Monday Feb 16, 2026

Monday Feb 16, 2026

Wednesday, 9 October 2024 03:44 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The yields in the secondary bond market edged up yesterday as market participants sought to book profits from the recent bull run. However, renewed buying interest at the elevated levels kept a cap on rates. Market activity was subdued and transaction volumes were relatively thin, as market participants adopted a cautious approach ahead of the upcoming Treasury bond auction due this week.

The yields in the secondary bond market edged up yesterday as market participants sought to book profits from the recent bull run. However, renewed buying interest at the elevated levels kept a cap on rates. Market activity was subdued and transaction volumes were relatively thin, as market participants adopted a cautious approach ahead of the upcoming Treasury bond auction due this week.

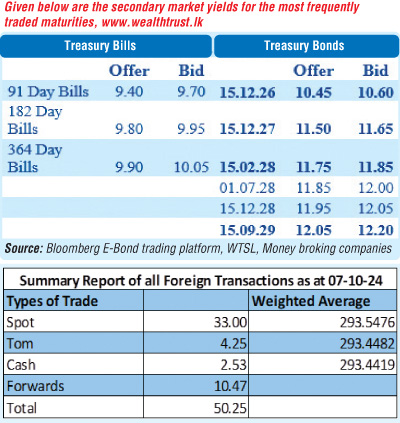

The shorter tenor maturities of 01.06.26 and 15.12.27 changed hands at the elevated level of 10.45% and 11.55% respectively. The yields on the 2028 tenors, specifically the liquid 15.02.28 maturity increased to an intraday high of 11.80%, up from an intraday low of 11.70%. The 01.07.28 and 15.12.28 maturities followed suit and traded at the rates of 11.85% and 11.90% respectively. Additionally, trades were observed on the 15.09.29 maturity within the range of 12.10%-12.12%.

The upcoming Treasury bond auction due this Friday, 11 October will have on offer Rs. 70.00 billion from a 15 March 2028 maturity bearing a coupon of 10.75% and Rs. 25.00 billion from a 01October 2032 maturity bearing a coupon rate of 09.00%. Meanwhile, the secondary bill market yesterday saw March 2025 maturities (approx. 6 months) changing hands within the range of 10.05%-9.93%.

This comes ahead of the Treasury bill auction due today, which will have a total amount of Rs. 85 billion on offer, a decrease of Rs. 57.50 billion over its previous week. Incidentally, this is the smallest offered amount since Mid-April 2024. This will consist of Rs. 40.00 billion on the 91-day, Rs. 35.00 billion on the 182-day and Rs. 10.00 billion on the 364-day maturities.

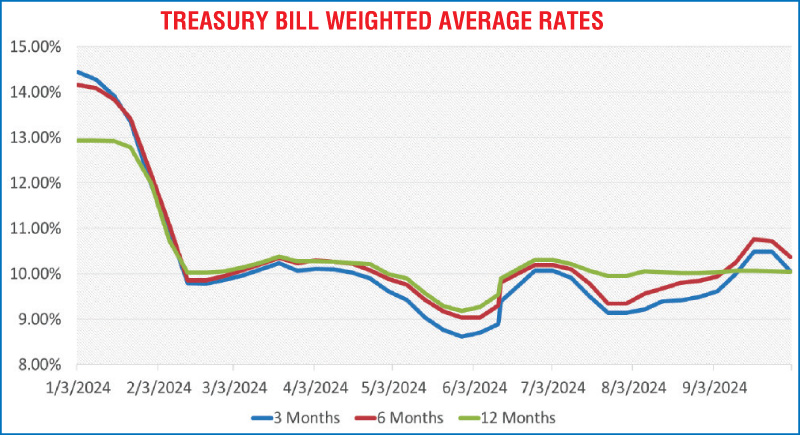

For context, the previous Treasury bill auction conducted last Wednesday (02 October) reflected the enthusiasm in the secondary market and recorded a bullish outcome. Yields were seen declining sharply on the shorter tenors. The weighted average rate for the 91-day tenor dropped by 43 basis points to 10.06%, while the 182-day tenor decreased by 35 basis points to 10.37%. The 364-day tenor saw a marginal decline of 1 basis point, bringing the rate to 10.04%. Total bids received exceeded the offered amount by more than two times, and the entire Rs. 142.50 billion on offer was successfully raised at the 1st phase. The 2nd phase also saw heavy demand, with the entire Rs. 14.25 billion on offer snapped up, against a total market subscription of a colossal Rs. 145.41 billion. The total secondary market Treasury bond/bill transacted volume for 07 October was Rs. 7.88 billion. In money markets, the weighted average rates on overnight call money and Repo stood at 8.60% and 8.80% respectively. The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight and 7-day term repo auction for Rs. 17.55 billion and Rs. 60.00 billion at the weighted average rates of 8.39% and 8.65% respectively.

The net liquidity surplus stood at Rs. 75.23 billion yesterday. No funds were withdrawn from the Central Banks SLFR (Standing Lending Facility Rate) of 9.25%, while an amount of Rs. 152.78 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.25%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day higher at Rs. 293.10/293.30 against its previous day’s closing level of Rs. 293.40/293.55.

The total USD/LKR traded volume for 07 October was US $ 50.25 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)