Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 2 August 2021 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The overall activity in the secondary bond market continued to be dull during the week ending 30 July, as yields were seen fluctuating within a narrow range on the back of thin volumes. The limited activity centred on the 15.12.22, 01.10.23 and 15.11.23 maturities as its yields were seen moving within the range of 5.72% to 5.80%, 6.27% to 6.30% and 6.35% to 6.38%, respectively.

The persistent reduction in demand at the weekly Treasury bill auction which saw its total accepted volume dip further to a low of 58.30% of its total offered amount coupled with a drop in the total accepted amount at the T-bond auctions to 68.90% against a total offered amount of Rs. 120 billion were seen as the reasons that led to the dull momentum. Furthermore, an issuance window of 20% each for the 01.12.24 and 15.03.31 maturities was unexpectedly opened following the announcement of the bond auction results, which was seen dampening sentiment further.

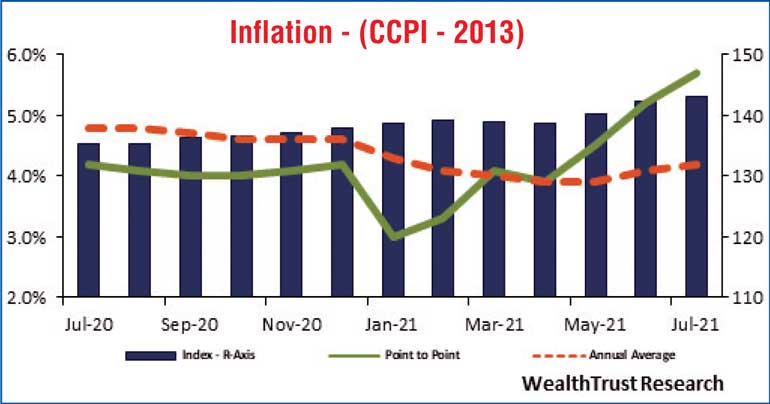

In the meantime, Colombo Consumer Price Index (CCPI) or inflation for the month of July increased for a third consecutive month to 5.7% on its point to point, when compared against its previous month’s figures of 5.2% while its annual average too increased further to 4.2% from 4.1%.

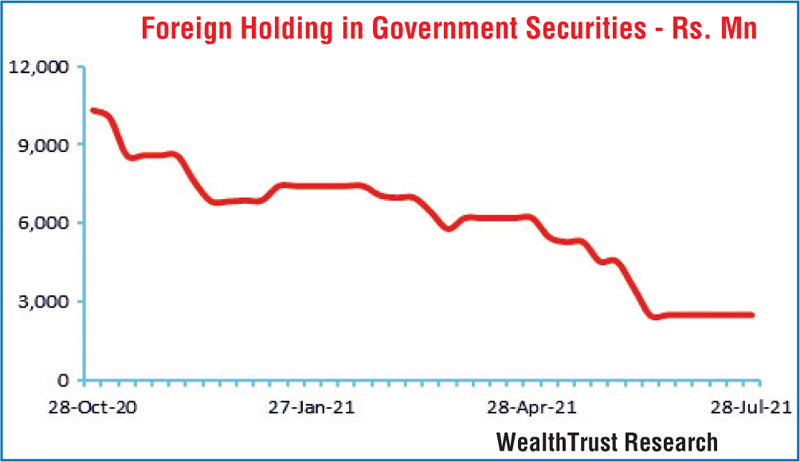

The foreign holding in rupee bonds remained steady for a third consecutive week at Rs. 2.49 billion for the week ending 28 July, while the daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 12.90 billion.

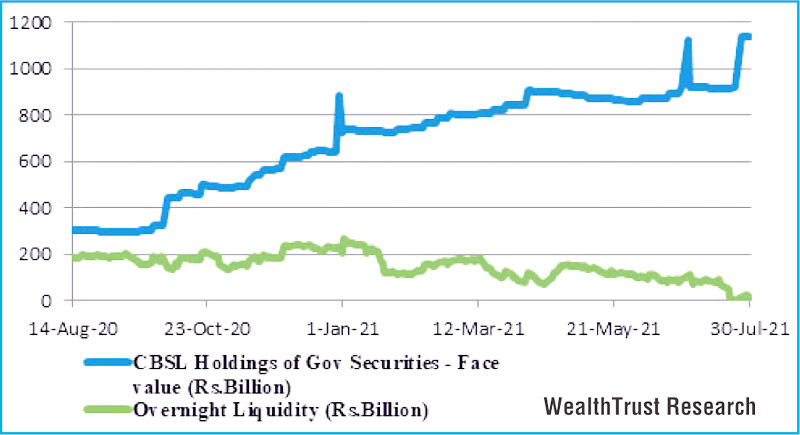

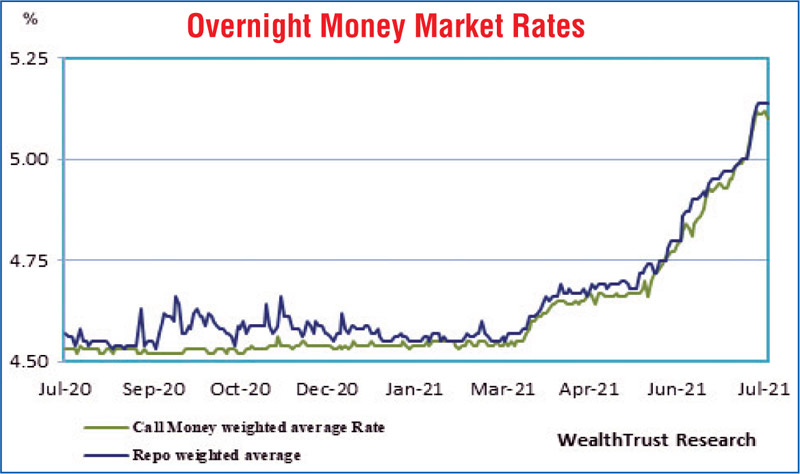

In money markets, the total outstanding surplus liquidity increased to Rs. 8.72 billion against its previous weeks of Rs. 0.03 billion while CBSL’s holding of government securities increased to Rs. 1,141.05 billion against its previous weeks of Rs. 922.09 billion. In addition, the overnight net surplus liquidity fluctuated during the week, within a high of Rs. 23.89 billion to a week closing low of Rs. 8.72 billion. The weighted average rates on overnight call money and repo increased further to average 5.11% and 5.14%, respectively, for the week.

USD/LKR

The Forex market continued to remain inactive during the week. The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 37.86 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)