Monday Feb 23, 2026

Monday Feb 23, 2026

Monday, 13 November 2023 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market last week was seen adopting a somewhat reserved stance ahead of today’s bond auctions with activity remaining moderate. Limited trades were observed across the yield curve with yields edging up on the short to medium tenures consisting of maturities of 2026 to 2032 while very short tenures of late 2024’s and 2025’s saw yields dip on the back of considerable demand. Accordingly, trades were observed during the week on the maturities of 24’s (01.08.24 and 15.11.24), the two 25’s (01.06.25 and 01.07.25) and the two 26’s (15.05.26 and 01.06.26) within the ranges of 14.50% to 14.45%, 14.95% to 14.83% and 15.23% to 14.92%. In addition, trades were observed on the maturities of 01.05.27, 01.07.28, 15.07.29, 15.05.30 and 15.05.31 in the ranges of 15.15% to 15.13%, 15.15% to 15.00%, 14.80% to 14.40%, 14.30% and 14.70% to 14.25% respectively as well.

The secondary bond market last week was seen adopting a somewhat reserved stance ahead of today’s bond auctions with activity remaining moderate. Limited trades were observed across the yield curve with yields edging up on the short to medium tenures consisting of maturities of 2026 to 2032 while very short tenures of late 2024’s and 2025’s saw yields dip on the back of considerable demand. Accordingly, trades were observed during the week on the maturities of 24’s (01.08.24 and 15.11.24), the two 25’s (01.06.25 and 01.07.25) and the two 26’s (15.05.26 and 01.06.26) within the ranges of 14.50% to 14.45%, 14.95% to 14.83% and 15.23% to 14.92%. In addition, trades were observed on the maturities of 01.05.27, 01.07.28, 15.07.29, 15.05.30 and 15.05.31 in the ranges of 15.15% to 15.13%, 15.15% to 15.00%, 14.80% to 14.40%, 14.30% and 14.70% to 14.25% respectively as well.

The Central Bank of Sri Lanka (CBSL) is due to conduct a round of Treasury Bond auctions today. The auctions will see a total offered amount of Rs. 250 billion, making it the largest in Sri Lanka’s history. The offerings include Rs. 60 billion of an 11.40% coupon bond maturing on 15 January 2027, Rs. 110 billion of a 10.75% coupon bond maturing on 15 March 2028, and Rs. 80 billion of an 11.25% coupon bond maturing on 15 March 2031. The settlement date is set for 15 November 2023.

For context, the previous bond auctions conducted on 30 October saw all bids rejected for the first time in over 19 months or since the round of auctions conducted on 29 March 2022.

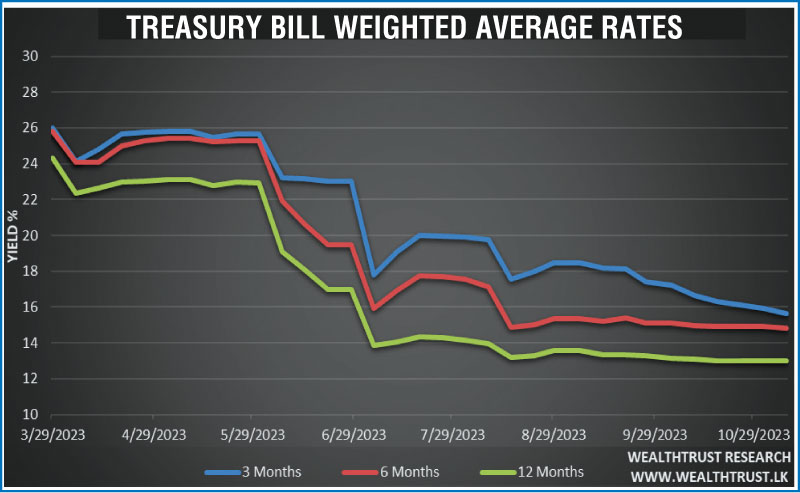

Meanwhile, last week’s Treasury Bill auction continued to receive a bullish response, as weighted average yields decreased across the board. The 91-day and 182-day bills saw the most demand, which led to its weighted average yields declining by 29 basis points and 12 basis points respectively to 15.64% and 14.81%, as it received bids of Rs. 117.52 billion and Rs. 108.8 billion against offered amounts of only Rs. 70.00 billion and Rs. 65.00 billion. The 364-day bills also declined by 03 basis points to record weighted averages of 12.99%, the first instance it dropped below the 13.00% levels since April 2022. The total bids received was 1.56 times greater than the total offered amount.

