Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 11 March 2024 00:05 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market saw subdued activity overall with the market initially moving sideways but saw yields moving upwards at the conclusion of last week. This upward tick in bond yields was against the backdrop of the outcome at the weekly Treasury bill auction and with the wait-and-see approach adopted by most market participants ahead of the upcoming Rs. 270 Treasury bond auction.

The secondary bond market saw subdued activity overall with the market initially moving sideways but saw yields moving upwards at the conclusion of last week. This upward tick in bond yields was against the backdrop of the outcome at the weekly Treasury bill auction and with the wait-and-see approach adopted by most market participants ahead of the upcoming Rs. 270 Treasury bond auction.

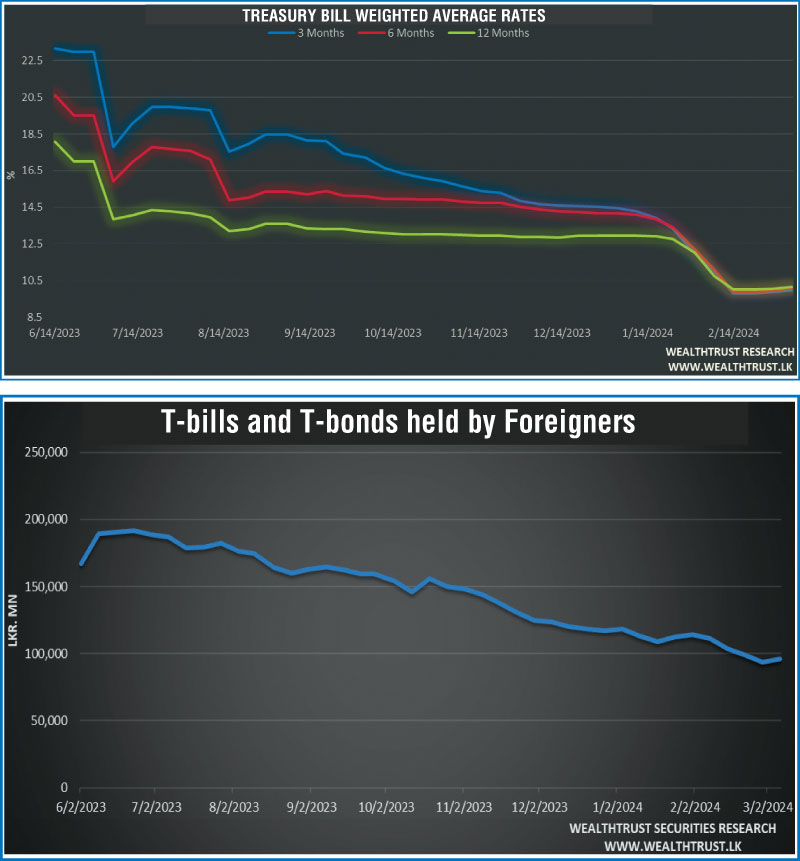

At the weekly Treasury bill auction conducted last Wednesday, the weighted average yields were seen increasing across all three maturities, for a second consecutive week. Prior to this, weighted average rates had been on a steady decline, with a bull run that saw decreases observed in at least one tenor since August 2023. The 91-day maturity increased by 9 basis points to 9.96%, the 182-day maturity increased by 13 basis points to 10.08%, while the 364-day maturity also went up by 09 basis points to stand at 10.14%. The auction saw the entire offered amount of Rs. 160.00 billion fully subscribed, for the first time in two weeks, at the 1st phase of the auction. The total bids received exceeded the total offered amount by 1.45 times.

This week will see a round of Treasury bond auctions due on 12 March (Tuesday) which will have on offer a total of Rs. 270.00 billion, making it the largest ever in Sri Lanka’s history. This comprises

Rs. 130.00 billion from a maturity of 15 December 2026 with a coupon rate of 11.25%, Rs. 110.00 billion from a maturity of 15 December 2028 with a coupon of 11.50% and Rs. 30.00 billion from a maturity of 15 March 2031 with a coupon rate of 11.25%.

For context, the previous round of auctions held on 13 February 2024, recorded a bullish outcome, with the entire offered amount of Rs. 55 billion being fully taken up and where the same 15.12.26 and 15.12.28 maturities offered at the upcoming auction, were issued at the weighted average rates of 10.81% and 11.90% respectively.

The secondary market trading was predominantly on the short end of the yield curve for much of the week. Trades were observed on the liquid 2026 tenors (01.06.26, 01.08.26 and 15.12.26) from intraweek lows of 10.80% to highs of 10.95%, while 2027 tenors (01.05.27 and 15.09.27) were seen moving up from intraweek lows of 11.75% to highs of 12.00%. Similarly, 2028 maturities (15.03.28, 01.07.28, 01.09.28 and 15.12.28) were seen dropping to lows of 12.10% and increasing to highs of 12.35%. On the medium tenor durations, maturities of 15.07.29, 15.05.30 and 01.07.32 were seen changing hands at levels of 12.35% to 12.40%, 12.30 to 12.55% and 12.90% to 13.00% respectively.

The foreign holding in Rupee bonds and bills for the week ending 29 February 2024 recorded a net inflow for the first time in five weeks, amounting to Rs. 2.44 billion. As a result, the total holding increased to Rs. 96.03 billion.

The daily secondary market Treasury bond/bill transacted volumes for the first three days of the week averaged at Rs. 39.11 billion.

In money markets, the total outstanding liquidity deficit reduced to Rs. 49.14 billion by the week ending 7 March from its previous week’s deficit of Rs. 91.70 billion. The Domestic Operations Department (DOD) of the Central Bank continued to inject liquidity during the week by way of overnight and term reverse repo auctions at weighted average yields ranging from 9.10% to 9.51%.

The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at

Rs. 2,715.62 billion as at 1 March 2024, unchanged from its previous week’s level.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts was seen appreciating further during the week to close at Rs. 307.30/307.40. This is as against its previous week’s closing level of

Rs. 308.80/308.90 and subsequent to trading at a low of Rs. 308.55 and a high of Rs. 307.30.

The daily USD/LKR average traded volume for the first three trading days of the week stood at

$ 80.88 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)