Saturday Feb 28, 2026

Saturday Feb 28, 2026

Wednesday, 23 October 2024 00:14 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market yesterday, saw renewed buying interest push down yields, resulting in a partial recovery from recently elevated levels. Market activity was seen picking up with robust volumes transacted.

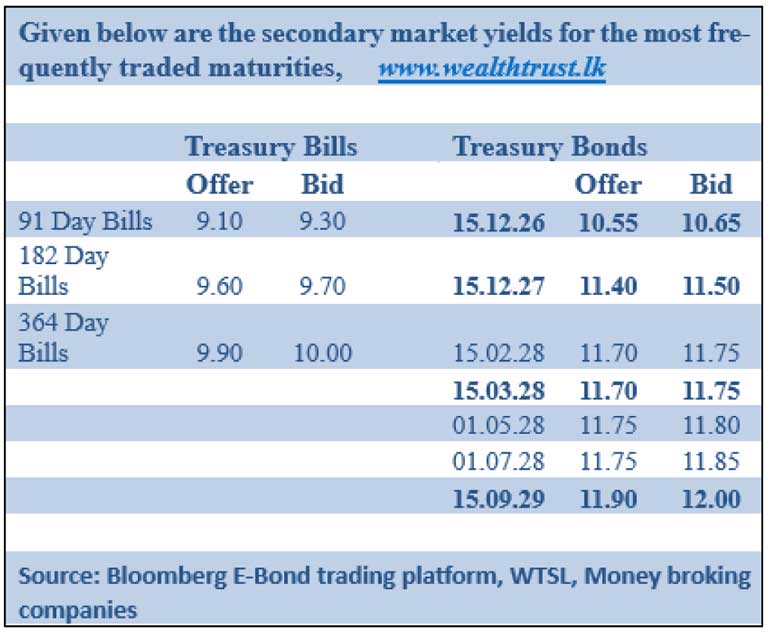

The yield on the 2026 maturities (i.e. 01.06.26 and 01.08.26) dropped from 10.53% to 10.45% intraday while the 15.09.27 saw yield dip from 11.47%-11.43%. The popular liquid 15.02.28 and 15.03.28 maturities saw yields decline from an intraday high of 11.80% to a low of 11.70%, collectively. The 01.07.28 and 15.12.28 tenors followed suit, trading at 11.80% and 11.95%-11.90% respectively. The yield on the medium tenor 01.10.32 maturity declined from 12.37%-12.35%.

This comes ahead of the Treasury bill auction due today, which will have a total amount of Rs. 125 billion on offer, an increase of Rs. 28 billion over its previous week. This will consist of Rs. 40 billion on the 91-day, Rs 42.50 billion on the 182-day and Rs. 42.50 billion on the 364-day maturities.

For context, at the Treasury bill auction held on Tuesday, 15 October, yields declined for the fourth consecutive week, reflecting the downward trend in the T-Bill market. The weighted average rates across all three tenors fell below 10.00%, reaching levels last seen in late July. The 91-day tenor saw a significant drop of 37 basis points to 9.32%, while the 182-day tenor fell by 30 basis points to 9.65%.

The 364-day tenor posted a more modest decline of 5 basis points, bringing the rate to 9.95%. Total bids received surpassed the offered amount by 2.62 times, with the full Rs. 97.00 billion on offer successfully raised in the first phase. The second phase also garnered strong interest, with the entire Rs. 9.70 billion taken up, with a total market subscription of Rs. 52.65 billion.

The total secondary market Treasury bond/bill transacted volume for 21 October was Rs. 5.49 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.57% and 8.68% respectively. The DOD (Domestic Operations Department) of the Central Bank injected liquidity by way of an overnight and 7-day term repo auction for Rs. 23.88 billion and Rs. 70.00 billion at the weighted average rates of 8.42% and 8.63% respectively.

The net liquidity surplus stood at Rs. 78.39 billion yesterday. Rs 0.20 billion was withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 9.25%, while an amount of Rs. 172.47 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.25%.

Forex market

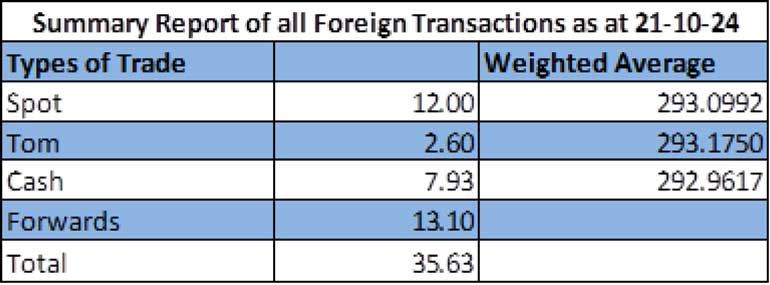

In the forex market, the USD/LKR rate on spot contracts closed the day depreciating marginally to Rs. 293.23/293.27 against its previous day’s closing level of Rs. 293.15/293.20.

The total USD/LKR traded volume for 21 October was $ 35.63 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)