Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Wednesday, 1 November 2023 00:20 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market saw yields decline on the back of increased and robust activity. Trading was seen across the yield curve. In particular, the 2028 tenors of 15.01.28, 01.05.28 and 01.07.28 saw significant buying interest drive yields down from 15.10% to 14.80% levels on the back of sizable volumes. Similarly, trades were observed on the liquid maturities of 01.07.25, two 2026’s (15.05.26 & 01.06.26), two 2027’s (01.05.27 & 15.09.27), 15.07.29 and 15.05.30 on considerable transaction volumes as well. Trading on the respective maturities were within the ranges of intraday highs and lows of 15.05% to 14.90%, 15.00% to 14.95%, 15.10% to 14.85%, 14.50% to 14.40% and 14.25%.

In secondary market bills, November 23 maturities traded at levels between 14.50% to 14.60% and January 2024 traded at a level of 15.55%.

Today’s weekly Treasury bill auction will have in total an amount of Rs.145 billion on offer which will consist of Rs.65 billion on the 91-day maturity, Rs.45 billion on the 182-day maturity and a further Rs.35 billion on the 364-day maturity. Last week’s auction (held on 25.10.23) saw a total amount of Rs. 147.87 billion taken up at the 1st phase and 2nd phases of the auction against an offered amount of Rs. 135.00 billion. Where the weighted average yield on the 91-day bill dropped by 20 basis points to 16.10%, the 182-day bill reduced marginally by 01 basis point to 14.93% and the 364-day bill remained unchanged at 13.02%.

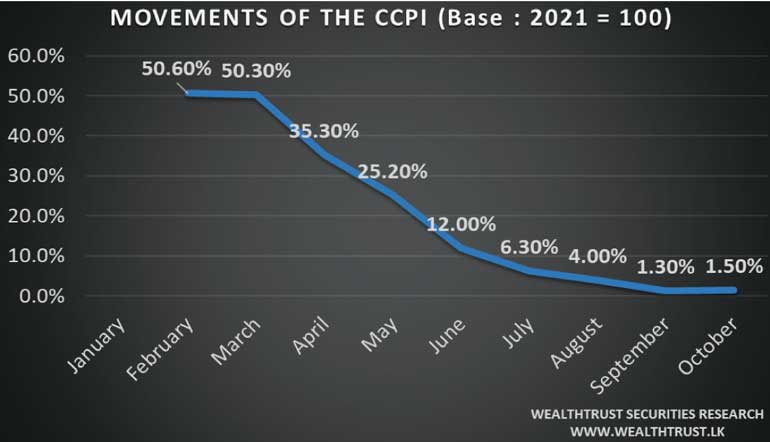

On the inflation front, the Colombo Consumer Price Index -CCPI (Base: 2021=100) for the month of October was registered at +1.50% on its point to point as against +1.30% recorded in September and a peak of +50.6% in February of 2023. This is the first instance that inflation has accelerated, albeit moderately, since the index was rebased at the start of the year 2023. However, notably on a month-on-month basis, the CCPI witnessed deflation, falling by 0.2% on the back of reduced food and beverage prices. The figure was also below a Bloomberg estimate of +2.3% for the month of October.

The figures align with the projections of the Central Bank of Sri Lanka, which lowered policy rates three times this year to stimulate economic growth and rein in real borrowing costs. The central bank had earlier expressed the view that the disinflation trend might reverse due to increased energy tariffs and higher taxes, but it anticipates price increases stabilizing at a 5% target in the medium term.

The total secondary market Treasury bond/bill transacted volume for 30th October 2023 was Rs.11.51 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 10.29% and 10.84% respectively while the net liquidity surplus stood at Rs.10.57 billion yesterday.

The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight repo auction for Rs 24.90 billion at a weighted average rate of 10.15%. While an amount of Rs. 28.29 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 11.00% and an amount of Rs. 63.75 billion was withdrawn from Central Banks SLFR (Standard Deposit Facility Rate) of 10.00%.

Forex Market

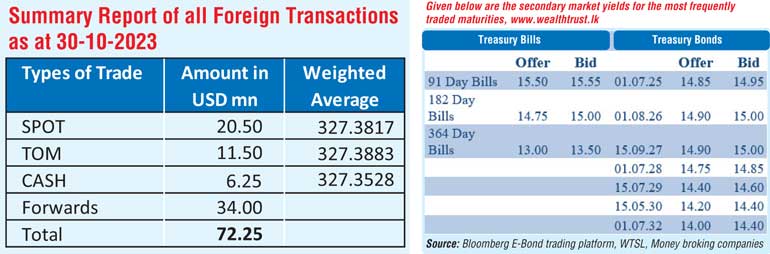

In the Forex market, the USD/LKR rate on spot contracts closed the day at Rs.327.80/328.00 against its previous day’s closing level of Rs.327.40/327.70. The total USD/LKR traded volume for 30th October was US $ 72.25 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)