Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 23 December 2024 02:02 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary Bond market started off the last week on a positive note, following news of the expiration of Sri Lanka’s offer to exchange its International Sovereign Bonds – with results indicating a very high participation rate of 97.86%. This resulted in the market rallying until midweek with a marked reduction in yields on the back of robust activity and transaction volumes. As market participants anticipated credit rating upgrades by credit rating agencies on Sri Lanka’s debt issuances. However, at the tail end of the week, yields were seen moving back up as market participants looked to book profits, reversing some gains as activity moderated.

The secondary Bond market started off the last week on a positive note, following news of the expiration of Sri Lanka’s offer to exchange its International Sovereign Bonds – with results indicating a very high participation rate of 97.86%. This resulted in the market rallying until midweek with a marked reduction in yields on the back of robust activity and transaction volumes. As market participants anticipated credit rating upgrades by credit rating agencies on Sri Lanka’s debt issuances. However, at the tail end of the week, yields were seen moving back up as market participants looked to book profits, reversing some gains as activity moderated.

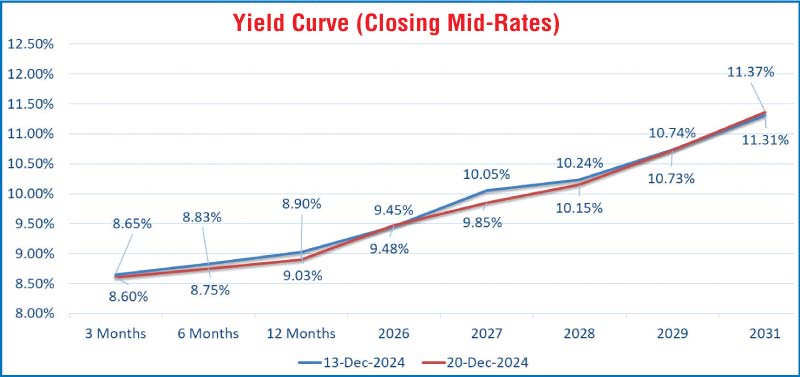

As a result, market two-way quotes closed the week broadly steady, with the notable exception being 2027 tenors which declined. In conclusion the T-bond section of the yield curve was seen mostly unchanged.

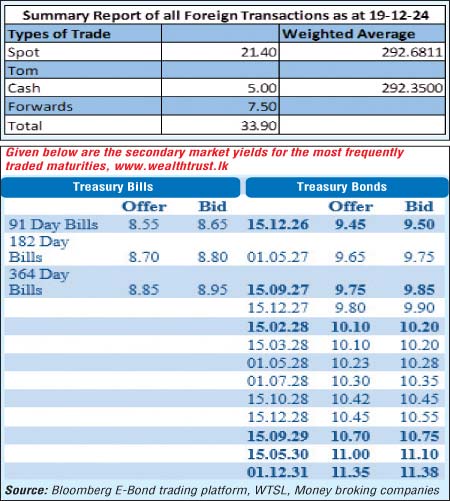

The shorter tenor 15.12.26 maturity was seen trading at 9.45%. Trades were observed on the 15.09.27 maturity at the rates of 10.00%-9.80%. The yield on the 15.02.28 and 15.03.28 maturities were seen trading within the range of 10.20%-10.06% and 10.25%-10.10%. The 01.05.28 maturity was seen trading at levels of 10.30%-10.15%, while the 01.07.28 maturity at 10.40%-10.25%. The 15.09.29 maturity was observed trading within the range of 10.73%-10.66%. Additionally, trades were seen on the medium 15.05.30, 01.12.31 and 01.07.32 maturities at the levels of 11.00%-10.98%, 11.40%-11.35% and 11.50%-11.48% respectively.

