Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 16 December 2024 03:19 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

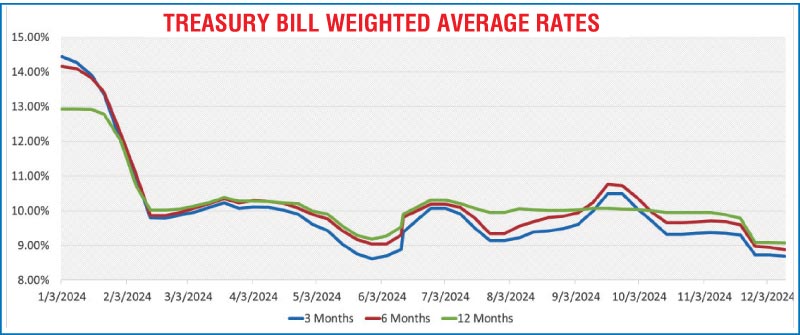

The secondary Bond market started slowly last week but quickly gained momentum as activity picked up. Yields fluctuated throughout the week, initially rising marginally at the very beginning. Subsequently, rates declined sharply, nose-diving on the back strong demand. Aggressive buying was observed leading up to and during the T-Bond auction. However, following the release of the auction results, yields moved back up as market participants booked profits, reversing some gains. Despite this, market two-way quotes closed lower on a week-on-week basis as yields consolidated at newly established levels with activity moderating. As a result, the T-Bond section of the yield curve was seen edging down lower at the end of the week.

The secondary Bond market started slowly last week but quickly gained momentum as activity picked up. Yields fluctuated throughout the week, initially rising marginally at the very beginning. Subsequently, rates declined sharply, nose-diving on the back strong demand. Aggressive buying was observed leading up to and during the T-Bond auction. However, following the release of the auction results, yields moved back up as market participants booked profits, reversing some gains. Despite this, market two-way quotes closed lower on a week-on-week basis as yields consolidated at newly established levels with activity moderating. As a result, the T-Bond section of the yield curve was seen edging down lower at the end of the week.

Accordingly, the 15.09.27 maturity was seen declining from an intraweek high of 10.15% to a low of 9.90%. The 15.02.28 maturity was seen declining from an intraweek high of 10.50% at the open to hit an intraweek low of 10.15%, before moving back up to trade at 10.25% at the close of the week. The other 2028 maturities followed suit, with the 01.05.28 maturity dropping from an intraweek high of 10.60% to a low of 10.20% subsequent to moving back up to a trade at 10.35%.

The 15.09.29 (auction maturity) saw yields drop considerably from an intraweek high of 10.95% at the start of the week to a low of 10.70% midweek before surrendering some gains to move back up to 10.75% at the close. The 15.05.30 was seen trading down the range of 11.20%-11.00%.

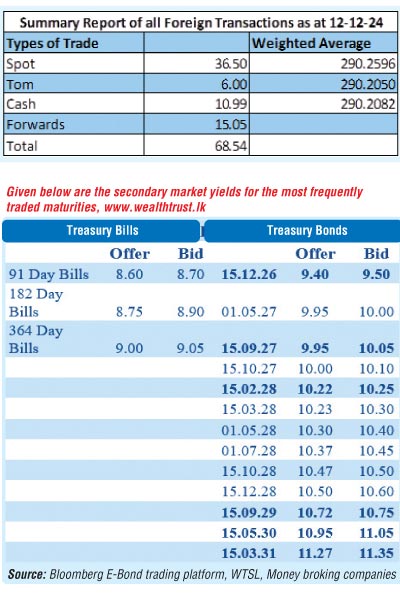

At the weekly Treasury bill auction conducted last Wednesday (11 December), weighted average rates declined across all three maturities. Accordingly, the weighted average rates on the 91-day tenor dropped by 04 basis points to 8.69%, the 182-day tenor by 06 basis points to 8.88% and the 364-day tenor by 01 basis point to 9.07%. Total bids received exceeded the offered amount by 2.27 times, and the entire Rs. 206.00 billion on offer was successfully raised at the First phase. The Rs. 132.50 billion Treasury bond auction conducted last Thursday (12 December) successfully raised Rs. 130.77 billion or 98.70% of the total offered amount. The 15.09.29 maturity (bearing an 11.00% coupon) recorded a resoundingly bullish outcome, being issued at a weighted average yield of 10.75%. The entire Rs. 77.50 billion offered was raised during the first phase of subscription through competitive bidding. Additionally, the 01.06.33 maturity (bearing a 9.00% coupon) was issued at a weighted average yield of 11.47%, raising 96.86% or Rs. 53.27 billion of the Rs. 55.00 billion offered across both phases.