An amount of Rs. 158.27 billion or 95.92% was raised of the total offered amount of Rs. 165.00 billion at the 1st phase of the auction, while a further 31.90 billion was raised at the 2nd phase across all three maturities.

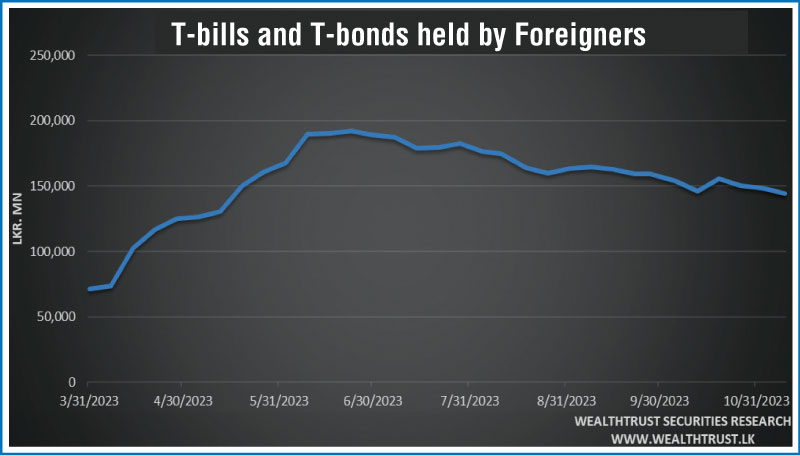

The foreign holding in Rupee bonds and bills continued to decline for a third consecutive week, with a net outflow of Rs. 4.27 billion, bringing the total holding to Rs. 144.08 billion as at 9 November 2023.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 36.38 billion.

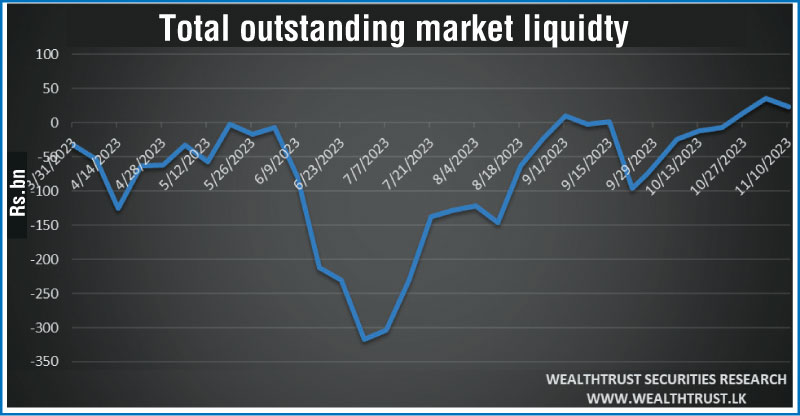

In money markets, the total outstanding liquidity recorded a surplus of Rs. 23.49 billion by the week ending 10 November from its previous week’s surplus of Rs. 35.51 billion. The Domestic Operations Department (DOD) of Central Bank continued to inject liquidity during the week by way of overnight to 30-day Reverse repo auctions at weighted average yields ranging from 10.04% to 12.47%.

The Central Bank of Sri Lankas (CBSL) holding of Gov. Security’s was registered at Rs. 2,819.35 billion, against its previous week’s level of Rs. 2,839.35 billion.

In the Forex market, the USD/LKR rate on spot contracts was seen exhibiting significant volatility, however recovering during the week to close at Rs. 327.00/327.50. This is as against its previous weeks closing level of Rs. 329.00/330.00. Subsequent to trading at a high of Rs. 326.45 and a low of Rs. 329.50.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 67.53 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)