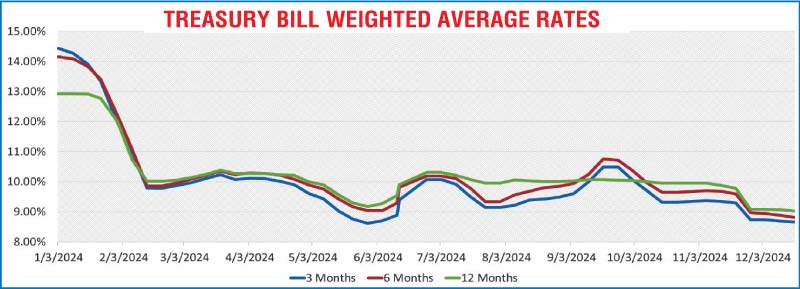

At the weekly Treasury bill auction conducted last Wednesday (18 December), weighted average rates declined across all three maturities for the second consecutive week. As such, rates continued on a downward trajectory with a drop observed on at least one tenor at auctions over the last six weeks. Accordingly, the weighted average rates on the 91-day tenor dropped by 03 basis points to 8.66%, the 182-day tenor by 07 basis points to 8.81% and the 364-day tenor by 01 basis point to 9.02%. Total bids received exceeded the offered amount by 2.22 times, and the entire Rs. 185.00 billion on offer was successfully raised at the first phase in competitive bidding. In addition, Rs. 18.50 billion being the maximum aggregate amount offered was raised at the second phase. The second phase was heavily oversubscribed with total market subscription of Rs. 111,401 million.

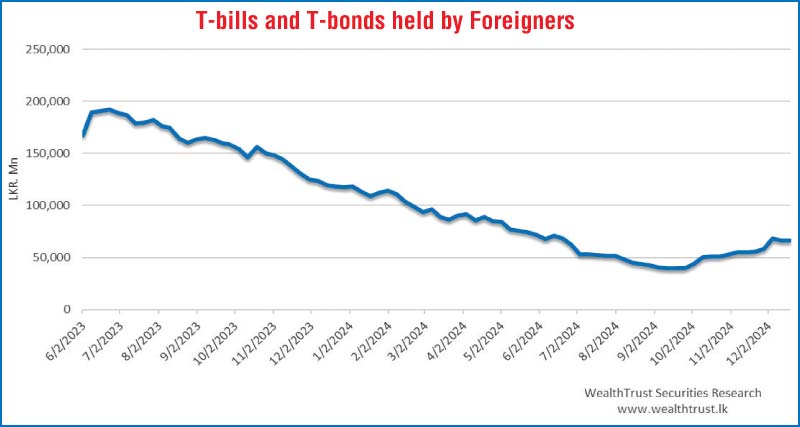

For the week ending 19 December 2024, the foreign holdings in Sri Lankan rupee-denominated Treasury securities saw a net inflow of Rs. 506.00 million. As such foreign holdings were seen resuming its upward trajectory after registering a net outflow last week. Prior to this, there had been twelve weeks of positive inflows. As a result, total foreign holdings were seen recovering to Rs. 66.56 billion.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 39.28 billion.

In money markets, total outstanding liquidity reduced sharply to Rs. 136.15 billion as at the week ending 20 December, down from Rs. 178.4 billion recorded the previous week. The Domestic Operations Department (DOD) of Central Bank injected liquidity during the week by way of a seven-day term reverse repo auctions at weighted average rate of 8.08%. The weighted average interest rate on call money and repo ranged between 8.00% and 8.03% to 8.10% respectively.

The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,515.62 billion as at 20 of December 2024, unchanged from the previous week’s level.

Forex market

In the Forex market, the USD/LKR rate on spot contracts were seen depreciating steeply, to close the week at Rs. 293.50/294.00 as against its previous week’s closing level of Rs. 290.15/290.30 and subsequent to trading at a high of Rs. 290.30 and a low of Rs. 293.50. On 18 December 2024, the Federal Reserve reduced its key interest rate by 0.25 percentage points to a range of 4.25% to 4.5%. Despite this cut, the Fed signalled a slower pace of rate reductions for the upcoming year, indicating a more cautious approach to monetary easing. The Fed’s hawkish stance, despite the rate cut, led to a strengthening of the US dollar. Investors interpreted the slower pace of future rate cuts as a sign of confidence in the US economy’s resilience, prompting increased demand for the dollar. This demand drove the dollar to its highest value against a basket of other currencies since November 2022.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 49.99 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)