Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 20 March 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

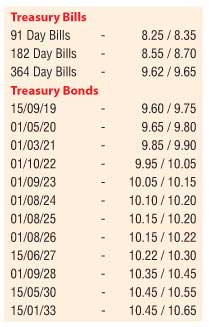

Activity in the secondary bond market remained moderate yesterday, with limited trades of the 01.03.21 maturity taking place at levels of 9.85% to 9.87%. Meanwhile in the secondary bill market, January and March 2019 maturities were traded at levels of 9.20% and 9.61% respectively.

The total secondary market Treasury bond/bill transacted volumes for 16 March was Rs. 5.62 billion.

In money markets, the overnight call money and repo rates averaged at 8.14% and 7.57% respectively as the Open Market Operations (OMO) Department of the Central Bank of Sri Lanka was seen draining out an amount of Rs. 15.10 billion on an overnight basis at a weighted average of 7.26%. The net surplus liquidity in the system stood at Rs.30.69 billion yesterday.

Rupee remains

mostly unchanged

In the Forex market, the USD/LKR rate on spot contracts remained mostly unchanged to close at Rs. 156.10/15.

The total USD/LKR traded volume for 16 March was $69.55 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 156.90/00; 3 Months - 158.40/55 and 6 Months - 160.65/80.