Monday Feb 23, 2026

Monday Feb 23, 2026

Friday, 10 June 2022 01:57 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities Ltd.,

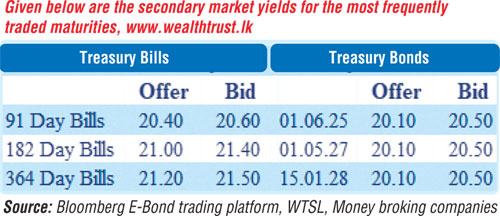

The secondary bill market remained active yesterday as the liquid May to June 2023 maturities changed hands at a low of 21.30% against its previous day’s closing level of 21.60/65.

The secondary bill market remained active yesterday as the liquid May to June 2023 maturities changed hands at a low of 21.30% against its previous day’s closing level of 21.60/65.

Meanwhile, the Treasury bond auctions due today will see a total volume of Rs. 50 billion on offer, consisting of Rs. 20 billion of a 01.06.2025 maturity and Rs. 30 billion of a 15.01.2028 maturity. The weighted average yield at the bond auctions conducted on 1 June was 22.38% and 21.86% respectively on the same maturities while an additional amounts of Rs. 3 billion and Rs. 5 billion respectively was taken up under its direct Issuance windows apart from Rs. 40 billion taken up at its 1st phase of the auction.

The total secondary market Treasury bond/bill transacted volume for 8 June was Rs. 47.63 billion. In money markets, the weighted average rates on overnight Call money and REPO were registered at 14.50% each while the net liquidity deficit stood at Rs. 550.35 billion yesterday. An amount of Rs. 201.36 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 13.50% while an amount of Rs. 751.71 billion was withdrawn from Central Banks SLFR (Standard Deposit Facility Rate) of 14.50%.

Forex market

In the Forex market, the middle rate for USD/LKR spot contracts remained steady at Rs. 360.0255 yesterday.

The total USD/LKR traded volume for 8 June was $ 9.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)