Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 22 May 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

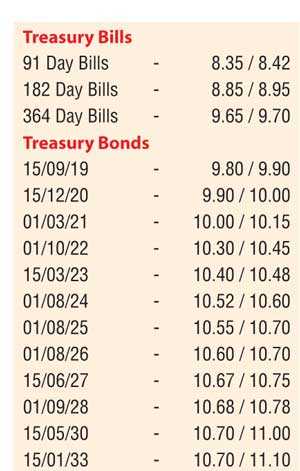

Activity in the secondary bond and bill market dried up considerably yesterday, as most market participants were seen on the sidelines. Limited trades were witnessed of the 15.03.23 and 01.08.24 maturities at levels of 10.40% to 10.50% and 10.55% respectively. On the very short end of the yield curve, bills and bonds consisting of the maturities of 15.08.18, 21.09.18 and 15.11.18 were seen changing hands at levels 8.53% to 8.59%, 8.52% and 8.96% to 9.00% respectively as well. The total secondary market Treasury bond/bill transacted volume for 18 May was Rs. 8.17 billion.

Meanwhile in money markets, liquidity was seen turning a net positive once again to record a surplus of Rs. 5.14 billion. The Open Market Operations (OMO) Department of the Central Bank of Sri Lanka drained out an amount of Rs. 10.00 billion on an overnight basis at a weighted average of 7.39% by way of a repo auction. The overnight call money and repo rates averaged at 7.92% and 7.93% respectively.

Rupee steady

In Forex markets, the spot rate was seen closing the day steady at Rs 157.85/95 as the market was at an equilibrium. The total USD/LKR traded volume for 18 May was $ 167.00 million.

Some forward USD/LKR rates that prevailed in the market: 1 Month - 158.70/90; 3 Months - 160.20/40; 6 Months - 162.45/65.