Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Friday, 25 April 2025 03:25 - - {{hitsCtrl.values.hits}}

By WealthTrust Securities

The Secondary Bond market yesterday saw yields decline on the back of continued buying interest. Strong demand was observed for the 2028-2029 tenors, pushing rates considerably lower — a sharp contrast to the broadly range-bound trading observed recently. Overall, market activity and transaction volumes were seen at healthy levels.

The Secondary Bond market yesterday saw yields decline on the back of continued buying interest. Strong demand was observed for the 2028-2029 tenors, pushing rates considerably lower — a sharp contrast to the broadly range-bound trading observed recently. Overall, market activity and transaction volumes were seen at healthy levels.

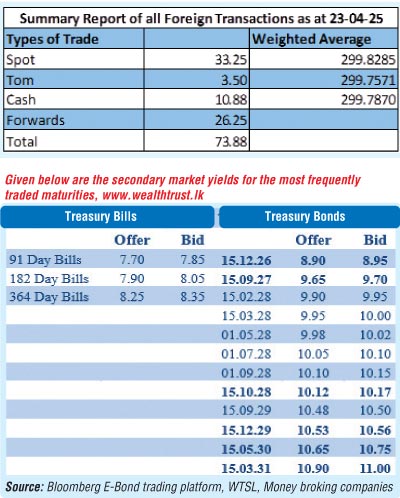

The 15.05.26 and 01.08.26 maturities were seen trading at the rates of 8.58% and 8.70% respectively. The 01.05.28 and 01.07.28 maturities were seen trading lower at the rates of 10.03%-10.00% and 10.10% respectively. The yield on the 15.10.28 maturity dropped down the range of 10.20%-10.15%. The 15.09.29 and 15.12.29 maturities were seen trading down the ranges of 10.52%-10.50% and 10.62%-10.55% respectively.

This followed news that Sri Lanka is likely to secure a staff-level agreement with the IMF as early as this week for the disbursement of the next tranche of the Extended Fund Facility, according to Bloomberg. It was also reported that Sri Lanka expects to finalise an arrangement covering its bilateral trade relationship with the United States before the expiry of a 90-day suspension on the 44% tariff imposed on the island nation.

This is ahead of Rs.115.00 billion Treasury Bond auctions due on 28 of April (next Monday):

The auctions will be comprised of:

1. Rs. 60.00 billion from a 15 June 2029 Maturity bearing a coupon rate of 11.75%

2. Rs. 55.00 billion from a 15 March 2031 Maturity bearing a coupon rate of 11.25%

3. Rs. 40.00 billion from a 15 March 2035 Maturity bearing a coupon rate of 11.50%

The settlement for which will be on 2 May 2025.

The total secondary market Treasury Bond/Bill transacted volume for 23 April was Rs. 27.03 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 7.97% and 8.00% respectively.

The net liquidity surplus increased further to Rs. 105.88 billion yesterday. Rs. 0.49 billion was withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 8.50%, while an amount of

Rs. 106.36 billion was deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 7.50%.

Forex market

In the Forex market, the USD/LKR rate on spot contracts closed the day depreciates to Rs. 300.05/300.12 as against its previous day’s closing level of Rs. 299.85/299.95.

The total USD/LKR traded volume for 23 April 2025 was $ 73.88 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)