Monday Apr 21, 2025

Monday Apr 21, 2025

Wednesday, 20 November 2024 00:13 - - {{hitsCtrl.values.hits}}

By WealthTrust Securities

The Secondary Bond market yesterday saw profit taking push yields up, reversing some gains from the recent Bull Run. However, renewed buying interest was seen kicking in at the higher levels, curtailing further upwards movement. Market activity and transaction volumes were seen at healthy levels.

The Secondary Bond market yesterday saw profit taking push yields up, reversing some gains from the recent Bull Run. However, renewed buying interest was seen kicking in at the higher levels, curtailing further upwards movement. Market activity and transaction volumes were seen at healthy levels.

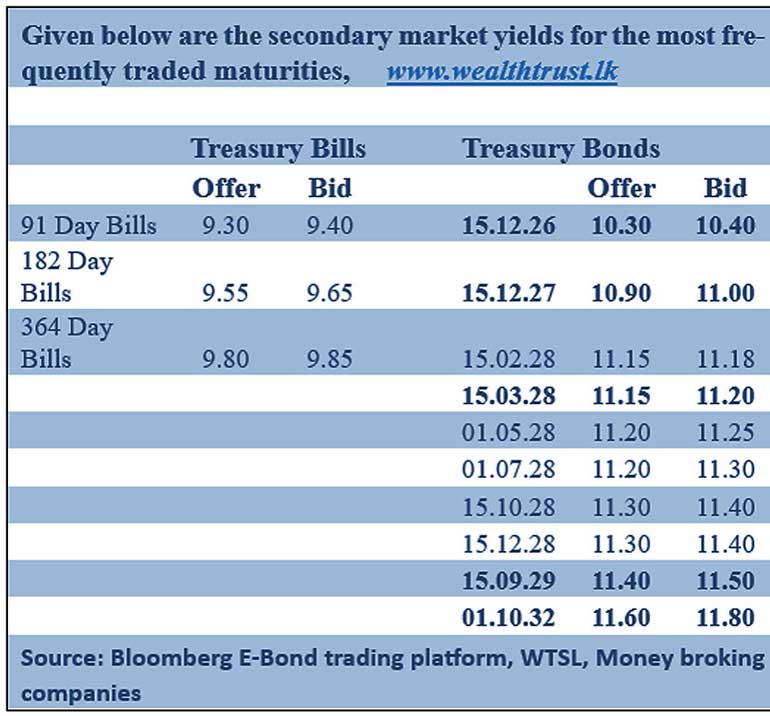

The 2026 tenors held broadly steady with the 01.06.26 and 01.08.26 maturities trading at the rates of 10.10%. However, the rest of the yield curve was seen inching up slightly. The 2027 tenors of 01.05.27, 15.09.27 and 15.12.27 were seen trading at the rates of 10.90%-10.95%, 10.90%-11.05% and 11.00% respectively. The yield on the 15.02.28 and 15.03.28 maturities were seen moving up the range of 11.10%-11.20%. The other 2028 tenors followed suit, with the 01.05.28 and 15.12.28 maturities trading at the rates of 11.15%-11.26% and 11.35% respectively. Additionally, the 15.09.29 maturity was observed trading at the rate of 11.53%.

Rates on secondary market bills held broadly steady. January to February 2025 maturities (approximately 3 months) traded at rates of 9.35%-9.45%, June 2025 (close to 6 months) bills traded at 9.75%, and November 2025 (approximately 1 year) bills traded at 9.82%.

This comes ahead of the Treasury bill auction due today, which will have a total amount of Rs. 145.00 billion on offer, a decrease of Rs. 2.50 billion over the previous week. This will consist of Rs. 50.00 billion on the 91-day, Rs 65.00 billion on the 182-day and Rs. 30.00 billion on the 364-day maturities.

For reference, at the weekly Treasury bill auction held last Wednesday: weighted average rates were seen declining across the board for the first time in four weeks. This reversed the previous trend of yields creeping up on the shorter tenors over the two consecutive weeks prior. Accordingly, the weighted average rates on the 91-day tenor decreased by 02 basis points to 9.35%, the 182-day tenor dropped by 06 basis points to 9.64% and the 364-day tenor declined by 07 basis points to 9.88%. Total bids received exceeded the offered amount by 2.16 times, and the entire Rs 147.50 billion on offer was successfully raised at its first phase. Additionally, Rs. 14.75 billion, being the maximum aggregate amount offered, was raised in the second phase across all three tenors, out of a total market subscription of Rs. 58,195 million.

The total secondary market Treasury bond/bill transacted volume for 18 November was Rs. 19.43 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.58% and 8.68% respectively. The DOD (Domestic Operations Department) of the Central Bank injected liquidity by way of an overnight and 7-day term reverse repo auctions for Rs. 30.98 billion and Rs. 40.00 billion at the weighted average rate of 8.48% and 8.77% respectively.

The net liquidity surplus stood at Rs. 64.73 billion yesterday. An amount of Rs. 9.93 billion was withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 9.25%, while an amount of Rs. 145.64 billion was deposited at the Central Bank’s SDFR (Standard Deposit Facility Rate) of 8.25%.

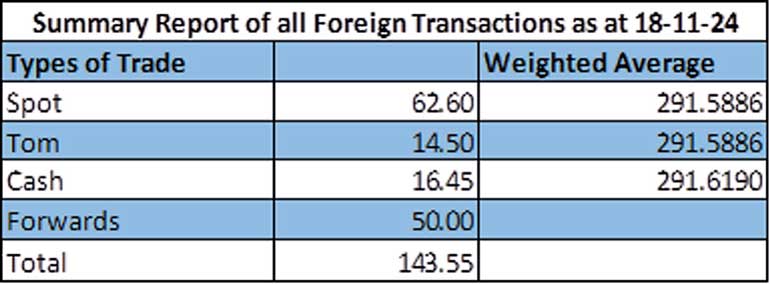

Forex market

In the Forex market, the USD/LKR rate on spot contracts closed the day appreciating to Rs. 291.00/291.15 as against Rs. 291.30/291.45 the previous day.

The total USD/LKR traded volume for 18 November was $ 143.55 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.