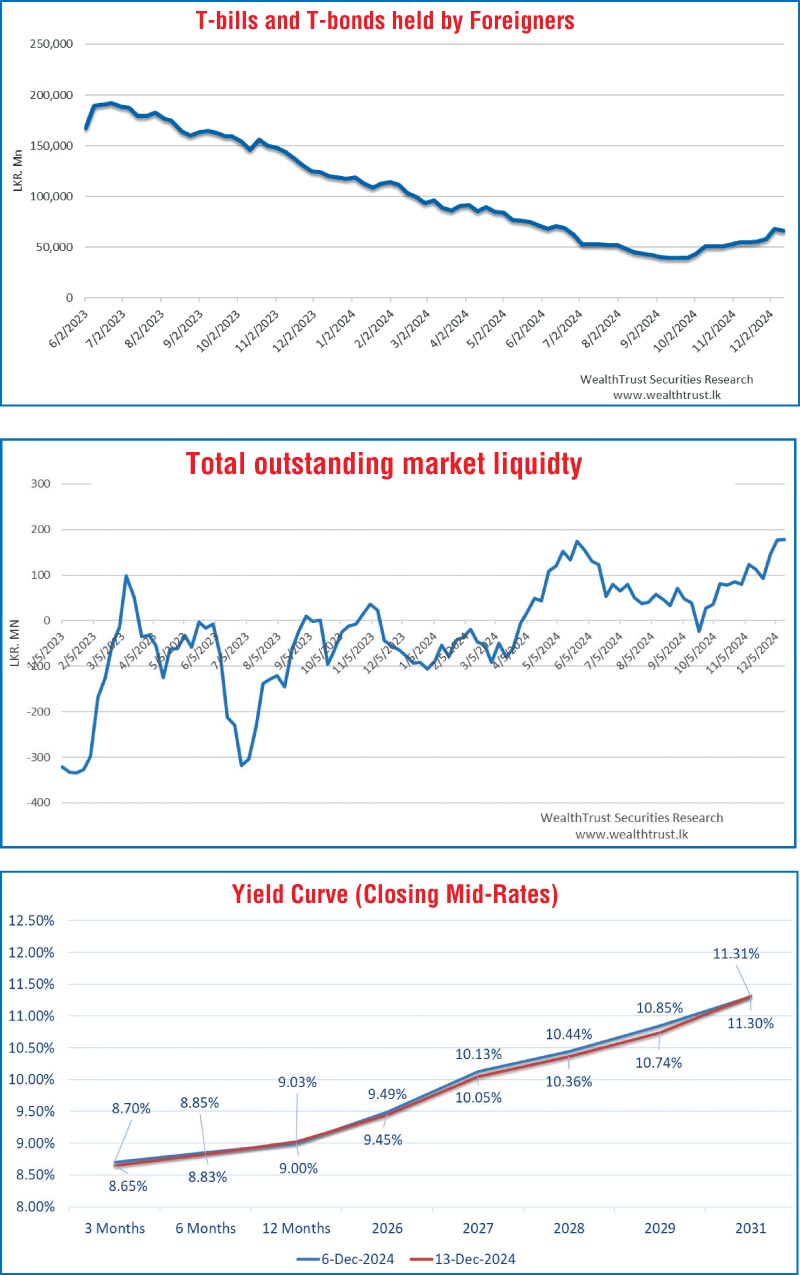

For the week ending 12 December 2024, the foreign holdings in Sri Lankan rupee-denominated Treasury securities saw a net outflow of Rs 2.10 billion. This marked the first instance following twelve weeks of positive inflows prior. As a result, total foreign holdings reached Rs. 68.15 billion, reaching the highest level in 24 weeks.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 47.55 billion.

In money markets, total outstanding liquidity increased marginally to Rs. 178.40 billion as at the week ending 12 December, up from Rs. 176.87 billion recorded the previous week. The Domestic Operations Department (DOD) of Central Bank injected liquidity during the week by way of overnight reverse repo auctions and a seven-day term reverse repo auctions at weighted average rates of 8.05% to 8.12% respectively. The weighted average interest rate on call money and repo ranged between 8.00% to 8.04% and 8.01% to 8.16% respectively.

The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,515.62 billion as at 12 December 2024, unchanged from the previous week’s level.

Forex market

In the Forex market, the USD/LKR rate on spot contracts was seen appreciating, to close the week at Rs. 290.15/290.30 as against its previous week’s closing level of Rs. 290.40/290.48 and subsequent to trading at a high of Rs. 290.24 and a low of Rs. 290.45.

The daily USD/LKR average traded volume for the first four trading days of the week stood at US $ 65.38 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money

broking companies)