Sunday Dec 14, 2025

Sunday Dec 14, 2025

Monday, 4 March 2024 00:05 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market commenced last week on an upbeat note, experiencing robust activity as yields declined.

The secondary bond market commenced last week on an upbeat note, experiencing robust activity as yields declined.

The bullish sentiment was driven by the news that a Treasury bond auction would not be conducted in line with the coupon maturity settlement due on 1 March 2024. However, the market began trading sideways midweek, with activity starting to moderate. By the end of the week, yields edged up as market activity slowed considerably, accompanied by low transaction volumes. Market participants were seen adopting a wait-and-see approach. This follows the publication of the primary auction advance release calendar, which includes a Rs. 270 billion Treasury bond auction scheduled for 12 March.

Trading which has been predominantly on shorter duration bonds as of the recent past, saw some notable transactions on medium tenor bonds as well this week.

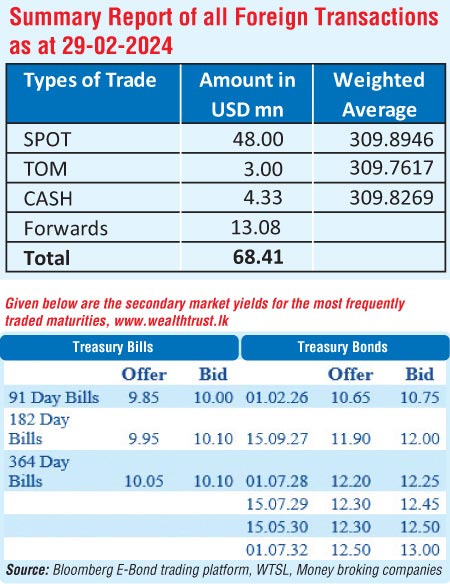

Accordingly, trades were observed on 2026 tenors (01.06.26, 01.08.26 and 15.12.26) from intraweek lows of 10.85% at the start of the week to highs of 11.05%, while 2027 tenors (01.05.27 and 15.09.27) were seen hitting intraweek lows of 11.80% to highs of 12.00%. Similarly, 2028 maturities (01.07.28, 01.09.28 and 15.12.28) were seen dropping to lows of 12.05% and increasing to highs of 12.30%. On the medium tenor durations, maturities of 15.07.29, 15.05.31 and 01.07.32 were seen changing hands at levels of 12.37% to 12.35%, 12.20 to 12.55% and 13.00% respectively.

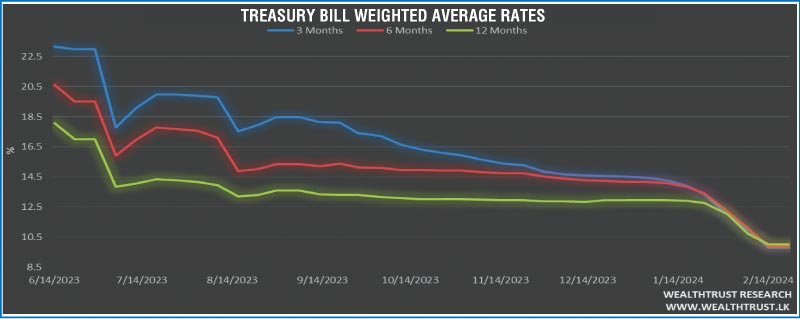

Meanwhile the Treasury bill auction conducted last Wednesday went undersubscribed for a second consecutive week, while the weighted average yields were seen increasing across all three maturities, albeit marginally, for the first time since end August of 2023. This follows an extended period where rates had been on a steady decline, with decreases observed in at least one tenor over the last 25 weeks.

The 91-day and 182-day maturities increased by 9 basis points each to 9.87% and 9.95% respectively, while the 364-day maturity also went up by 3 basis points to stand at 10.05%. Only 85.15% or Rs. 104.31 billion of the total offered amount of Rs. 122.50 billion was raised at the 1st phase of the auction. This was despite total bids exceeding the offered amount by over 1.61 times. An additional Rs. 2.02 billion was raised at the 2nd phase which was opened, across all three tenors.

The foreign holding in Rupee bonds and bills for the week ending 29 February recorded a net outflow for a fourth consecutive week, amounting to Rs. 5.57 billion. As a result, the total holding decreased to Rs. 93.59 billion, falling to its lowest level since early April 2023. This marks a steady decline in foreign holdings since peaking at Rs. 191.91 billion in June of last year.

On the inflation front, the CCPI or Colombo Consumer Price Index – CCPI (Base: 2021=100) for the month of February 2024 was recorded at 5.90%, cooling on its point to point as against 6.40% recorded in January. The CCPI was seen decelerating for the first time since September 2023. This is attributable to a significant moderation in food prices which had previously surged last month and benefiting from a stronger currency.

The daily secondary market Treasury bond/bill transacted volumes for the first three days of the week averaged at Rs. 27.55 billion.

In money markets, the total outstanding liquidity deficit increased to Rs. 91.70 billion by the week ending 22 February from its previous week’s deficit of Rs. 53.91 billion. The Domestic Operations Department (DOD) of Central Bank continued to inject liquidity during the week by way of overnight and term reverse repo auctions at weighted average yields ranging from 9.13% to 9.74%.

The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,715.62 billion as at 1 March 2024, down from its previous week’s level of Rs. 2,735.62.

In the forex market, the USD/LKR rate on spot contracts was seen appreciating further during the week to close at Rs. 308.80/308.90. This is as against its previous week’s closing level of Rs. 310.95/311.05 and subsequent to trading at a high of Rs. 311.20 and a low of Rs. 308.85.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 78.51 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)