Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 3 January 2025 00:10 - - {{hitsCtrl.values.hits}}

Rupee stable

By Wealth Trust Securities

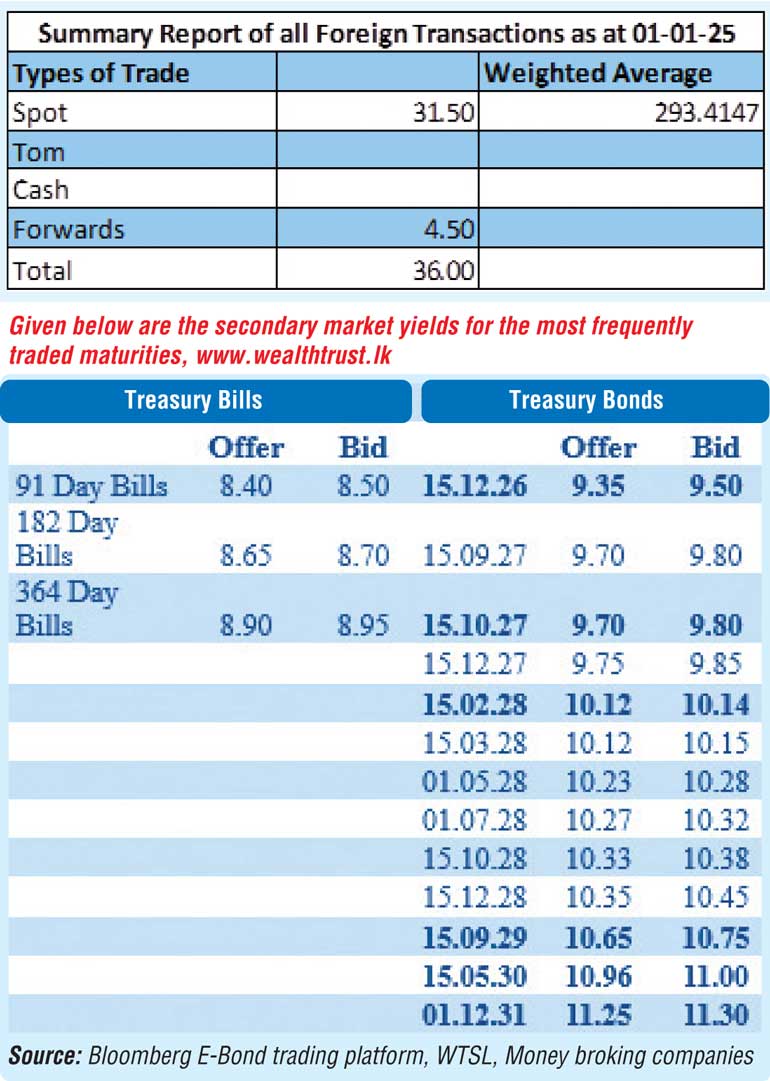

Secondary Bond market activity remained subdued yesterday with moderate volumes being transacted. Yields were seen holding broadly steady as the market reached a consolidation phase – sporadic bouts of buying interest were met with profit taking pressure that cancelled each other out.

The 2027 tenors 15.10.27 and 15.12.27 were observed trading at the rates of 9.80% and 9.80%-9.85% respectively. The 15.02.28 maturity was seen trading within the narrow range of 10.12%-10.10%. The 01.07.28 maturity was seen trading at the rate of 10.26%. The 15.10.30 maturity was seen changing hands at the rate of 11.15%-11.08%. Additionally, trades were seen on the 15.03.31 at the rate of 11.28%.

Meanwhile, in secondary market bills March and June 2025 maturities were seen changing hands at the rates of 8.46% and 8.70%-8.68% respectively.

The total secondary market Treasury Bond/Bill transacted volume for 1 January was Rs. 54.74 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.00% and 8.13% respectively.

The net liquidity surplus stood at Rs. 149.36 billion yesterday. An amount of

Rs. 1.18 billion was withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 8.50%, while an amount of Rs. 150.54 billion was deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 7.50%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day broadly steady at

Rs. 293.15/293.40 against its previous day’s closing level of

Rs. 293.10/293.30.

The total USD/LKR traded volume for 1 January 2025 was $ 36.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)