Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 23 April 2025 00:06 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market continued to be in a state of consolidation with largely range-bound trading being observed. However, the market activity and transaction volumes were seen picking up yesterday from the lull observed the day prior.

Accordingly, the 01.06.26 and 01.08.26 maturities were seen trading at the rates of 8.60% and 8.80%-8.75% respectively. The 01.05.27 and 15.09.27 maturities traded within the ranges of 9.52%-9.50% and 9.70%-9.65%. The 15.02.28 and 15.03.28 maturities were seen trading at the rates of 9.99%-9.97% and 10.00% respectively. The 01.05.28 and 01.07.28 maturities were seen trading at the rates of 10.12%-10.09% and 10.11% respectively. The 01.09.28 and 15.10.28 maturities were seen changing hands at the rates of 10.20% and 10.25%-10.23% respectively. The 15.12.29 maturity traded at the rate of 10.63% and the 01.10.32 and 15.12.32 medium tenors traded within the range of 11.18%-11.15% collectively.

This comes ahead of the Treasury bill auction due today, which will have a total amount of Rs. 115 billion on offer, an increase of Rs. 27.50 billion over the previous week. This will consist of Rs. 30 billion on the 91-day maturity, Rs 60 billion on the 182-day and Rs. 25 billion on the 364-day maturity.

For reference, the weekly Treasury bill auction held last Wednesday went undersubscribed at the 1st phase for a fourth consecutive week. Only 71.32% or Rs. 62.40 billion of the total Rs 87.50 billion on offer was accepted. This was despite total bids received exceeding the offered amount by 2.44 times. Nevertheless, further an amount of Rs. 33.85 billion was raised at its phase II. The auction saw weighted average yield rates remain broadly steady. Accordingly, the weighted average rate on the 91-day tenor was recorded unchanged at 7.59% and the 364-day tenor at 8.31%. However, the weighted average rate on the 182-day tenor increased by 05 basis points to 7.96%.

The total secondary market Treasury bond/bill transacted volume for 21 April was

Rs. 10.54 billion.

The net liquidity surplus stood at Rs. 83.22 billion yesterday. Rs. 11.30 billion was withdrawn from the Central Banks SLFR (Standing Lending Facility Rate) of 8.50%, while an amount of Rs. 94.51 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 7.50%.

The weighted average rates on call money and repo were registered at 7.99%.

Forex market

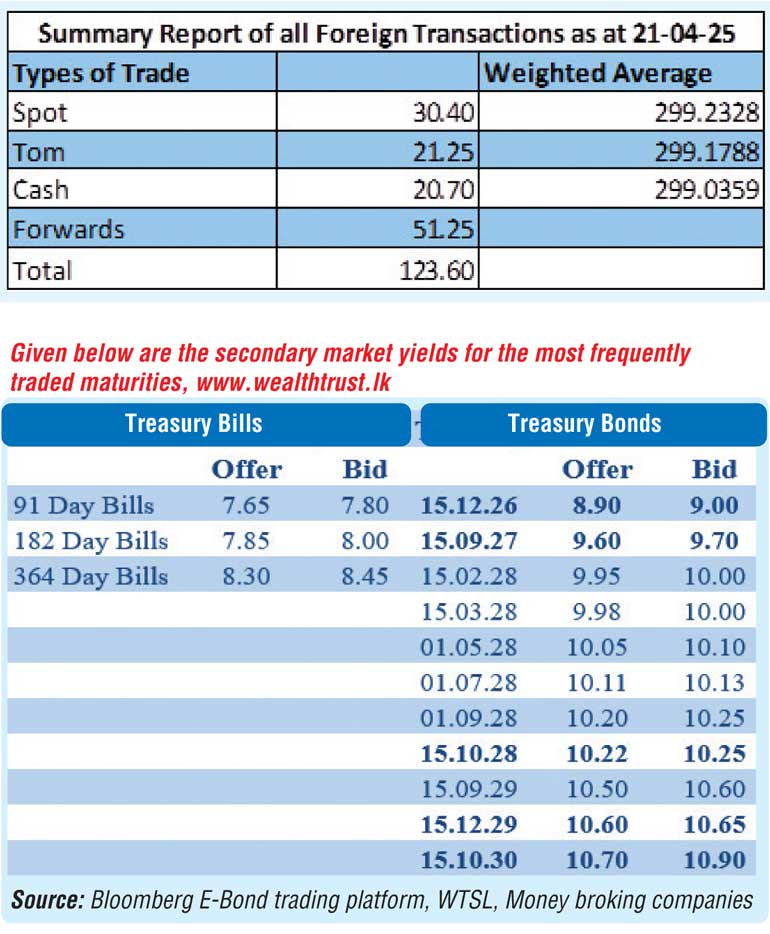

In the Forex market, the USD/LKR rate on spot contracts closed the day depreciating to Rs. 299.85/299.90 as against

Rs. 299.25/299.40 the previous day.

The total USD/LKR traded volume for 21 April was

$ 123.60 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)