Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 10 September 2024 02:06 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The trading week commenced with secondary bond market yields increasing yesterday, as the upcoming Presidential election and a Rs. 290 billion round of Treasury bond auctions (due to be held this Thursday), draws nearer.

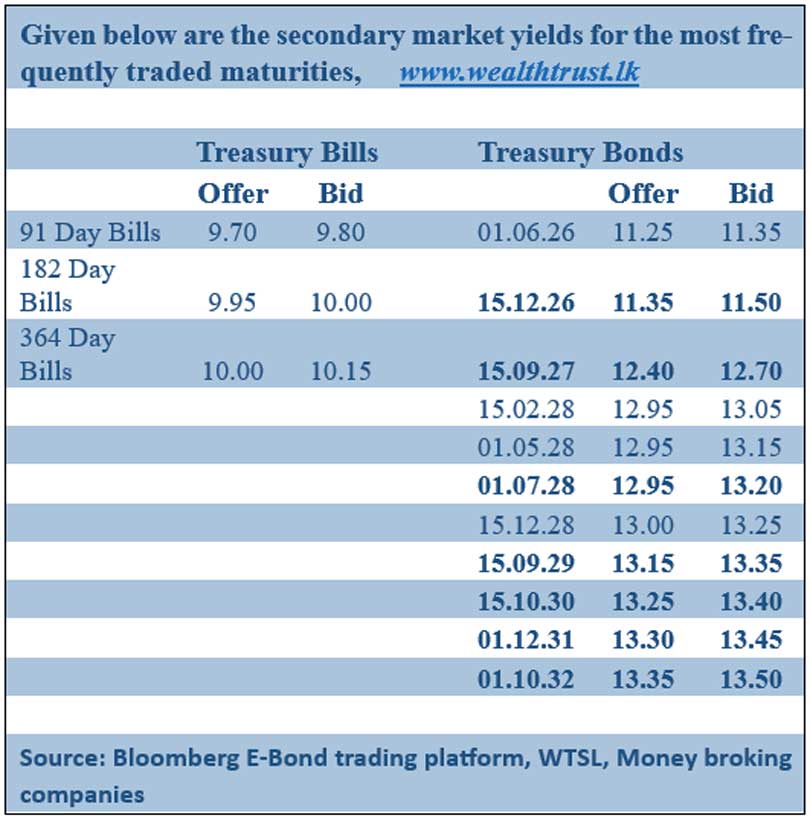

The shorter tenor 01.07.25 was seen trading at the rate of 10.25%, the 01.02.26 maturity up from 10.55% to 10.60%. The 2028 tenors saw an increase in yields. Accordingly, the yields on the 15.02.28 15.03.28, 01.05.28 and 15.12.28 maturities were observed increasing from 12.85% to 13.00%, 12.95% to 13.00%, 13.00% and 13.20% to 13.25% respectively. Additionally, trades were observed on the medium tenor 15.05.30/15.10.30 and 01.07.32 maturities within the ranges of 13.3650% to 13.4150% and 13.50% to 13.60%. However, some renewed buying interest was seen kicking in at these elevated levels, which helped cap the rate increase and led to a slight recovery. The market saw considerable activity with sizeable volumes transacted.

Strong demand was witnessed on very short-term T-bills in the secondary market. September bills were seen trading at the rate of 8.87%. In addition, October, November and December bills were seen moving at the rates of 9.20%, 9.47% and 9.50% respectively.

The details of the upcoming Rs. 290.00 billion Treasury bond auction scheduled for 12 September (this Thursday) were announced. The auction will comprise of Rs. 100.00 billion from a 1 February 2028 maturity bearing a coupon of 10.75%, Rs. 150.00 billion from a 15 June 2029 maturing bond bearing a coupon of 11.75% and Rs. 40.00 billion from the 15 September 2034 maturity bearing a coupon of 10.25%.

The total secondary market Treasury bond/bill transacted volume for 6 September was Rs. 10.17% billion.

In money markets, the weighted average rate on overnight call money was at 8.55% and repo was at 8.70%.

The net liquidity surplus stood at Rs. 87.64 billion yesterday as an amount of Rs. 107.67 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.25%.

The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight reverse repo auction for Rs. 20.00 billion at a weighted average rate of 8.63%.

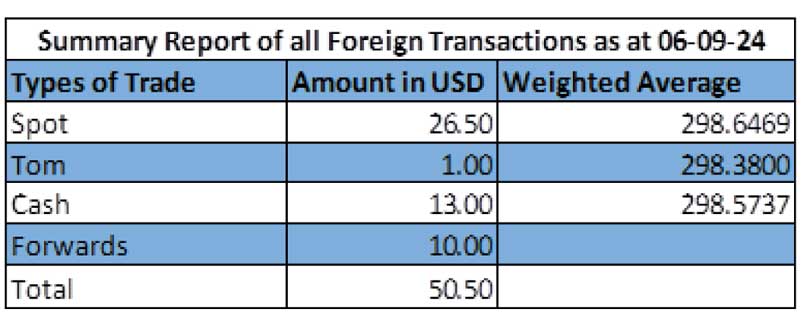

Forex Market

In the Forex market, the USD/LKR rate on spot contracts depreciating steeply to close trading yesterday at Rs. 301.50/302.00 against its previous day’s closing level of Rs. 298.80/298.90.

The total USD/LKR traded volume for 6 September was $ 50.50 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)