rate) of 7.50%.

Forex market

In the Forex market, the USD/LKR rate on spot contracts closed the day depreciating to Rs. 296.90/297.10 against its previous day’s closing level of Rs. 296.40/296.60.

The total USD/LKR traded volume for 17 December 2024 was $ 122.20 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)