Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 17 December 2024 00:30 - - {{hitsCtrl.values.hits}}

By WealthTrust Securities

The secondary Bond market kickstarted the week buoyed by positive sentiment as yields dipped, following news of Sri Lanka’s announcement of the expiration of its Consent Solicitation and Exchange Offer for International Sovereign Bonds (ISBs) on 13 December, with preliminary results indicating very high participation from ISB holders. This mirrored the enthusiasm seen in the stock market as well. Trading activity and transaction volumes were seen at healthy levels earlier in the day but subsequently moderated to a virtual standstill during the latter part of the day.

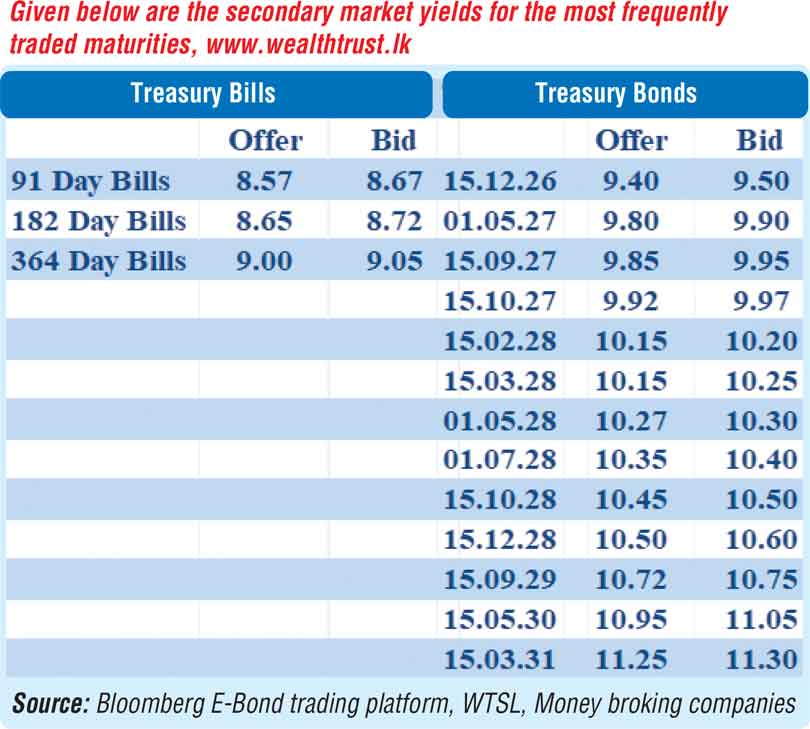

As activity slowed down, two-way quotes were observed edging up slightly again, leading to a partial reversal. Despite this, two-way quotes on shorter tenor maturities of 2027-2028 were observed closing the day lower.

Trading activity was concentrated on shorter tenor bonds, restricted to durations from 2027 to 2028. Accordingly, the yield on 15.09.27 dropped to 9.94% from 10.00%, intraday. The 15.02.28 and 15.03.28 maturities saw yields decline from intraday highs to lows of 10.20%-10.16% and 10.25%-10.18%, respectively. The 01.05.28 and 01.07.28 maturities were seen trading at the rate of 10.30% and 10.40%,

respectively.

The total secondary market Treasury bond/bill transacted volume for 13 December was Rs. 12.35 billion.

In money markets, the weighted average rates on overnight call money and repo stood at 8.00% and 8.10%, respectively, yesterday. The DOD (Domestic Operations Department) of the Central Bank abstained from injecting liquidity by way of an overnight/term reverse repo auctions.

The net liquidity surplus stood at Rs. 202.12 billion yesterday. Rs. 1.46 billion was withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 8.50%, while an amount of Rs. 203.58 billion was deposited at the Central Bank’s SDFR (Standard Deposit Facility Rate) of 7.50%.

Forex market

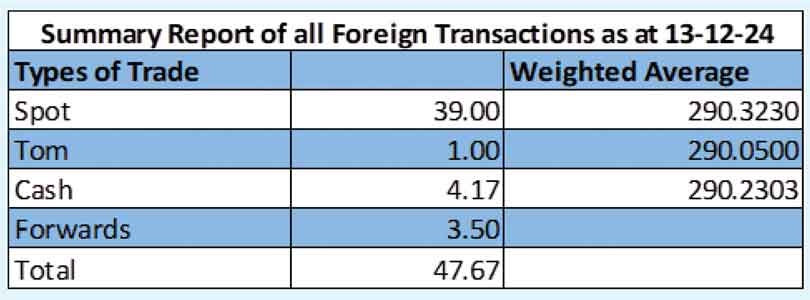

In the Forex market, the USD/LKR rate on spot contracts closed the day depreciating to Rs. 290.70/290.80 against its previous day’s closing level of Rs. 290.15/290.30.

The total USD/LKR traded volume for 13 December was $ 47.67 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money

broking companies)