Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 2 July 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

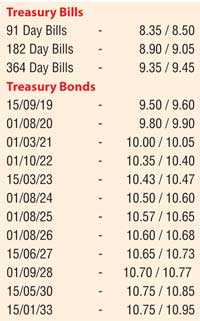

Activity in the secondary bond market moderated during the shortened trading week ending 29 June 2018, following a rise in the weighted average of the 364 day bill for the first time in five weeks at its weekly Treasury bill auction.

The sluggish sentiment was further supported by the by the continued decrease in the foreign holding of rupee bonds for an ninth consecutive week, recording an outflow of Rs. 3.51 billion for the week ending 26th June 2018.

The fluctuations in yields across the yield curve continued within a narrow range with the short end of the curve consisting of the 01.05.20, three 2021’s (i.e. 01.03.21, 01.08.21 and 15.12.21) and 15.03.23 maturities changing hands at levels of 9.75% to 9.80%, 10.00% to 10.15% and 10.40% to 10.47% respectively. Continued foreign selling on the belly end to the long end of the curve saw the maturities of 01.08.24, 01.08.25, two 2026 maturities (i.e. 01.06.26 and 01.08.26), 15.06.27 and two 2028’s (i.e. 15.03.28 and 01.09.28) change hands at levels of 10.50% to 10.55%, 10.55% to 10.66%, 10.60% to 10.72%, 10.68% and 10.67% to 10.80% respectively as well.

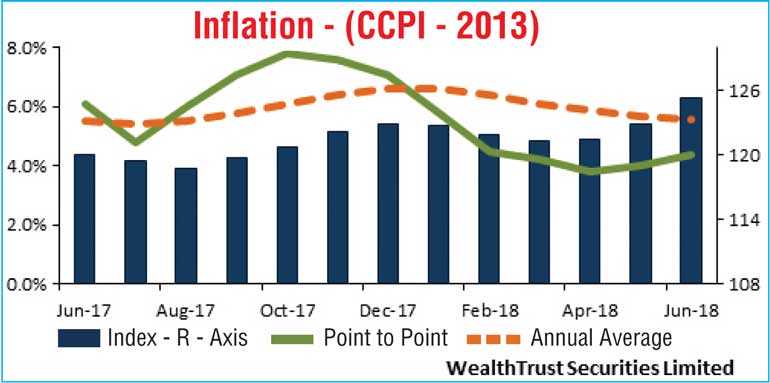

The CCPI (Colombo Consumer Price Index) on its Point to Point for the month of June increased to 4.4% from 4.0% recorded in May with the annual average decreasing to 5.6% from 5.7%.

The daily secondary market Treasury bond/bill transacted volumes for the first three days of the week averaged Rs. 5.24 billion.

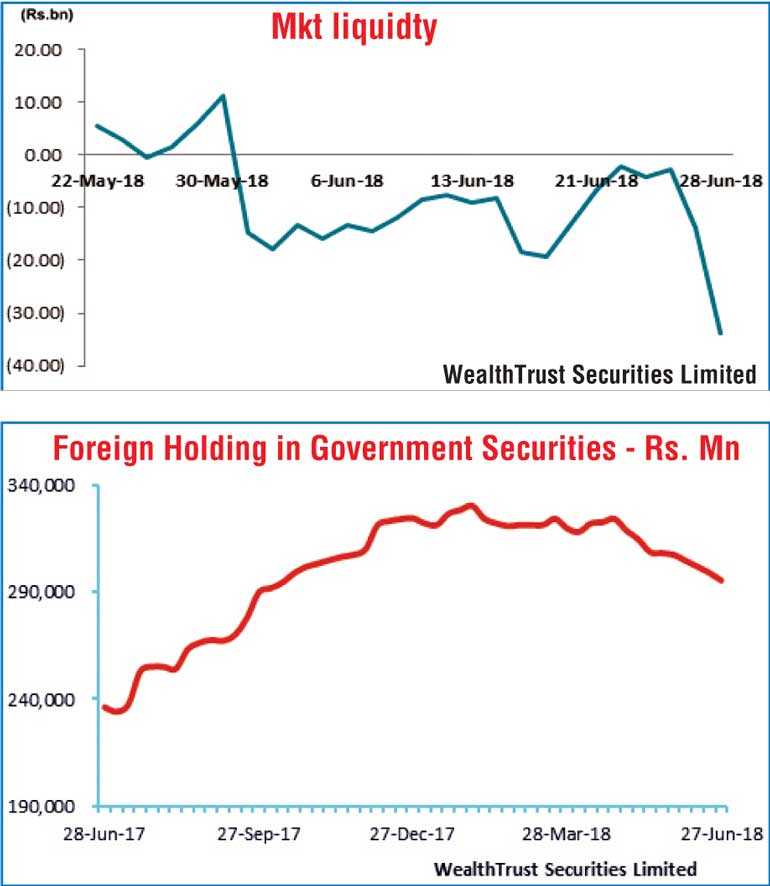

In money markets, the OMO Department of the Central Bank of Sri Lanka continued to conduct overnight Reverse Repo auctions throughout the week in order to infuse liquidity at weighted averages of 8.49% and 8.50% as the average net liquidity shortfall in the system increased to Rs. 33.70 billion by Friday from its intraweek low of Rs. 2.71 billion. The overnight call money and repo rates averaged at 8.48% and 8.44% respectively for the week.

Rupee appreciates further

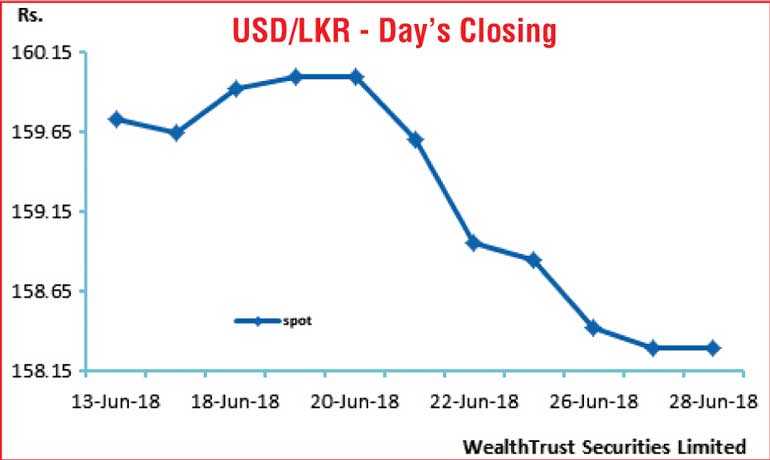

The Rupee on its spot contracts were seen appreciating further during the week to close the week at Rs. 158.20/40 against its previous weeks closing of Rs. 158.90/00 on the back of continued selling interest by banks.

The daily USD/LKR average traded volume for the first three days of the week stood at $ 105.35 million.

Some of the forward dollar rates that prevailed in the market were one month – 159.00/20; three months – 160.60/90 and six months – 163.00/30.