Saturday Feb 21, 2026

Saturday Feb 21, 2026

Wednesday, 19 June 2024 00:20 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market kicked off the shortened trading week on a dull note. Sparse trades were observed on thin overall transaction volumes, with the market at a standstill for much of the day and yields holding broadly steady.

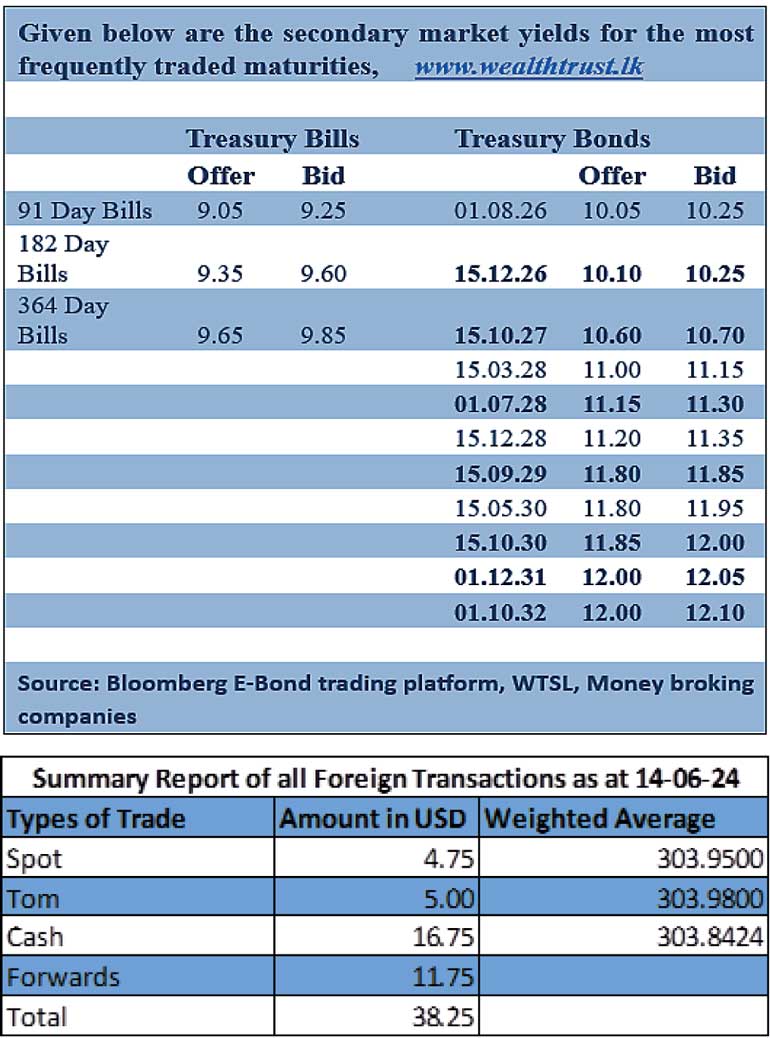

Accordingly, the 01.05.27 maturity was seen transacting at the rate of 10.60%, on a single block trade. Additionally, the 15.09.29 maturity was seen trading within the range of 11.82% to 11.85% maturity and the 01.12.31 maturity within the range of 12.04% to 12.08%, on low volumes.

The Treasury bill auction scheduled for today will offer a total volume of Rs. 230.00 billion, just Rs. 5.00 billion shy of the all-time high volume offered volume two weeks ago. This will consist of Rs. 75.00 billion on the 91-day maturity, Rs. 90.00 billion on the 182-day and Rs. 65.00 billion on the 364-day maturities.

For context, at last Wednesday’s Treasury bill auction (12/06/24), the entire offered amount of Rs. 215 billion was successfully taken up during the first phase with total bids received exceeding the offered amount by 1.45 times. However, weighted average yields rose for the second week, with rates across all three tenors moving up. The yield for the 91-day maturity increased by 19 basis points to 8.89%, the 182-day maturity by 26 basis points to 9.30%, and the 364-day maturity by 27 basis points to 9.54%.

The total secondary market Treasury bond/bill transacted volume for 14 June was Rs. 25.19 billion.

In money markets, the weighted average rate on overnight call money was at 8.75% and repo was at 8.90%.

The net liquidity surplus stood at Rs. 56.73 billion yesterday as an amount of Rs. 35.62 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 9.50% against an amount of Rs. 147.35 billion been deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.50%.

Further, the DOD (Domestic Operations Department) of Central Bank injected liquidity by way of overnight and 7-day term reverse repo auction for Rs. 30.00 billion and Rs. 25.00 billion at the weighted average rates of 8.73% and 9.00% respectively.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day edging up further, at Rs. 304.75/305.40 against its previous day’s closing level of Rs.304.00/304.15.

The total USD/LKR traded volume for 14 June was $ 38.25 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)